Corporate Customers

This page introduces the onboarding process and the Know Your Business (KYB) requirements for a corporate customer. The Nium One platform onboards a corporate customer through a client. It verifies their identity and assigns them a wallet that holds the balance.

The term corporate customer includes:

- Small and medium enterprise (SME)

- Business

- Business client

Introduction

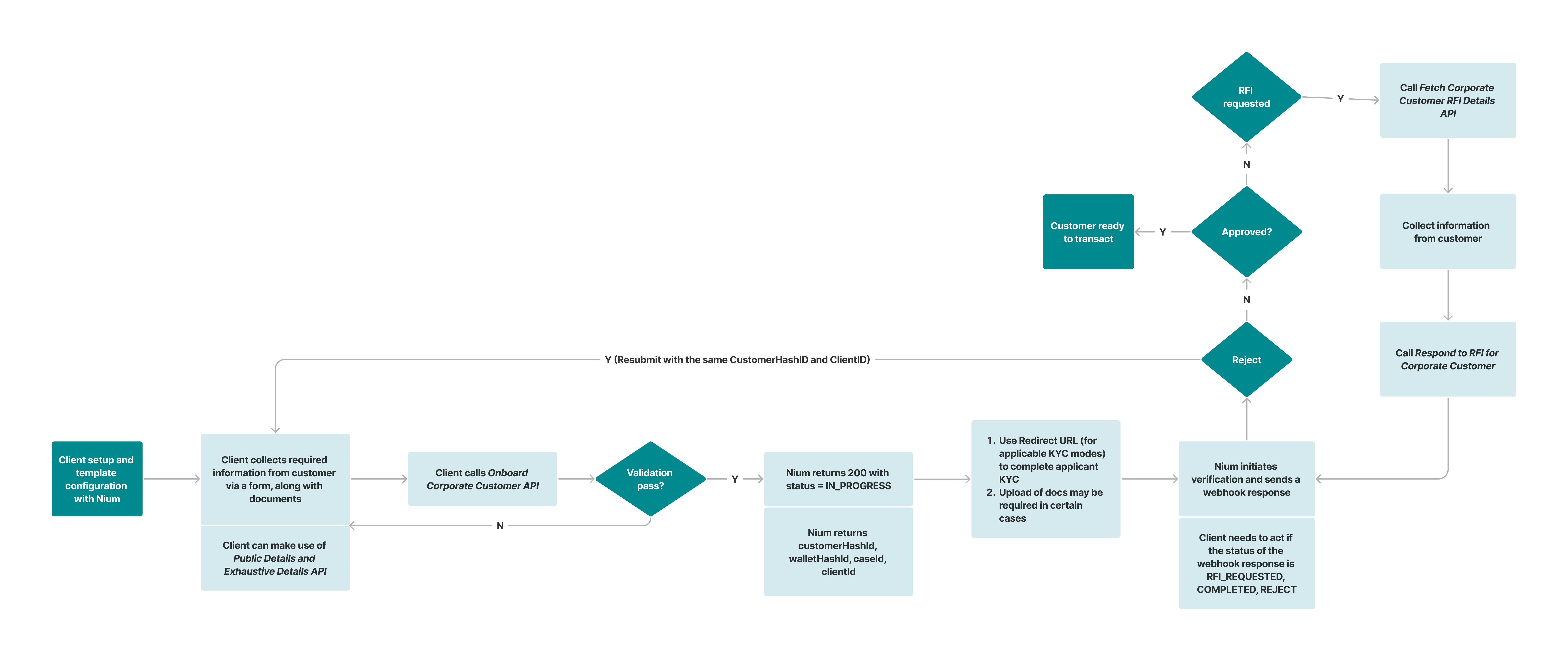

Onboarding process flow

After you complete your client setup you need to onboard your corporate customer. You need to submit an application through an API so Nium can complete the customer's KYB verification according to regional regulatory guidelines.

Nium requires the customer to wait for the KYB process to complete before they can make transactions. Nium offers an eKYB flow to onboard a customer in most regions. The eKYB verification completes in a few minutes allowing the customer to transact quickly after submitting their application.

