This report contains a breakdown of the sum of funds deposited and information about how these funds have been used.

This report aims to provide a high-level view of the flow of funds in Nium for a given period. The report is generated monthly.

This report is a spreadsheet with multiple sheets. It contains main balance sheets (one per currency) and associated detailed sheets. Each entry in the main balance sheets can be reconciled against associated sheets that show more detail for each transaction.

File repository path: Ixaris Reconciliation

File name pattern: BalanceSheet_client

Main Balance Sheet Report Content

Opening Balance

| Field | Description |

|---|

| Funding Account | Represents the total balance of the funding account (for one specific currency) at the start of the period covered by the report. |

| Card Balances | Represents the total balance of issued cards at the start of the period covered by the report. |

| Pending Credit Balances | Represents the sum of funds remaining on single-use cards after an authorization request has been received (and before a settlement request is received) at the start of the balance sheet period. Any remaining funds beyond the authorization request amount are frozen until settlement during this period. The remaining funds are transferred back to the funding account as soon as the settlement request is received.

Note: Refer to "The Authorisation and Settlement Process" for a more detailed description of card scheme authorizations and the settlement process.

Note: Cards loaded with the exact amount to be spent will have minimal frozen funds. |

Funding In

| Field | Description |

|---|

| Internal Transfers In | Represents the total amount of funds deposited from other funding accounts (in the same or different currency). |

| Bank Funding | Represents the total amount of funds deposited into a funding account from client bank accounts. |

| Credit/Debit Card Funding | Represents the total funds deposited into a client's credit/ debit card funding account. |

| Manual Adjustments | Represents the total amount of manual adjustment credits.

Note: See Manual Adjustments for a more detailed description of manual adjustments. |

Settlements

| Field | Description |

|---|

| Settlement Refund | Represents the total amount of purchase refunds processed on the cards. |

Other Funding/Refunds

| Field | Description |

|---|

| Disputes Won | Represents the total amount of disputes won. |

Main Balance Sheet Report Content

Ending Balance

| Field | Description |

|---|

| Funding Account | Represents the total balance of the funding account (for one specific currency) at the end of the period covered by the report. |

| Card Balances | Represents the total balance of issued cards at the end of the period covered by the report. |

| Pending Card Balances | Represents the sum of funds remaining on single-use cards after an authorization request has been received (and before a settlement request is received) at the end of the balance sheet period. |

Funding Out

| Field | Description |

|---|

| Internal Transfers Out | Represents funds transferred to other funding accounts (these will match the corresponding Internal Transfers In the entry for those funding accounts). |

| Return to Bank Account | Represents the total amount of funds returned to client bank accounts. |

| Return to Credit Debit Card | Represents the total amount of funds returned to client credit/debit cards. |

| Manual Adjustments | Represents the total amount of manual adjustment debits.

Note: See "Manual Adjustments" for a more detailed description of manual adjustments. |

Settlements

| Field | Description |

|---|

| Forex Fees | Represents Forex fees associated with purchases performed through virtual cards. |

| Settlement Purchases | Represents merchant purchases performed through virtual cards. |

Charges

| Field | Description |

|---|

| Funding Deposits | Represents fees for funding account deposits. Nium may charge such fees according to the Nium service agreement. |

| Card Creation | Represents fees for virtual card creation. Nium may charge such fees according to the Nium service agreement. |

| Internal Transfers Fees | Represents fees for transfers between funding accounts. Nium may charge such fees according to the Nium service agreement. |

| Internal Transfers Conversion Fees | Represents fees for currency conversion associated with transfers between funding accounts. Nium may charge such fees according to the Nium service agreement. |

| Spend Fees | Represents fees for merchant purchases. Nium may charge such fees according to the Nium service agreement. |

| Card Creation Forex Charges | Represents Forex charges incurred during virtual card creation and associated with loading funds onto a card. |

| Card Deletion Forex Charges | Represents Forex charges incurred during virtual card deletion and associated with moving funds from the card to a funding account. |

| Card Deletion Transfer Charges | Represents transfer fees associated with virtual card deletion (moving funds from the card to a funding account). Nium may charge such fees according to the Nium service agreement. |

| Dispute Won Processing Fees | Represents fees associated with the processing of disputes won. |

| Dispute Lost Processing Fees | Represents fees related to the processing of disputes lost. |

| Invalid Dispute Processing Fees | Represents fees related to the processing of invalid disputes. |

