Direct Debit AU

In Australia, Nium’s platform accepts Direct Debit payments from business customers with an Australian bank account through:

- PayTo using New Payment Platform (NPP) rails

- Direct Entry (DE) using [Bulk Electronic Clearing System (BECS)](Bulk Electronics Clearing System (BECS)) rails

Before your customer can use Direct Debit in Australia, the following requirements must be met:

- The customer must be a corporate customer.

- They must have an Australian bank account with PayTo or BECS Direct Debit enabled and a Nium AUD wallet.

- They must authorize the Direct Debit mandate for their bank account and accept Nium’s terms and conditions (T&C).

- Their bank account must have sufficient funds to process the transaction.

- Only the customer can authorize the Direct Debit mandate for their bank account.

For more information, see Direct Debit guide.

Link and verify bank accounts

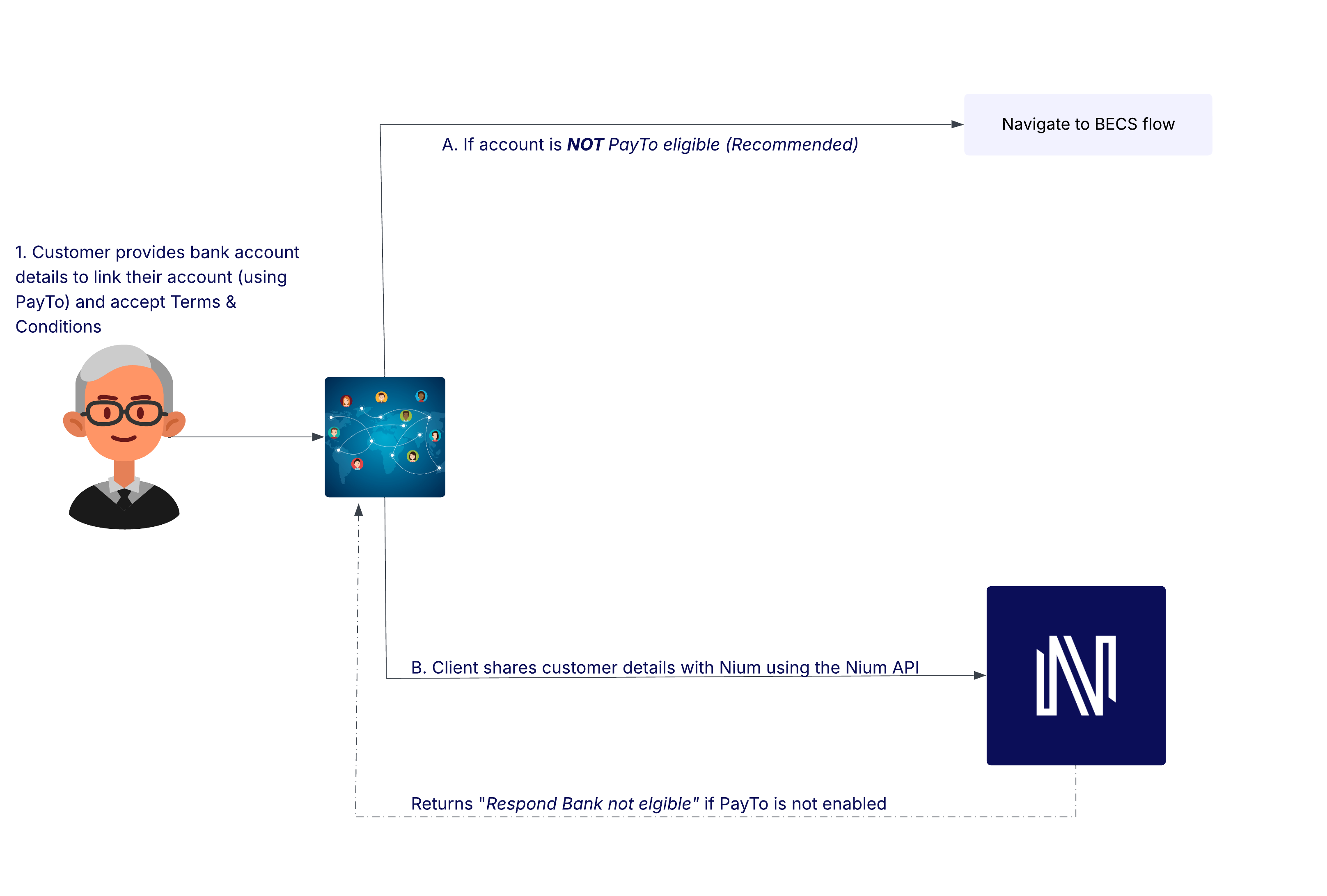

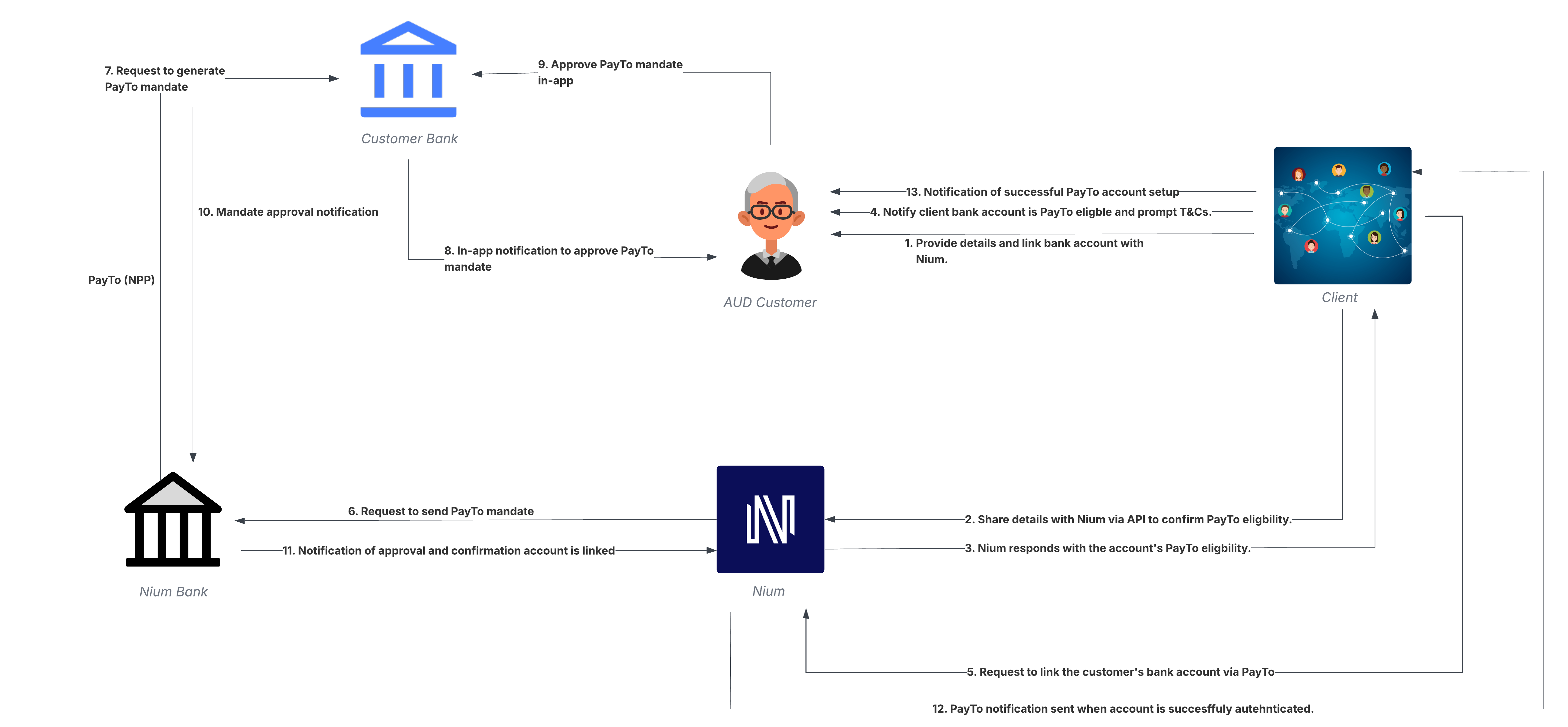

When customers link their bank account, they are first directed through the PayTo flow.