The corporate customer onboarding process is composed of the following parts.

| Corporate customer onboarding | Description |

|---|---|

Submission of required information:

| You need to collect the following information from the corporate customer and submit it to Nium via APIs:

|

Information verification:

| After the information is received, Nium starts the verification process:

|

Definitions

| Entity type | Definition |

|---|---|

| Applicant | An applicant is an individual who is submitting the application on behalf of the corporate customer. Usually, an applicant is an authorized representative or signatory of the corporate customer. An applicant has to undergo Know Your Customer (KYC) verification as part of the KYB process. |

| Business | A business is a corporate customer that's being onboarded. |

| Stakeholder | A stakeholder is an individual or entity that's declared in the registration documents of the business as an officer or shareholder. Information about all stakeholders needs to be submitted. Nium performs a KYC check on all stakeholders according to regulatory guidelines. Stakeholder can be a business or a natural person. |

Region-specific KYB and KYC offerings

For detailed onboarding steps about your region, click the onboarding link next to the region's name.

Australia — AU onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real time | E_KYC for AU resident via database verification. E_DOC_VERIFY for non-AU resident via a live selfie photograph. MANUAL_KYC manual submission of documents. | E_KYC for AU resident via database verificationMANUAL_KYC for non-AU resident via manual submission of documents |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_KYC for AU resident via the database verification. E_DOC_VERIFY for non-AU resident via a live selfie photograph. MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents, regardless of residence |

Canada - CA onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real time | E_KYC for AU resident via database verification. E_DOC_VERIFY for non-AU resident via a live selfie photograph. MANUAL_KYC manual submission of documents. | E_KYC for AU resident via database verificationMANUAL_KYC for non-AU resident via manual submission of documents |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_KYC for AU resident via the database verification. E_DOC_VERIFY for non-AU resident via a live selfie photograph. MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents, regardless of residence |

European Union — EU onboarding

Only customers registered in EEA are eligible to be onboarded under EU region. Please contact your account manager, in case you need to onboard customers registered outside of EEA.

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Enable the pre-population of data. Lesser time to approval. | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. | E_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference. |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. | E_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference. |

Hong Kong — HK onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| Manual KYB | Requires Nium compliance review and manual submission of documents. | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents, regardless of residence. |

Japan — JP onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| Manual KYB | Requires Nium compliance review and manual submission of documents. | MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents, regardless of residence. |

New Zealand— NZ onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real time | E_KYC for NZ resident via database verification. E_DOC_VERIFY for non-NZ resident via a live selfie photograph. MANUAL_KYC manual submission of documents. | E_KYC for NZ resident via database verificationMANUAL_KYC for non-NZ resident via manual submission of documents |

| Manual KYB | Requires Nium compliance review and manual submission of documents. | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents. |

Singapore — SG onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real time | E_KYC for SG residents via Myinfo verificationE_DOC_VERIFY for non-SG residents. This enum is used when verification is performed via a live selfie photograph. MANUAL_KYC manual submission of documents | E_KYC via Myinfo verification or MANUAL_KYC E_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference. |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_KYC for SG residents via the Myinfo verificationE_DOC_VERIFY for non-SG residents and is applicable via a live selfie photograph. MANUAL_KYC manual submission of documents. | E_KYC via Myinfo verification or MANUAL_KYC E_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference. |

United Kingdom — UK onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real time | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. | E_KYC for UK residents via the database verificationE_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference for non-UK residents. |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_DOC_VERIFY regardless of residence and is applicable via a live selfie photograph. | E_KYC for UK residents via the database verificationE_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference for non-UK residents. |

United States — US onboarding

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| eKYB | Real-time | E_KYC for US residents via database verification. E_DOC_VERIFY for non-US residents and is applicable via a live selfie photograph. MANUAL_KYC manual submission of documents. | E_KYC for US residents via the database verification. MANUAL_KYC for non-US resident via manual submission of documents. |

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_KYC for US residents via database verification. E_DOC_VERIFY for non-US residents and is applicable via a live selfie photograph. MANUAL_KYC manual submission of documents. | MANUAL_KYC manual submission of documents, regardless of residence. |

