Direct Debit EU

Nium One platform clients in the European Union can accept Single Euro Payments Area (SEPA) Core Direct Debit payments from business customers with an EU bank account.

You can use Direct Debit as many times as you want. Direct Debit is a non-real-time payment method from payment creation, to processing, and acknowledgment of its success or failure.

Refer to the Direct Debit guide for more information.

Prerequisites

These are the requirements for this funding mechanism:

- Your customer needs to have a bank account in the EU with Direct Debit SEPA Core enabled and a Nium EUR wallet.

- Your customer needs to authorize the Direct Debit mandate to debit their bank account and accept Nium's terms and conditions (T&C).

- Your customer needs to have enough money in their added bank account to start your transactions.

- Your customer is the only person who can authorize the Direct Debit mandate for their bank account.

- Your customer needs to be a corporate customer.

Configuration

- Nium approves your Direct Debit mandate setup pages. You can't change these pages without notifying Nium in advance. You need to collect the Direct Debit mandate from your customer, displaying the SEPA customer protection rules to your customer while collecting their bank account details.

- During the mandate creation and customer account addition, the customer needs to authenticate themselves with Nium via an email one-time password (OTP) process.

- You agree to send advance notifications to your customers three days before initiating the payment request to Nium.

Direct Debit API endpoints

The following APIs support the Direct Debit feature:

| HTTP method | API name | Action |

|---|---|---|

| POST | Add Funding Instrument | Add the funding instrument to your customer's wallet to start a Direct Debit transaction. Use this API to add the payer's physical bank account to the customer's wallet so that Direct Debit payments can be initiated against it. Provide the funding instrument's country code, currency code, and International Bank Account Number (IBAN). |

| GET | Get Funding Instrument Details | Get the details of your customer's funding instrument using the fundingInstrumentId. This endpoint is optional. The fundingInstrumentId is returned as a response in the Add Funding Instrument request. |

| GET | Get Funding Instrument List | Get the list of funding instruments registered with your customer. It's optional to use this API. |

| POST | Confirm Funding Instrument | Confirm the funding instrument with OTP authentication. Use this API to communicate the OTP you received from Nium. Nium sends the OTP to the customer through email after the Add Funding Instrument API call. By confirming the Direct Debit mandate, your customer authorizes Nium to debit payments from their bank account. The debit payments appear on your customer's bank statement as Nium. |

| POST | Fund Wallet | Fund into your customer's wallet by selecting the funding channel as a direct_debit transaction. You also need to provide the fundingInstrumentId obtained from the response in the Add Funding Instrument API call. The debit payments appear on your customer's bank statement as Nium. |