If Nium determines that the customer’s bank account is not enabled for PayTo, the customer is redirected to a fallback flow where they can approve BECS as the payment rail and accept the required BECS terms and conditions.

For settlement timelines, see Funding a wallet with Direct Debit.

Custom payment pages

In Australia, customers must complete a Direct Debit Request (DDR) to authorize merchants to debit their bank account through BECS AU, the local Direct Debit scheme.

Clients can create their own custom payment pages to collect payment details and the DDR, allowing them to maintain consistent branding.

To build a custom payment page:

- Host your payment pages over HTTPS.

- Create a page for customers to enter their information.

- Create a summary and confirmation page.

- Create a setup success page.

- Create a page for customers to approve the payment.

Linking a bank account - PayTo

- After onboarding, the customer must link and authorize their external bank account so Nium can pull funds into their wallet.

- In your UI, the customer enters their Account Number and BSB Code, then selects PayTo if they know—or are unsure—whether their bank supports PayTo.

- The customer must accept the Direct Debit terms and conditions.

- Your system captures this by calling the

/addFundingInstrumentendpoint withchannelDirect Debit andrailPayTo.

- Your system captures this by calling the

- Nium checks whether the customer’s bank account is enabled for PayTo.

- If PayTo is not supported, you receive a Funding Instrument Failed webhook.

- When this occurs, prompt the customer to set up BECS instead and ask them to approve it in your UI. Their existing T&Cs selection should remain unchanged.

- If PayTo is supported, the customer receives a notification from their banking app to approve the PayTo mandate (Payment Agreement).

- The customer has up to 5 days to approve the mandate.

- If they do not approve it within this timeframe, the mandate expires and the bank account setup must be retried.

- If they approve it in time, Nium notifies you (using the appropriate webhook) and you should show in your UI that the bank account is approved for PayTo funding.

- Because PayTo uses NPP rails, this flow can be completed in near real time once the customer approves the mandate in their banking app.