Other Countries — SG onboarding

Businesses which are not covered in any of the above regions can be onboarded through SG as the regulatory region. All the required parameters, required documents, and the onboarding flow are the same as that of SG. Currently, only Manual KYB is supported.

| KYB offering | Business verification | Applicant verification | Stakeholder verification |

|---|---|---|---|

| Manual KYB | Requires Nium compliance review and manual submission of documents | E_DOC_VERIFY or MANUAL_KYC based on the applicant's preference. | E_DOC_VERIFY or MANUAL_KYC based on the stakeholder's preference. |

Implementation

You can onboard corporate customers with Nium in two ways:

-

Custom API Integration: Use Nium's Customer Account - Corporate APIs to build a tailored onboarding experience. This option is ideal for clients who want a fully customized onboarding journey.

-

Onboarding Forms: Use Nium's pre-built onboarding forms for a faster, low-effort setup. This is a good fit for clients with a smaller number of corporate customers to onboard and minimal engineering resources.

For more details about our pre-built Onboarding Forms, see Onboarding Forms.

The following details how to onboard corporate customers using a custom Integration.

Client Configuration

Before you call our APIs for Onboarding, follow the steps below:

- IP Whitelisting: Provide the IPs that make server calls to be whitelisted in our system. If you have IP based restriction to receive our webhooks, you can whitelist the below: Sandbox: 52.212.51.166 Production: 54.77.46.201

- Webhook notifications: Provides an endpoint to receive onboarding webhooks.

- Webhooks: We recommend subscribing to the following webhook onboarding updates. CUSTOMER REGISTRATION WEBHOOK: Sent when a customer is created and returns the walletHashid and customerHashId. CARD CLIENT KYB STATUS WEBHOOK: Provides status updates after a customer is successfully created.

- KYC redirect URL: Provides an endpoint to receive browser redirects if you're using E_DOC_VERIFY or E_KYC in SG.

Choosing the regulatory region of the customer

If you are client is getting onboarded in multiple regions, Nium will perform due diligence on the multiple entities of the client and generate multiple clientHahsIds, one for each region.

Maintain the mapping of clientHahsId vs region and make sure onboarding requests for a customer are submitted only using the clientHashId configured for that region.

Regulatory regions should be chosen based on the registered country of the customer as described in the table below.

Please contact Nium support if you have an arrangement that doesn't follow the table below.

| Customer registered country | Regulatory region |

|---|---|

| AU or NZ | AU or NZ respectively |

| CA, HK, JP | CA, HK, JP respectively |

| GB, CH, MC | UK |

| US | US |

| EEA countries | EU |

| SG | SG |

| None of the above* | SG |

- Customers with registeredCountry in China (CN), India (IN), Malaysia (MY) and South Africa (ZA) fall outside of Nium cross-border policy supported countries and hence cannot be onboarded under any regulatory region. Reach out to Nium support for guidance on such customers.

Submitting information

You need to send the required information below by one or more APIs summarized in the table.

| Region | eKYB required steps |

|---|---|

| AU and NZ | 1. (Optional) Public Corporate Details using Business ID API 2. Onboard Corporate Customer API |

| EU / SG / UK | 1. Public Corporate Details using Business ID API 2. Exhaustive Corporate Details using Business ID API 3. Onboard Corporate Customer API |

| US | Onboard Corporate Customer API |

For MANUAL_KYB, you only need to call the Onboard Corporate Customer API.

Before you onboard a corporate customer in a particular region, you need to create a clientHashId in that particular region. For more details, see Getting Started or contact Nium Support.

Onboard API response

You can implement the following actions based on the status field in the response.

| HTTP code | Status | Next steps |

|---|---|---|

| 200 | IN_PROGRESS | 1. Use a redirect URL to complete KYC. 2. Upload required documents using Upload documents API. 3. Wait for the webhook response. |

| 400 | BAD_REQUEST | Correct the data and resubmit the application. |

200 response

Once the application is submitted via the Onboard Corporate Customer API, a customer is created and you receive the following customer information in the response, along with any errors or remarks, to be stored for future use:

caseIdclientIdcustomerHashIdwalletHashId

The response also contains the status which is always IN_PROGRESS. One or both of the following can happen at this stage:

-

When a

redirectURLis provided for applicant, it means the applicant has to be redirected to the vendor's page for completion of the applicant's KYC. IfredirectURLis issued for a stakeholder, you are expected to distribute the URL to the stakeholder. Refer to the individual region pages for more information. Once the process is completed for the applicant and all the stakeholders, wait for webhook events to indicate the change in the corporate customers'complianceStatus. -

Additional documents might be required, which can be submitted via the Upload Document for Corporate Customer API, regardless of a

redirectURL. Refer to the individual regions for the complete list of documents required for eKYB and manual KYB flows. Also, you can make use of theremarksfield in the response, which can be shown to the applicant, and collect documents accordingly.

After either or both of the above-mentioned steps are completed as required, Nium initiates verification of the application. The application can either get verified in real time or through manual review. The status of the application changes to either ACTION_REQUIRED, COMPLETED, or REJECT, accordingly. Any change in status is communicated via webhook, so wait for the webhook event to complete.

Response example for IN_PROGRESS with redirectUrl

{

"clientId": "NIM1749530216XYN",

"caseId": "680551ce-1189-495a-93ca-f22156ff619f",

"status": "IN_PROGRESS",

"remarks": "BUSINESS -> Application is being reviewed by our compliance agent",

"customerHashId": "a90dc76e-4a09-4d07-ae98-aeab5c7fa1a7",

"walletHashId": "7b6182fa-21a3-4dbb-b12e-adda0e66bc9c",

"redirectUrl": "https://idv.preprod.nium.com/preprod/compliance/callback/load?referenceNumber=492d74c3-ebc6-4f8e-869e-be2822c4c622",

"expiry": "43200", // deprecated

"errors": [],

"kycURLs": {

"applicantKycUrl": {

"redirectUrl": "https://idv.preprod.nium.com/preprod/compliance/callback/load?referenceNumber=492d74c3-ebc6-4f8e-869e-be2822c4c622",

"referenceId": "49b7a26f-3f24-480e-94d9-bb24c6701ae4"

},

"stakeholderKycUrls": [

{

"redirectUrl": "https://idv.preprod.nium.com/preprod/compliance/callback/load?referenceNumber=2e07c4d8-241a-4282-a0a7-93ee2ecd193b&referenceId=247f2897-00ee-48f2-ad71-69be1887343b",

"referenceId": "247f2897-00ee-48f2-ad71-69be1887343b",

"firstName": "KATIE",

"middleName": "ATIKINSON",

"lastName": "RONTAK",

"dateOfBirth": "1981-06-15",

"nationality": "GB"

}

]

}

}

redirectURLandkycURLs.applicantKycUrls.redirectUrlare the same. Redirect URL is retained to support integrations of old clients.redirectURLis returned only for those stakeholders or applicant for whomkycModeis submitted asE_DOC_VERIFY. AdditionallyE_KYCinSGregion returnsredirectURL. To know which regions supportE_DOC_VERIFY, see Region specific KYB and KYC offerings- It is recommended to pass

referenceIdof the stakeholders in the Onboard Corporate Customer API. If not passed, you can use the name and date of birth to match with your stakeholder. - There is no expiry on the

redirectURL. Customer can refresh the browser or click on the same link, in case the session expires. The fieldexpiryprovided in the response will be deprecated. - In case applicant and stakeholder are the same person (but submitted twice in the application) and both are submitted as E_DOC_VERIFY then only one redirectURL will be returned for the applicant, there will be no stakeholderKYCURL returned in this scenario.

- See region wise guides for more tips on how to integrate the E_DOC_VERIFY flow.

- You can also fetch the redirectURLs in customerDetails V2 and Customer List V3 APIs as shown below:

"stakeholders": [

{

"referenceId": "ef08d819-1459-4058-84ab-7c8796c83cab",

"redirectURL": "https://idv.preprod.nium.com/preprod/compliance/callback/load?referenceNumber=4eb841b6-7428-465a-8311-8c3dca93358a&referenceId=ef08d819-1459-4058-84ab-7c8796c83cab",

"stakeholderDetails": {

"firstName": "KATIE",

"middleName": "ATIKINSON",

"lastName": "RONTAK"

}

]

"applicantDetails": {

"referenceId": "9f39bef4-780a-4451-ae04-02108902326b",

"redirectURL": "https://idv.preprod.nium.com/preprod/compliance/callback/load?referenceNumber=71abe935-f3d9-4dc3-8ae1-ce9b2904a2fd",

"firstName": "SHELDON",

"middleName": "PATTERSON",

"lastName": "COOPER",

}

400 response

In case of any basic validation failures, Nium returns an HTTP 400 Bad Request response status code to the Onboard Corporate Customer API. You need to look at the errors field and resubmit with the correct customer details.