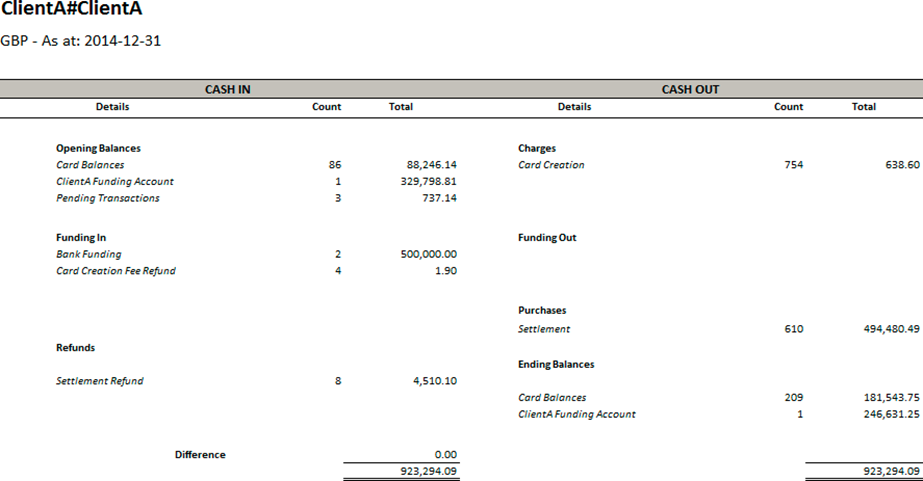

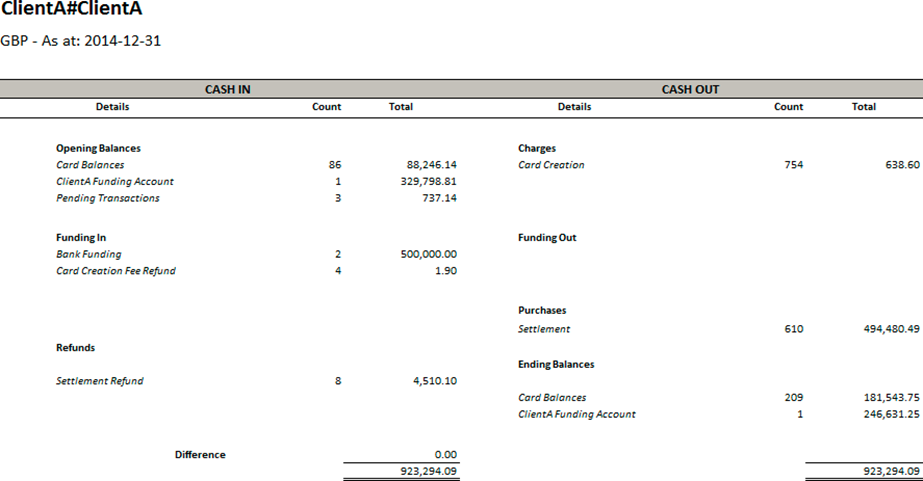

This is an example of a main balance sheet report:

Associated detailed sheets

The following associated detailed sheets are available:

| Sheet | Description |

|---|

| Settlements | This sheet contains details of transaction settlements. |

| Bank Deposits | This sheet contains full details of deposits made into funding accounts. |

| Balances-FA | This sheet contains account balances of all funding accounts. |

| Balances-Cards | This sheet contains the account balances of all virtual cards. |

| Balances-PC | This sheet contains account balances that are pending credit. |

| Transfers | This sheet contains full details of transfer transactions involving a Forex fee or a transfer charge. |

| Loss Txns | This sheet contains details of losses due to insufficient funds for card settlements. |

| Suspended Txns | This sheet contains details of transactions that are pending. This means that transaction balance movements are not all completed. (For example, funds withdrawn from the funding account but not yet credited to the virtual card.) |

| Cards Created | This sheet contains card creation details for all cards with entries in balance sheet reports. |

| Cards Deleted | This sheet contains details of deleted cards. |

| Disputes | This sheet contains details of disputes won, disputes lost and fees deducted for invalid disputes. |

Settlements report

This sheet of the Balance Sheet report contains details of transaction settlements.

| Field | Description |

|---|

| Transaction Entry Id | A unique transaction identifier. |

| Transaction Date | The date when the transaction took place. |

| Transaction Type | The type of the transaction. |

| Details | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Currency | The currency of the transaction. |

| Actual Amount | The actual amount of the transaction is expressed in Currency. |

| Card Balance Adjust | The adjustment amount on the card is expressed in Currency. It is the sum of the card transaction amount, the non-Forex charge, and the Forex fee. |

| Charge | Charge applied to the settlement, expressed in Currency. |

| Forex Fee | Forex fees for the reported transaction (if applicable), expressed in Currency. |

| Issuer | The name of the card issuer. |

| Card Brand | The card scheme of the issued card. |

| Month | The year and month when the transaction took place. |

| Card Reference | A unique external reference of the card is returned through the Nium API. |

Bank deposits report

This sheet of the Balance Sheet report contains full details of deposits made into funding accounts.

| Field | Description |

|---|

| Transaction Entry Id | A unique transaction identifier. |

| Transaction Date | The date when the transaction took place. |

| Transaction Type | The type of the transaction. |

| Details | It contains transaction details and adjustment notes, if applicable. |

| Currency | The currency of the transaction. |

| Balance Adjust | The adjustment amount on the card is expressed in Currency. It is the sum of the card transaction amount, the non-Forex charge, and the Forex fee. |

| Charge | A charge is applied to the deposit/withdrawal. |

Balances-FA report

This sheet of the Balance Sheet report contains account balances of all funding accounts.

| Field | Description |

|---|

| Balance Id | Contains a unique balance entry identifier. |

| Details | Contains the name of the funding account. |

| Currency | Represents the currency of the transaction. |

| Balance | Represents the current balance of the funding account. |

Balances-Cards report

This sheet of the Balance Sheet report contains the account balances of all virtual cards.

| Field | Description |

|---|

| Balance Id | Contains a unique balance entry identifier. |

| Details | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Currency | Represents the currency of the transaction. |

| Balance | Represents the current balance of the virtual card. |

| Issuer | Contains the name of the card issuer. |

| Card Brand | Represents the card scheme of the issued card. |

| Card Reference | It contains a unique external reference of the card returned through the Nium API. |

Balances-PC report

This sheet of the Balance Sheet report contains account balances that are pending credit.

| Field | Description |

|---|

| Balance Id | Contains a unique balance entry identifier. |

| Details | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Currency | Represents the currency of the transaction. |

| Balance | Represents the current balance of the virtual card. |

Transfers report

This sheet of the Balance Sheet report contains full details of transfer transactions that either involved a Forex fee or a transfer charge.

| Field | Description |

|---|

| Month | Represents the year and month when the transaction took place. |

| Transaction Entry Id | Contains a unique transaction identifier. |

| Transaction Date | Represents the date when the transaction took place. |

| Transfer Type | Contains a description of the type of transfer. |

| Source Currency | Represents the base currency of the source instrument. |

| Source Amount | Represents the transaction amount expressed in Source Currency. |

| Destination Currency | Represents the currency of the transaction. |

| Destination Amount | Represents the transaction amount expressed in Destination Currency. |

| Transaction Charge Currency | Represents the currency of the transaction charge. |

| Transfer Charge | Represents the transaction charge for the transfer expressed in Transaction Charge Currency. |

| Forex Fee | Represents Forex fees for the reported transaction (if applicable) expressed in the relevant currency (depending on Charging Side). |

| Transfer Details | Indicates whether the transfer was a standard transfer with a charge (empty value) or a CONVERSION transfer (involving a Forex fee). |

| Charging Side | Indicates whether the charge or Forex fee was charged to the SOURCE or the DESTINATION. |