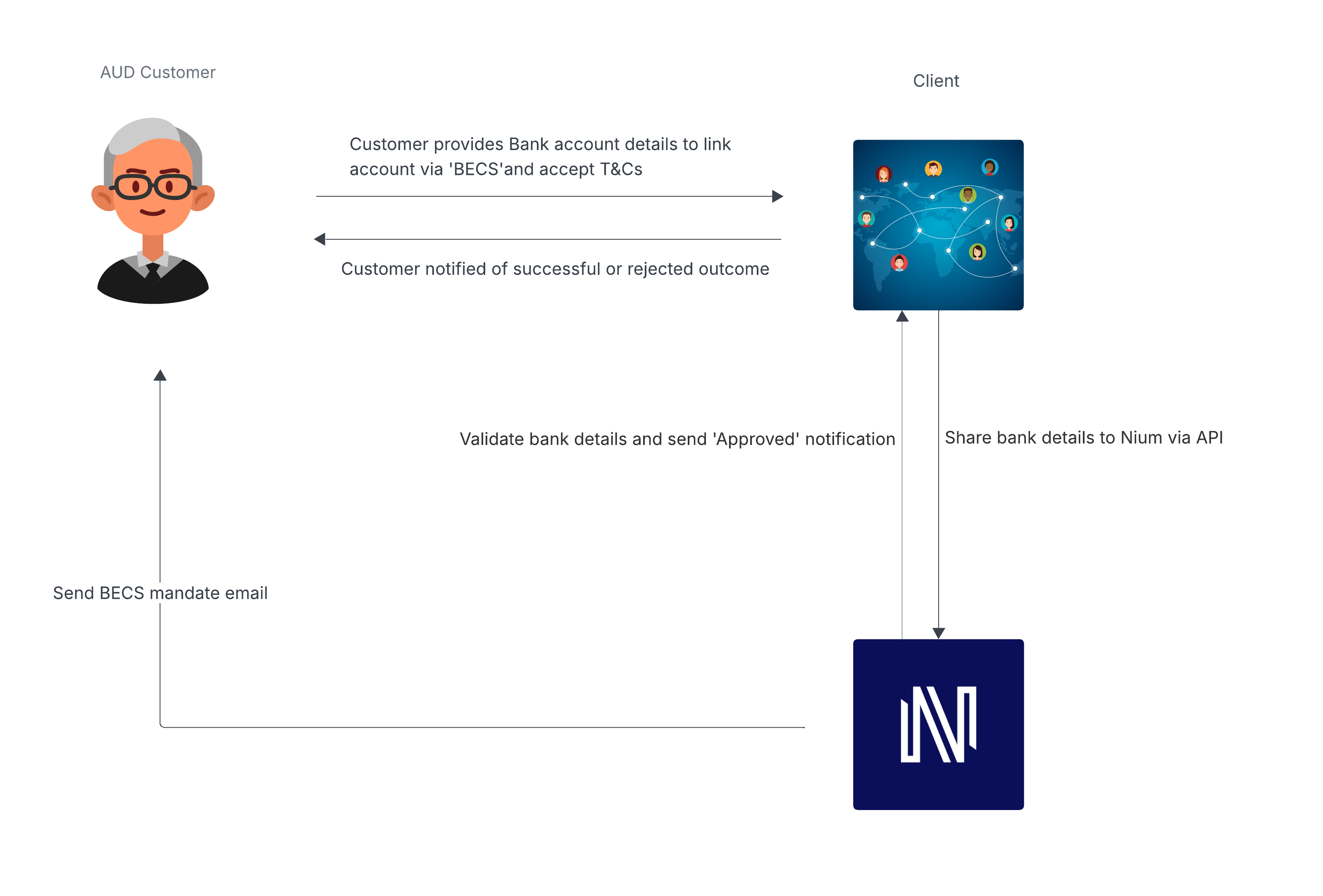

Linking a bank account — BECS

If the customer’s bank does not support PayTo, they can link their account using BECS.