{

"status": "BAD_REQUEST",

"message": "Unable to create customer v1: Validation failed for input provided",

"errors": [

"[\"The maximum length of email is 60 characters\"]"

]

}

All corporate customers are required to have a unique business name and business registration number.

Bad request example with a non-unique name:

{

"status": "BAD_REQUEST",

"message": "Unable to create customer v1: Corporate customer already exist with customerHashId 88464f2d-8caa-4cd4-a1db-346d9defde05",

"errors": [

"[\"Corporate customer already exist with customerHashId 88464f2d-8caa-4cd4-a1db-346d9defde05\"]"

]

}

errorDetails object

In addition to the above basic errors, more detailed errors are presented in the below format with code and description. For details on the different error codes, see Onboarding error codes.

{

"status": "BAD_REQUEST",

"code": "unable to initiate CaaS Corporate Onboarding",

"message": "{\"errors\":[{\"code\":\"E100\",\"description\":\"Tax Details is Missing for Business Entity MONEYWISE PARTNERS324905\"},{\"code\":\"E100\",\"description\":\"Tax Country is Missing for Business Entity MONEYWISE PARTNERS324905\"},{\"code\":\"E100\",\"description\":\"Registered Address Line 1 is Missing for Business Entity MONEYWISE PARTNERS324905\"},{\"code\":\"E100\",\"description\":\"Address Registered Country is Missing for Business Entity MONEYWISE PARTNERS324905\"},{\"code\":\"E100\",\"description\":\"Address Post Code is Missing for Business Entity MONEYWISE PARTNERS324905\"},{\"code\":\"E200\",\"description\":\"Share percentage is Missing for Stakeholder Ultimate Beneficial Owner Mila John Jekovar\"}],\"custAdtlInfoNeeded\":false,\"statusCode\":\"400\",\"errorMessage\":\"Compliance Request Validation Failed with Errors - Tax Details is Missing , Tax Country is Missing , Tax Number is Missing , Registered Address Line 1 is Missing , Address Registered Country is Missing , Address Post Code is Missing for Business entity MONEYWISE PARTNERS324905. \\n Share percentage is Missing for stakeholder Ultimate Beneficial Owner Mila John Jekovar. \\n Please provide the required information.\",\"isCustAdtlInfoNeeded\":false}",

"errorDetails": [

{

"code": "E100",

"description": "Tax Details is Missing for Business Entity MONEYWISE PARTNERS324905"

},

{

"code": "E100",

"description": "Tax Country is Missing for Business Entity MONEYWISE PARTNERS324905"

},

{

"code": "E100",

"description": "Address Registered Country is Missing for Business Entity MONEYWISE PARTNERS324905"

},

{

"code": "E100",

"description": "Address Post Code is Missing for Business Entity MONEYWISE PARTNERS324905"

},

{

"code": "E200",

"description": "Share percentage is Missing for Stakeholder Ultimate Beneficial Owner Mila John Jekovar"

}

]

}

Webhooks

After receiving the response from the Onboard Corporate Customer API, for all cases where status = IN_PROGRESS, Nium sends a webhook event to the configured client URL, under Notification Webhook.

You need to look for the corresponding template within the webhook event's response CARD_CLIENT_KYB_STATUS_WEBHOOK in the Client-KYB Status event.

