Letter of Authorization

A Letter of Authorization (LOA) or Power of Attorney (POWER_OF_ATTORNEY) is a document signed by a business signatory that authorizes an applicant to conduct financial transactions and related activities on behalf of the business. This document is critical because it verifies the applicant’s authority to represent the business.

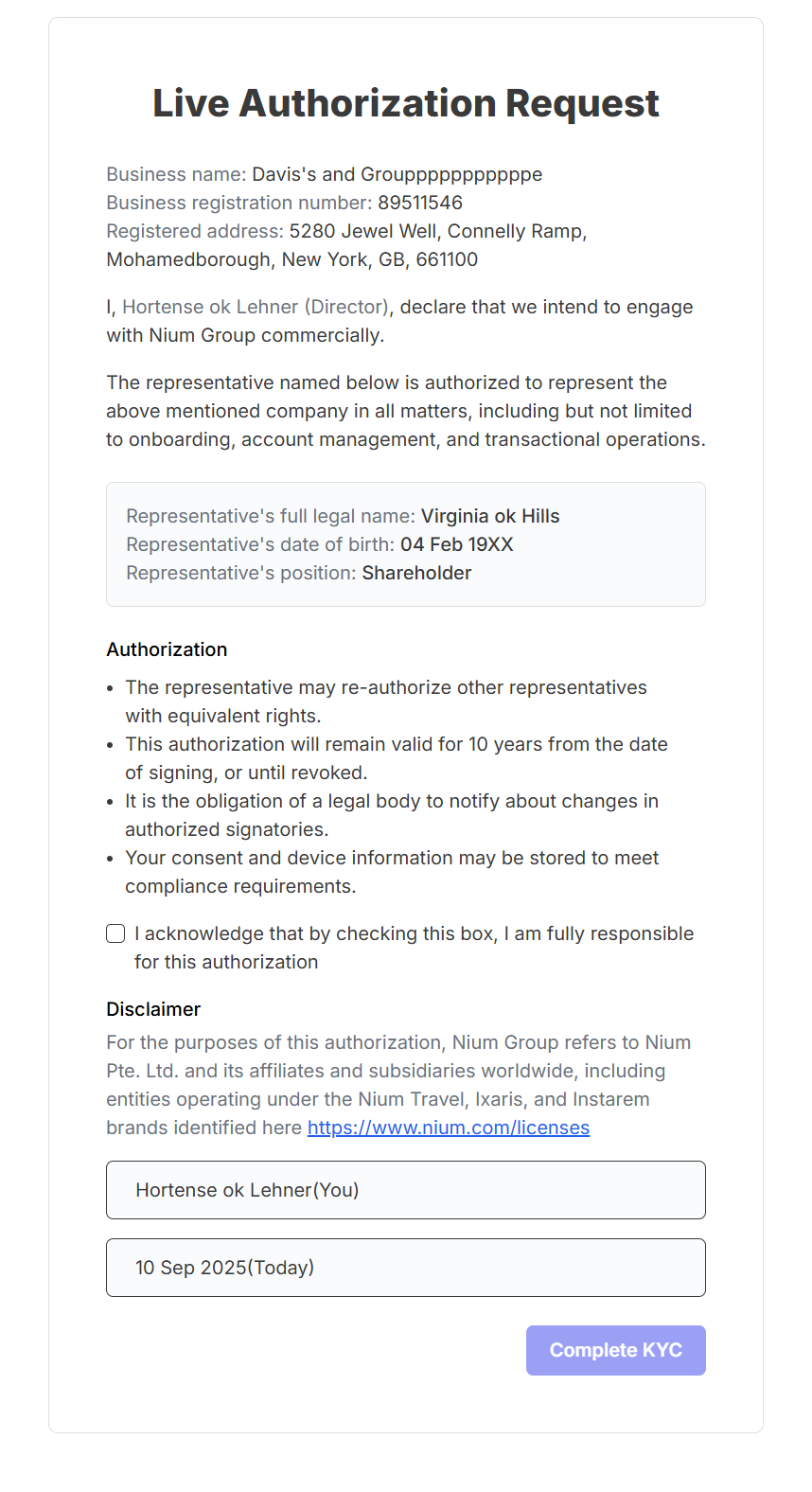

Live-authorization is a digital process where a signatory authorizes the applicant without requiring physical documents or signatures.

Regional requirements

APAC/UK

For customers in AU, NZ, SG, HK, UK, CA, and JP:

If the applicant is not a DIRECTOR, UBO (Ultimate Beneficial Owner), or an equivalent role, they must submit a Letter of Authorization (documentType = LOA).

- In the UK, use

POWER_OF_ATTORNEY. - If the LOA is missing or incorrect, a compliance agent will raise an RFI (Request for Information) with the template

applicantAuthorizationLetter. For more details about RFI templates, see RFI Templates. - The LOA must be issued and signed by directors or other authorized signatories.

US

For customers in the US:

- If the applicant is not an officer, an LOA can be submitted.

- If not submitted, the LOA will be requested via an RFI.

EU

For customers in the EU:

- If the applicant is not a DIRECTOR, they must submit a

POWER_OF_ATTORNEY. - If issued in a non-EEA country, the Power of Attorney must be certified by an apostille.

- Alternatively, the applicant can nominate a director to provide live-authorization.

- A live-authorization does not require an apostille, regardless of where it is issued.

LOA template

Applicants can use the following application, have it signed by directors or authorized signatories (or officers in the US):

Live-authorization

Live-authorization is an alternative to submitting a Power of Attorney. Applicants can nominate a director (or other signatory with equivalent powers) to provide digital authorization.

Benefits of live-authorization include:

- Removing the need for physical documents.

- In the EU, avoids the requirement for a Power of Attorney certified by an apostille.

Currently, live-authorization is available only in the EU but we're on brining this capability to more regions.

Process

- Applicant nominates a director as the Live-Authorizer and skips submitting a Power of Attorney.

- Applicant completes biometric verification using a link (Onfido).

- The nominated director receives a separate link (shared by the client), reviews applicant and authorization details, provides consent, and completes biometric verification.

- This process creates a legally enforceable authorization equivalent to a signed LOA or Power of Attorney.

Implementation notes

- If the applicant is not a Director, your UI should allow them to either:

- Submit a Power of Attorney, or

- Nominate a director for Live-authorization.

- For the nominated director:

- Pass

stakeholderDetails.isLiveAuthorizeras true andkycModeas E_DOC_VERIFY.

- Pass

- You receive an additional

redirectURLin the Onboard Corporate Customer response. Share this link with the nominated director. - Do not submit a Power of Attorney for this applicant.

- Once all required documents and biometric checks are completed (by the applicant, director, and others), the

complianceStatusupdates toACTION_REQUIREDand Nium reviews the application. - If Live-authorization fails, operations may request re-authorization or a Power of Attorney via RFI.

Validations

- Only one stakeholder can be nominated for live-authorization.

- The position field must contain DIRECTOR if

isLiveAuthorizeris set to true. - Currently, only directors are eligible for live-authorization.

kycModeE_DOC_VERIFY must be used whenisLiveAuthorizer = true.