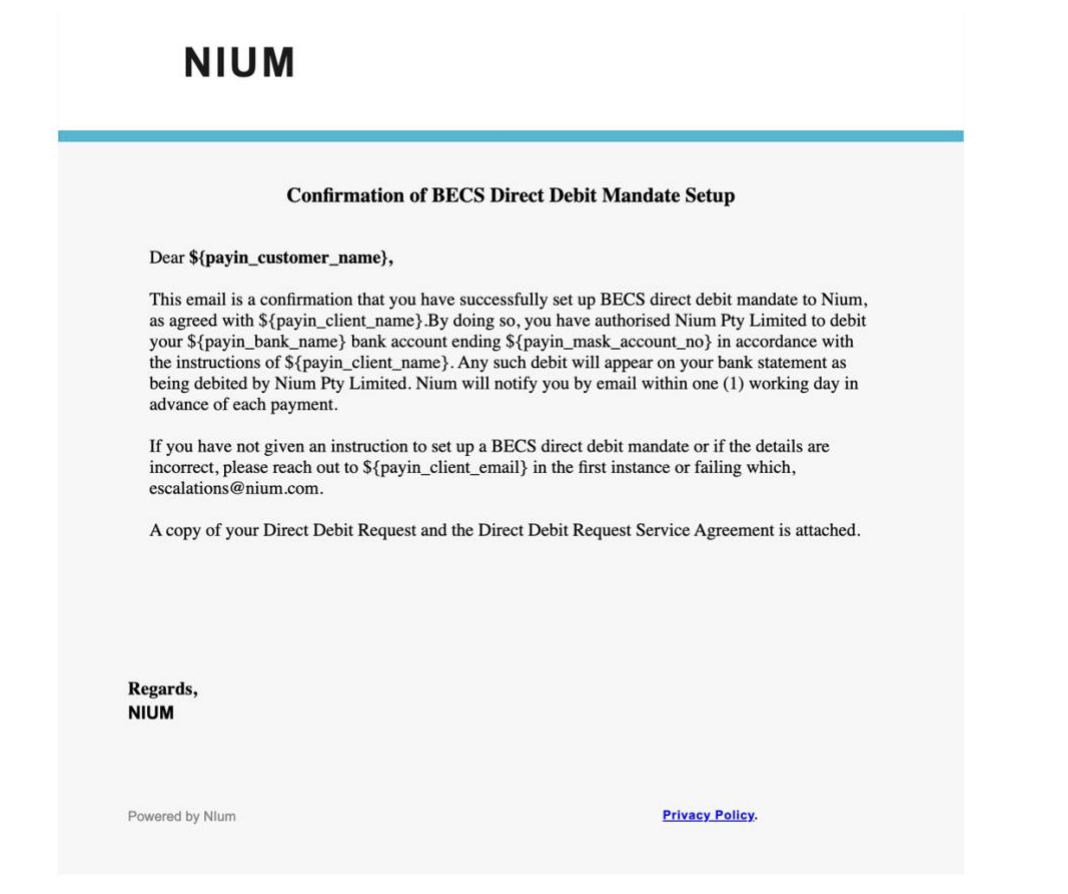

Nium sends a BECS mandate email to the customer’s registered contact and approves the bank account after validating the details.

Use the BECS linking flow only when PayTo is not supported.

Example email

Your UI screens for collecting bank account details and T&C acceptance for both PayTo and BECS must be approved by Nium. For more information, contact your Nium account manager or Nium Support.