To learn more about webhooks, see Notifications and Webhooks.

complianceStatus field

In the webhook response, the complianceStatus field can have one of the following values.

| complianceStatus | Description |

|---|---|

ACTION _REQUIRED | Wait for the next state while your compliance agent is reviewing the application. |

COMPLETED | This is not a terminal state. RFIs can be raised even after this state. Transactions are not allowed yet. Look at status field for confirmation of approval. |

REJECT | The corporate customer needs to resubmit the application to restart the process along with clientId and customerHashId. This is not a terminal state. |

RFI_REQUESTED | If the compliance agent finds insufficient information in the application, they raise a request for information (RFI) to you to collect the missing information from the corporate customer. |

RFI_RESPONDED | After you gather the missing information, send it via the Respond to RFI API. After the missing information is received, you receive this webhook event. Once compliance status changes to RFI_REQUESTED, a compliance officer will work on the application only after it reaches RFI_RESPONDED. The client has to make sure that all the RFIs are responded to and compliance status has reached RFI_RESPONDED |

complianceStatus only details the progress of the application but doesn't confirm the approval. RFIs can be raised after any complianceStatus and it is advisable to keep the RFI process open in any state.

Resubmission is not allowed if the customer's application is rejected due to high risk or non-compliance. Please reach out to your Nium account manager or Nium Support for more details.

When an application is rejected due to high risk or non-compliance reasons, resubmitting the application returns error R800. Use the R800 error to identify applications that were rejected due to non-compliance reasons and can't be resubmitted.

{

"status": "BAD_REQUEST",

"code": "unable to initiate CaaS Corporate Onboarding",

"message": "{\"errors\":[{\"code\":\"R800\",\"description\":\"Application cannot be resubmit as it was rejected for high risk."}],\"isCustAdtlInfoNeeded\":false}",

"errorDetails": [

{

"code": "R800",

"description": "Application cannot be resubmit as it was rejected for high risk."

}

}

status field

This field can have the following values.

| Status | Description |

|---|---|

Pending | This state indicates that the application is under review. This is not a terminal state. |

Clear | This is a terminal state and is the confirmation of approval. Client can communicate the approval to customers and transactions are allowed only in this state. In rare scenarios of post-approval due diligence, RFIs can be raised even after this state, which can be inferred from the change in complianceStatus |

Failed | The corporate customer needs to resubmit the application to restart the process along with clientId and customerHashId. This is a terminal state and Compliance agent might not entertain the resubmission. |

The same status can also be found in Customer Details API.

RFI process

While the application status is ACTION_REQUIRED, the compliance agent may request additional information by raising an RFI request, which sets the complianceStatus as RFI_REQUESTED in the webhook response. Then, you need to call the Fetch Corporate Customer RFI Details API to fetch the RFI templates requested by using the clientID and caseID parameters or by using only the customerHashId.

There can be multiple RFI templates in the response.

The Respond to RFI for Corporate Customer API should be used to respond to all required fields for each RFI template raised. The required fields are different for each RFI template but are a subset of the Onboard Corporate Customer API. For the complete list of RFI templates and required fields or documents by region, see the RFI templates page. After an RFI template is responded, the status of the template changes to RFI_RESPONDED in the Fetch Corporate Customer RFI Details API.

Once all the RFI templates are responded, the status of the application changes from RFI_REQUESTED to RFI_RESPONDED and you will receive a webhook with complianceStatus=RFI_RESPONDED

After the application, the complianceStatus can again become RFI_REQUESTED or one of the terminal states becomes COMPLETED or REJECTED.

