Key Concepts

Nium is a flexible, comprehensive, and easy-to-embed fintech infrastructure platform. Companies use Nium to launch and manage their payment platforms and take advantage of several features, including:

- Domestic or cross-border transfers

- Holding balances in multicurrency wallets

- Card issuing

- Receiving multiple currencies into a single wallet locally, for example, receiving GBP in the UK using the Faster Payments Service (FPS) or the Clearing House Automated Payment System (CHAPS)

This guide provides a high-level overview of the platform features.

Clients

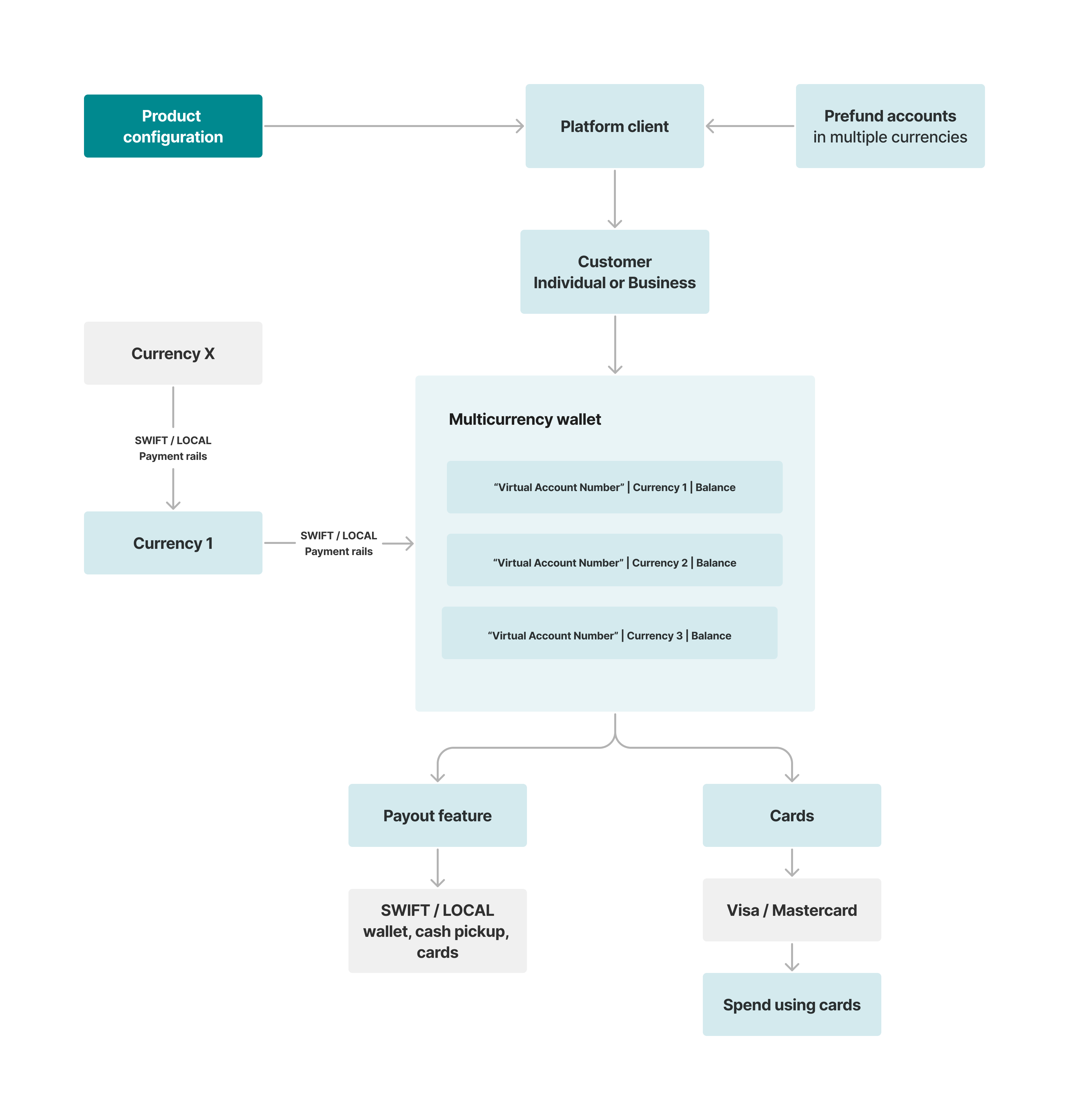

It all starts with the setup of a platform client. Nium configures the solution that meets your needs. The client configuration captures the multicurrency configuration, virtual account number-related configuration, card-issuing details, customer onboarding requirements, risk parameters, fee details, and so on.

As the diagram above illustrates, the platform client is at the top of the hierarchy. As part of the platform client onboarding—that is as part of your onboarding before you can integrate and access the APIs—Nium does the needful API configuration of IP allow listing and keys provisioning. It helps you with the details you need to connect to the platform API endpoints. You use the APIs to onboard new customers, issue them cards, check balances, see transaction listings, and manage payouts, among other tasks.

Depending on the nature of the product or program you're planning to build you might want to make use of the prefund accounts capability. If you're operating as a corporate travel and expense (T&E) business, for example, funding to the underlying customer-level wallet only comes from you. You can then fund first into your prefund account and then allocate funds to the respective customer-level wallets using your pre-funded account as the funding source. You can fund into the prefund accounts using local and Society for Worldwide Interbank Financial Telecommunication (SWIFT) bank rails.