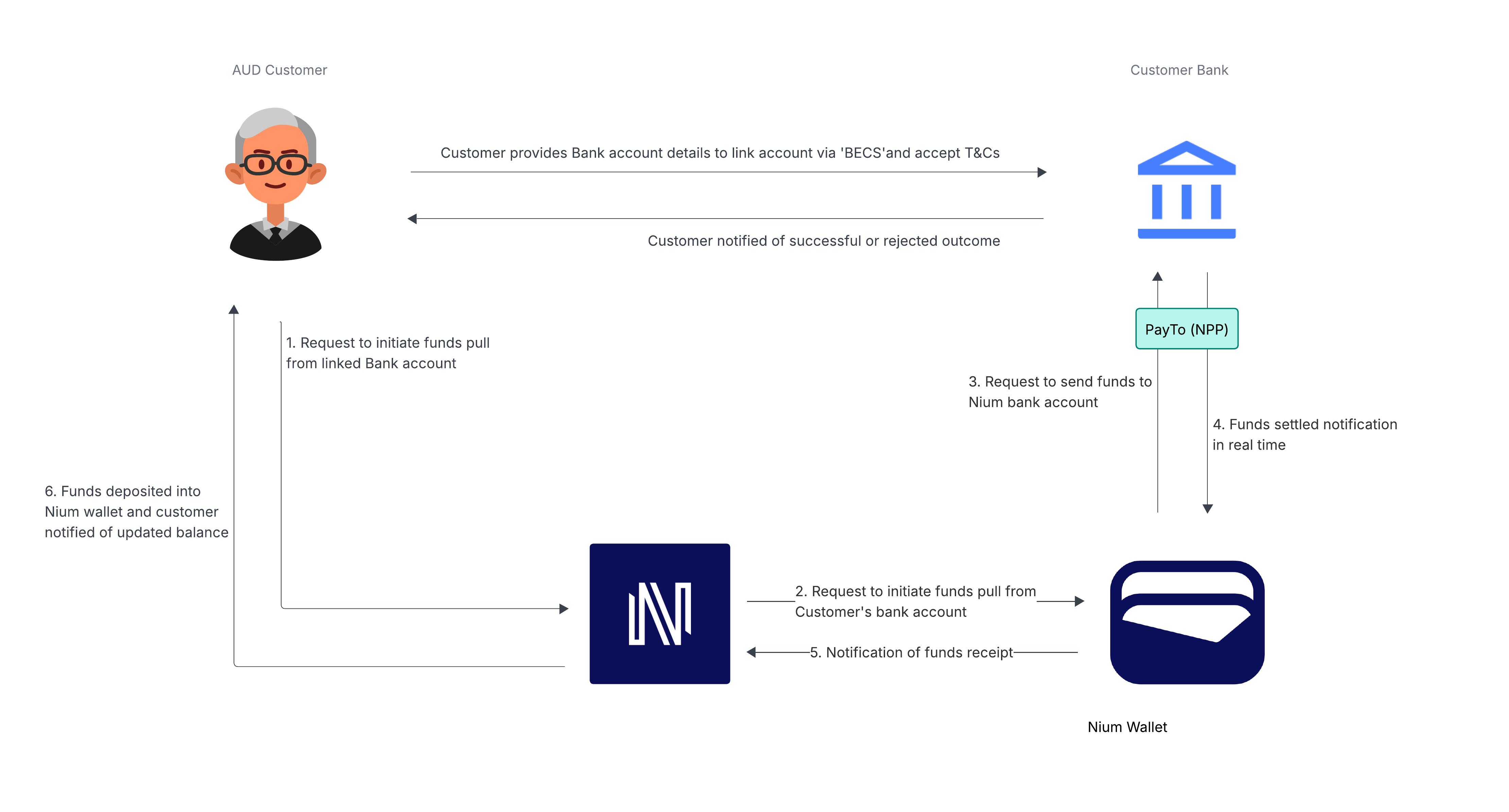

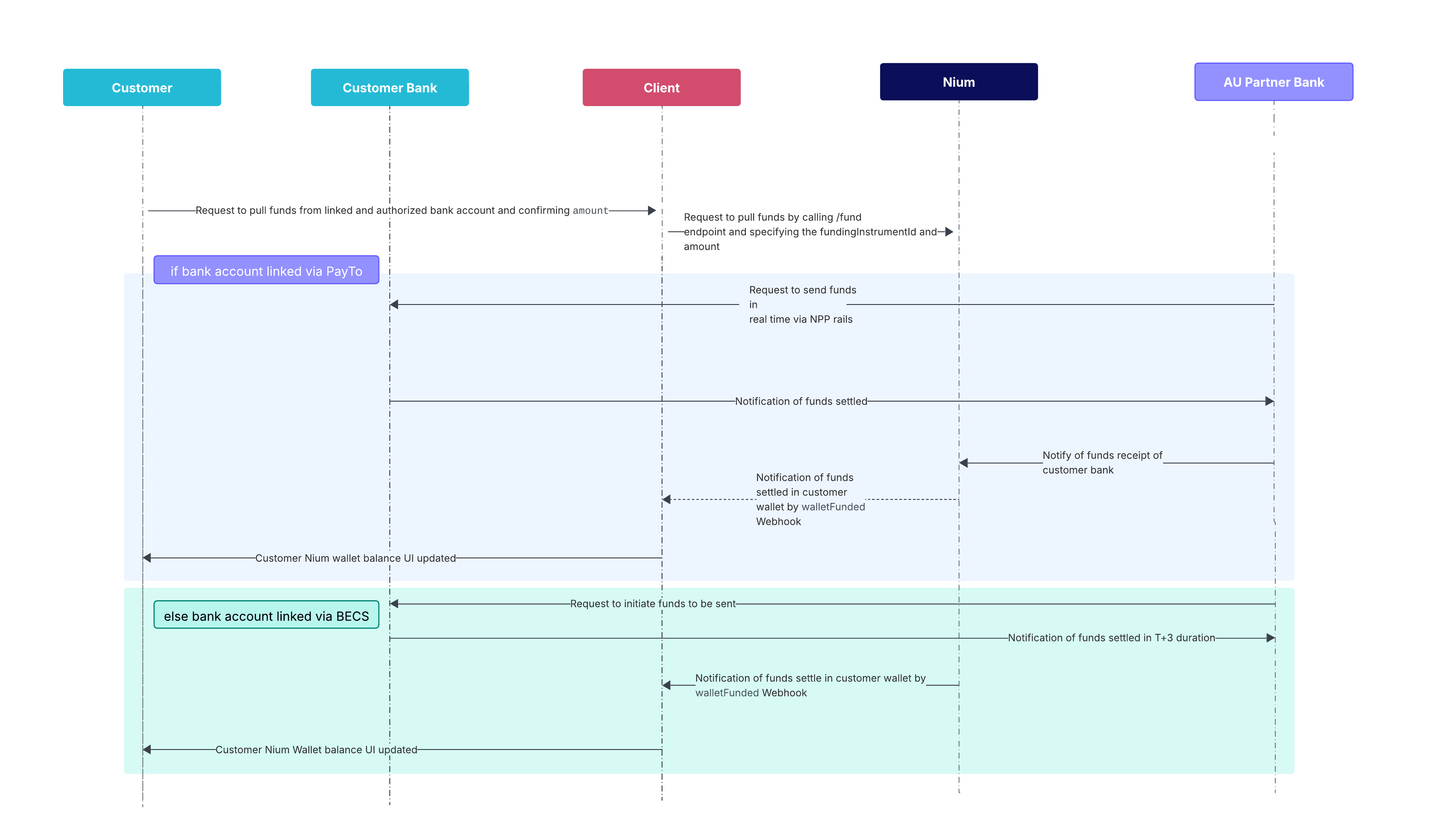

Funding a wallet with Direct Debit

Once a customer’s bank account is linked and authorized, they can initiate a Direct Debit transfer by specifying the AUD amount to deposit into their Nium wallet.

To start the transfer, use the Fund Wallet request and include the fundingInstrument details. Nium automatically determines whether the payment should be processed through PayTo or BECS.

You will receive a Wallet Funded webhook when the funds are deposited into the customer’s wallet.

This webhook includes updated wallet balance details, which you can display in your UI to help customers initiate their next payout.

Settlement timelines

The time it takes for funds to appear in the customer’s wallet depends on the payment method used—PayTo or BECS:

- PayTo: Funds typically settle in near real time.

- BECS: Funds settle within T+3 days (three business days after the transaction date).

Direct Debit requests

The following endpoints support Direct Debit:

| HTTP method | Request | Description |

|---|---|---|

| POST | Add Funding Instrument | Adds a funding instrument (the customer’s bank account) to their wallet so Direct Debit payments can be initiated. Provide the country code, currency code, account number, and BSB code. |

| GET | Get Funding Instrument Details | Retrieves details of a specific funding instrument using the fundingInstrumentId (optional). The ID is returned in the response to the Add Funding Instrument request. |

| GET | Get Funding Instrument List | Returns a list of funding instruments linked to a customer (optional). |

| POST | Fund Wallet | Transfers funds into the customer’s wallet using Direct Debit. Provide the fundingInstrumentId from the Add Funding Instrument response. Debit payments appear on the customer’s bank statement as Nium. |

Mandates

You need to get your customer's permission to debit their bank account through a mandate. A mandate is an authorization that the customer provides that gives Nium permission to debit their account. The mandate isn't physically signed by the customer. Once Nium receives an instruction from you via API, it's assumed that your customer has duly agreed to the mandate.

After you have that, Nium notifies your customer every time you debit their bank account before each payment. Nium is the service provider to debit the funds from the customer’s bank account.

Your customer may cancel a mandate at any time by emailing their bank or financial institution. Canceling a mandate invalidates any future direct debit requests that you issue using this mandate. If you want to accept additional payments from your customer, you need to establish a new mandate with them.

Chargebacks

Customers can ask their bank to reverse a Direct Debit payment for up to seven years after the money is added to their Nium wallet.

If the bank approves the request, the money is taken out of the customer’s wallet.