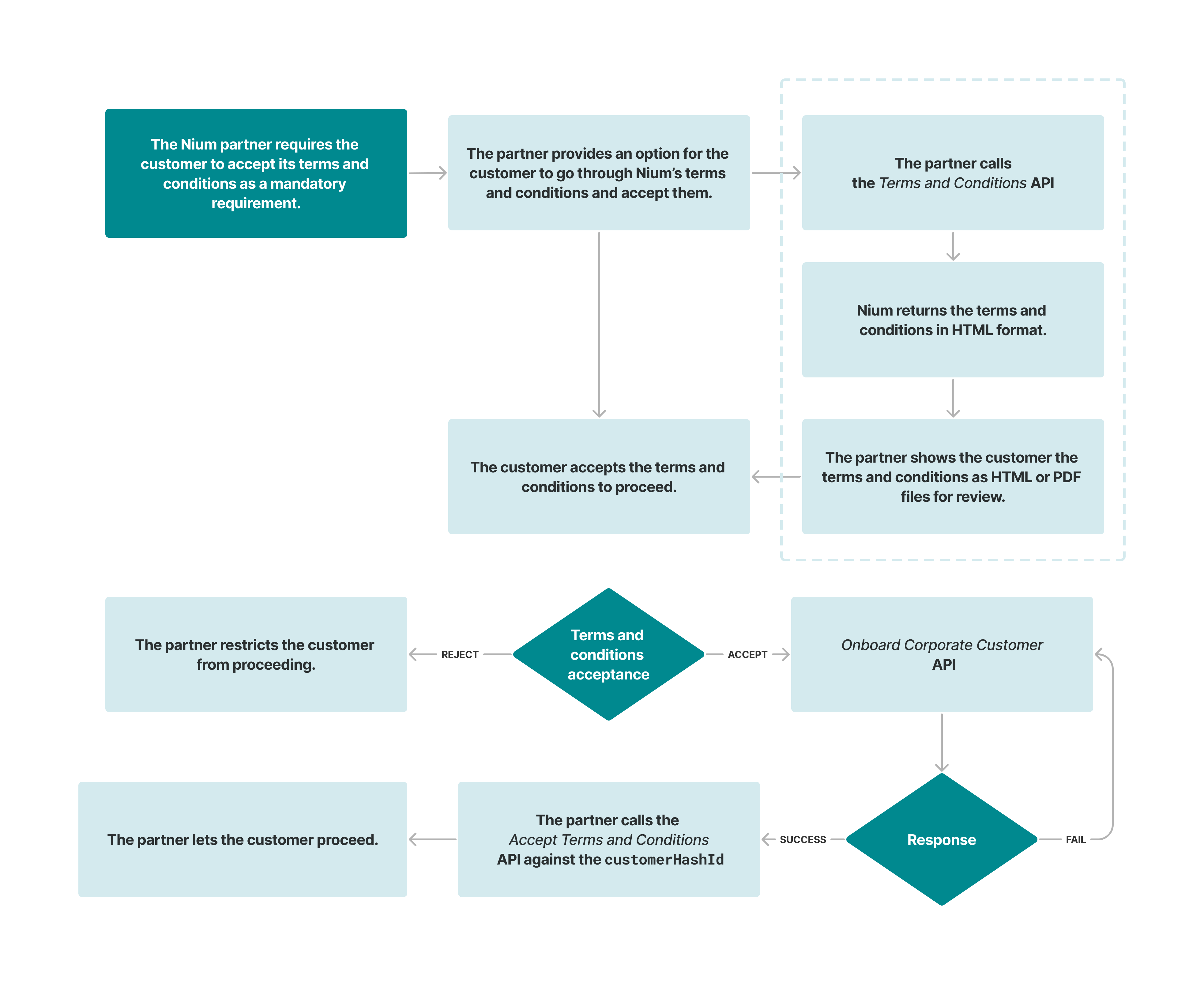

Terms and Conditions

Regenerate KYC URL API [Will be deprecated]

Expiry on the E_DOC_VERIFY URL is removed and hence this API is redundant and will be deprecated. Clients that already integrated this API will receive a dummy expiry to support their flows.

Update Corporate Customer API

After the onboarding is complete and the customer is approved, the Update Corporate Customer API allows you to perform the following actions on a corporate customer:

- Update business details and risk details of a corporate customer.

- Add new stakeholders and update information for existing stakeholders.

- Replace and update existing applicant information.

- Add new documents for business details, stakeholder details, and applicant details.

This API can be called only if the compliance status is COMPLETED; any other status results in a validation error.

All the fields in the request body of the Update Corporate Customer API are the same as the Onboard Corporate customer API except authenticationCode. Clients of EU and UK must pass the authentication code submitted by the end customer. This is a regulatory requirement in the UK and US.

Please note:

- You do not need to pass the entire request body. Send only the fields that need to be updated. If any field is not passed in the request body, it will remain unchanged.