Loss Txns report

This sheet of the Balance Sheet report contains details of losses due to insufficient funds for card settlements.

| Field | Description |

|---|

| Transaction Entry Id | Contains a unique transaction identifier. |

| Transaction Date | Represents the date when the transaction took place. |

| Transaction Type | Represents the type of transaction. |

| Details | It contains the card details and the account name associated with the loss. |

| Currency | Represents the currency of the transaction. |

| Loss Amount | Represents the loss amount resulting from the transaction (expressed in Currency). |

| Issuer | Contains the name of the card issuer. |

| Card Brand | Represents the card scheme of the issued card. |

Suspended Txns report

This sheet of the Balance Sheet report contains details of pending transactions.

| Field | Description |

|---|

| Transaction Entry Id | Contains a unique transaction identifier. |

| Transaction Date | Represents the date when the transaction took place. |

| Transaction Status | Represents the status of the transaction. |

| Transaction Type | Represents the type of transaction. |

| Currency | Represents the currency of the transactions. |

| Transaction Amount | Represents the transaction amount expressed in Currency. |

| Balance Adjust | Represents the adjustment amount on the card expressed in Currency. It is the sum of the card transaction amount, the non-Forex charge, and the Forex fee. |

| Suspension Status | Represents the current suspension status of the transaction, such as REVERSAL (indicating that the suspension has been resolved and the transaction has been reversed) or SUSPENDED (indicating that the transaction is still suspended). |

Cards created report

This sheet of the Balance Sheet report contains card creation details for all cards that have entries in balance sheet reports.

| Field | Description |

|---|

| Creation Date | Represents the date when the virtual card was created. |

| Card Number | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Currency | Represents the currency of the card. |

| Card Reference | It contains a unique external card reference as returned through the Nium API. |

| Issuer | Contains the name of the card issuer. |

| Card Brand | Represents the card scheme of the issued card. |

| Creation Charge | Represents the charge associated with the creation of the instrument. |

| Charge Currency | Represents the currency of the Creation Charge. |

Cards deleted report

This sheet of the Balance Sheet report contains details of deleted cards.

| Field | Description |

|---|

| Deletion Date | Represents the date when the virtual card was deleted. |

| Currency | Represents the currency of the card. |

| Card State | Represents the state of card deletion: Pending Destruction or Deleted. |

| Card Number | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Issuer | Contains the name of the card issuer. |

| Card Brand | Represents the card scheme of the issued card. |

| Deletion Type | Contains a description of the deletion activity. |

| Deletion Charge | Represents the charge associated with the deletion of the instrument. |

| Charge Currency | Represents the currency of the Deletion Charge. |

Disputes report

This sheet contains details of disputes won, disputes lost and fees deducted for invalid disputes.

| Field | Description |

|---|

| Transaction Entry Id | Contains a unique transaction identifier. |

| Transaction Date | Represents the date when the transaction took place. |

| Transaction Type | Represents the type of transaction. |

| Details | Contains the first six and the last four digits of a card. This should not be used to match or map card numbers (multiple cards can share the same first six and last four digits). Card reference should be used instead. For example, 406742******8806. |

| Currency | The currency of the transaction. |

| Actual Amount | The actual amount of the transaction is expressed in Currency. |

| Card Balance Adjust | The adjustment amount on the card is expressed in Currency. It is the sum of the card transaction amount, the non-Forex charge, and the Forex fee. |

| Charge | Charge applied to the dispute, expressed in Currency. |

| Issuer | The name of the card issuer. |

| Card Brand | The card scheme of the issued card. |

| Card Reference | A unique external reference of the card is returned through the Nium API. |