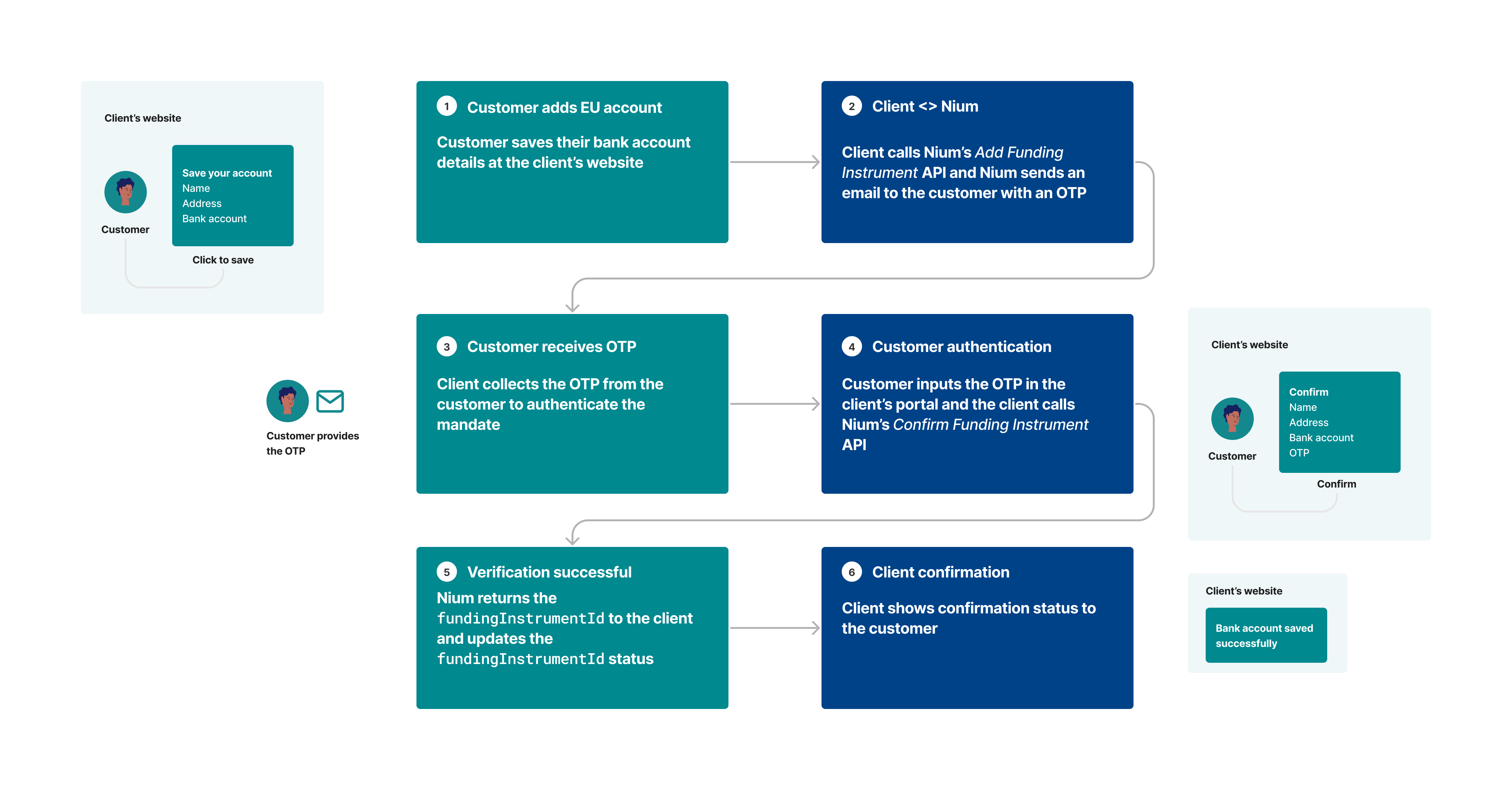

The EU Direct Debit customer experience.

Payment flow

- Call the Add Funding Instrument API to add your customer’s bank account.

- Nium sends an email with the OTP to the customer.

- Call the Confirm Funding Instrument API with the OTP.

- Nium validates it and returns the

fundingInstrumentId. - Nium sets up the Direct Debit.

- You and your customer can inquire about the status by calling the Get Funding Instrument Details API.

Funds flow timeline

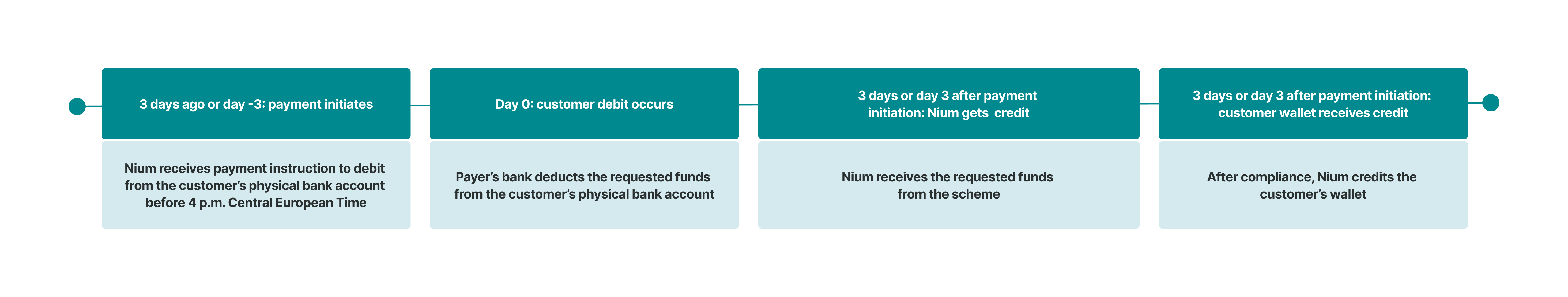

Direct Debit is a non-real-time payment method and can take 6 days from payment creation to processing, and acknowledgment of its success or failure.

The EU Direct Debit settlement timing, which takes 6 days.

Mandates

You need to get your customer's permission to debit their bank account through a mandate. A mandate is an authorization that the customer provides, giving Nium permission to debit their account. The mandate isn't physically signed by the customer. Once the customer provides the OTP, which has been verified successfully, they have duly agreed to the mandate.

Once you have that, you need to notify your customer every time you debit their bank account at least 3 days before each payment. If you fail to do this, you become liable for any chargebacks. Nium is the service provider to debit the funds from the customer’s bank account. It also sends your customer an email with this information 3 days before each payment.

Your customer may cancel a mandate at any time by emailing their bank or financial institution. Canceling a mandate invalidates any future direct debit requests that you issue using this mandate. If you want to accept additional payments from your customer, you need to establish a new mandate with them.

Chargebacks

The customer can initiate a dispute with their bank after the funds are credited to their Nium wallet. If their bank agrees, the money is pulled from your customer's Nium wallet as explained below:

- 8 months — customers are not required to provide any reason

- 13 months — customers are required to provide evidence to their bank