- Any parameter which is an array will be entirely replaced by the input values passed in the API, such as the

tax_detailsandprofessionalDetailsarrays. - You can either add a new stakeholder or update and existing stakeholder. To add a new stakeholder, you needn't send a

referenceId; or if you do, you need to send a newreferenceId. When updating details of an existing stakeholder, you need to pass thereferenceIdof the existing stakeholder. - You can either replace the applicant or update the existing applicant. To replace the applicant, you needn't send a

referenceId; or if you do, you need to send a newreferenceId. When updating details of an existing applicant, you need to pass thereferenceIdof the existing applicant. - After the Update Corporate Customer API is called, the status of the application changes to

ACTION_REQUIREDand the application goes to manual review. After Nium's compliance team completes verification, the status changes toCOMPLETEDand the data is updated in the database. RFIs may be raised by our compliance officer to complete the verification.

Once the Update Corporate Customer API the complianceStatus changes to ACTION_REQUIRED, the customer status remains CLEAR which will allow the customer to transact.

Ongoing Due Diligence (ODD)

Corporate customers approved more than one year ago are subject to Ongoing Due Diligence (ODD).

ODD is a periodic review process that applies to active customers based on their risk profile and transaction history. During this review, a compliance officer may issue one or more Requests for Information (RFIs). You are expected to respond promptly to any RFIs to help complete the review.

Failure to respond may result in temporary account suspension. If you have any questions please contact your Nium Account Manager or Nium Support for more information.

Completing ODD

When going through Ongoing Due Diligence (ODD):

- The

statusfield remains Clear during the Ongoing Due Diligence (ODD) process. Customers can continue to process transactions as usual. - If an RFI is raised, the

complianceStatuswill change to RFI_REQUESTED, similar to the onboarding flow. It can also transition to the following states: ACTION_REQUIRED, RFI_RESPONDED, and COMPLETED. - Use the same onboarding requests from manage RFIs:

- Expired documents will be requested via RFI. This may include the latest BUSINESS_REGISTRATION_DOC or other relevant documents.

- If new stakeholders are identified, you may be asked to provide their details and verification documents.

- You may also be asked to provide an updated ownership structure if any changes in shareholding are detected.

To track changes in ODD status, subscribe to the CUSTOMER_ODD_STATUS_WEBHOOK event. For more information, see Customer ODD Status.

The oddStatus field in the event can return the following values:

oddStatus | Description |

|---|---|

odd_due | The customer is due for Ongoing Due Diligence (ODD). A compliance officer will initiate the review shortly. |

odd_initiated | The ODD process has been initiated by a compliance officer. You may receive one or more Requests for Information (RFIs). |

odd_completed | The ODD process is complete. No further action is required until the next review is due. |

Event example: ODD status event

{

"clientHashId": "86ce8d7b-f3fa-46d5-8d1c-53212aade5b5",

"customerHashId":"857dc08e-dffa-4e9a-ad96-79041c8a7025",

"oddStatus":"odd_due",

"template": "CUSTOMER_ODD_STATUS_WEBHOOK",

"customerType":"corporate"

}

Region businessType matrix

businessType | AU | EU | SG | UK | US |

|---|---|---|---|---|---|

ASSOCIATION | Yes | Yes | Yes | Yes | No |

CORPORATION | No | No | No | No | Yes |

ESTATE | No | No | No | No | Yes |

GENERAL_PARTNERSHIP | No | No | No | No | Yes |

GOVERNMENT_ENTITY | Yes | Yes | Yes | Yes | No |

LIMITED_LIABILITY_COMPANY | No | No | No | No | Yes |

LIMITED_LIABILITY_PARTNERSHIP | No | Yes | No | Yes | Yes |

OTHERS | No | No | Yes | Yes | No |

PARTNERSHIP | Yes | No | Yes | No | No |

PRIVATE_COMPANY | Yes | Yes | Yes | Yes | No |

PUBLIC_COMPANY | Yes | Yes | Yes | Yes | Yes |

REGULATED_TRUST | Yes | No | No | No | No |

SOLE_TRADER | Yes | No | Yes | Yes | Yes |

TRUST | No | Yes | Yes | Yes | Yes |

UNICORP_ASSOCIATION | No | No | No | No | Yes |

UNICORP_PARTNERSHIP | No | No | No | Yes | No |

UNREGULATED_TRUST | Yes | No | No | No | No |