Refer to the Parent-child hierarchy overview to set up the parent corporate customer and the child individual customer. This configuration is useful in Spend and Payroll Management use cases.

Customers

Next in the hierarchy is the customer. There are two types of customers, the individual customer and the corporate or business customer. The individual customer is an end user who holds the balance. In a corporate customer T&E use case, this would be a staff member who receives a T&E card. In a consumer-funded use case, this would be the retail end customer who has the account. Depending on the nature of the product or program, the Know Your Business (KYB), the Know Your Customer (KYC), and the onboarding flow differ. For more information, refer to the Individual customer onboarding overview and the Corporate customer onboarding overview guides.

Work with your Nium program representative to help you navigate your onboarding. As an example, where the KYC process is mandatory, Nium's e-KYC options—MyInfo in Singapore, greenID in Australia, and Onfido in multiple markets—need to be used to automate the KYC and the onboarding process.

Multicurrency wallets

Every customer or account holder gets a multicurrency wallet or a multicurrency account. Since a wallet is considered an account, the terms wallet and account are used interchangeably. The wallet is set up for the platform client. It has placeholders or stores to carry one or as many currencies as configured for the platform client. For more information, refer to the Wallet overview guide.

Virtual account numbers

Based on the product configuration, the platform automatically assigns virtual account numbers (VANs) at the wallet-currency level by using the configured VAN sources. You can also use the Assign Payment ID API to assign VANs at the currency level. If the product configuration, for example, is such that a VAN for SGD, from Nium's SG bank partner, needs to be assigned, then when the wallet is created, the platform automatically allocates an SGD VAN from the SG bank partner and maps it to the SGD currency of the wallet. This facilitates the account holder to fund SGD in the wallet by using the SG local bank rails, for instance, the Fast And Secure Transfers (FAST) service in Singapore.

Nium can assign a VAN from the following countries:

- SGD (local) in SG

- GBP (local) in the UK

- AUD (local) in AU

- EUR (SEPA) in EU

- USD (local) in the US

Contact your Nium representative to learn about additional VAN sources.

The multicurrency balances held within the wallet—if the product requires multicurrency support—can be exchanged between each other. Nium provides competitive foreign exchange (FX) rates and helps you with liquidity. The platform also lets you move funds from one customer's wallet to another customer’s wallet—provided the transaction is performed in the same currency and the two customers are under the same platform client.

Payins

The Payin service lets you receive, hold, and offer payment methods through bank transfers, cards, digital wallets, and a Nium-assigned virtual account number (VAN). The Payin product capabilities include monetary collections and funding. The Payin collections capability helps you collect money from a third party—a payer or a buyer—and put it into your Nium wallet. An example would be a business-to-business collections process where a United States (US)-registered software company collects money from its business customers to charge for its software service subscription. The Payin funding capability helps you fund your Nium wallet through a bank transfer from your own bank account into your Nium-assigned VAN or funding wallet account. An example would be a corporate customer that wants to fund into their Nium wallet to use the money to compensate their payroll employees for their work on a regular basis.

Transactions

Nium offers a comprehensive payment network built through global partnerships with clearing systems, banks, and service providers. Clients use this network to process various types of transactions (also called transfers), including:

- Payouts (also known as remittances)

- Wallet to wallet transfers

Whether you need to process transactions for your business, personal use, or create a seamless experience for your customers, Nium provides the necessary tools.

Payouts

A payout is a transaction that transfers funds (credit or debit) between a client and a third party.

Funds available in a wallet can be used for both domestic and cross-border payouts. The platform automatically deducts the required balance from the appropriate wallet and processes the transaction through Nium’s global payment network.

Nium’s foreign exchange (FX) conversion services let you send funds from any available wallet currency to a supported recipient currency. For example, you can transfer funds from a USD wallet balance to a PHP wallet or a bank account in the Philippines. Our FX service automatically applies conversion charges, making cross-border transfers seamless.

For more information, see Payouts.

Wallet to wallet transfers

Using Nium’s FX conversion services, you can transfer funds between wallets in different currencies.

For example, you can transfer funds from your USD wallet balance to your GBP wallet or a bank account in the United Kingdom. Our FX service automatically applies conversion charges, streamlining cross-border transfers.

For more information, see the Wallets guide.

Cards

As part of the client setup, you could work with Nium to configure one or many card programs. By using the Cards API endpoints, you could issue one or many cards—physical or virtual—referring to the configured card programs linked to a given wallet. The balance always stays at the wallet level and cards are payment instruments to act on the balance.

Read about the Delegated Model for an alternative approach to keep the wallet-level balances at your end.

Every time a Nium-issued card is used at the merchant point of sale or at an ATM terminal, Nium processes the card transactions—authorization, clearing, and settlement—and you don't need to worry about the transaction processing, reconciliation, and settlement. You can use the APIs to manage the cards—set limits, block or unblock cards—check balances at the wallet level, and check transaction listing. You can subscribe to webhooks to receive real-time events from the platform and you could use that to manage communication with the end users, such as push notifications, email messages, and Short Message Service (SMS).

For more information, refer to the Card overview guide.

To learn more about the technical words this guide uses, refer to the Glossary of Nium terms.