Managing Funding Accounts

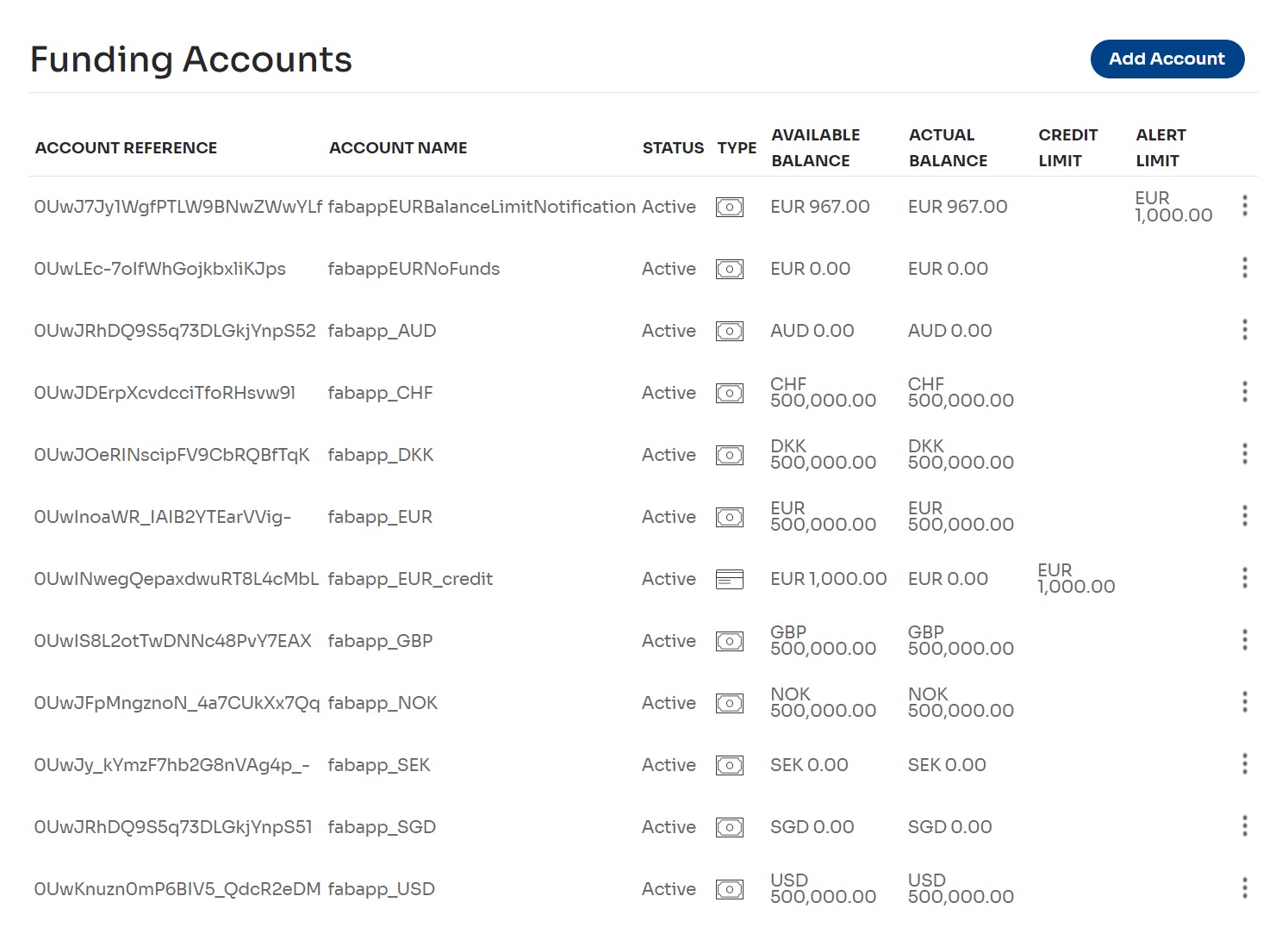

In simple terms, funding accounts are where your money is deposited and stored before you load it onto a virtual card. During your account setup, we create one or more funding accounts for you.

You can create new funding accounts and load, edit, and delete funding accounts in the Nium Portal. You may choose to have a single funding account for all your cards or create separate funding accounts for different expenses (travel, advertising, etc.)

After you create a funding account, you can:

- transfer money to it from another funding account

- add money to it from a linked bank account.

When the funding account contains money, you can:

- withdraw money from your funding account to a linked bank account

- transfer money from one funding account to another

📘 NOTE

If your account is configured to use credit, the credit funding accounts can only be created and deleted by your Nium company account administrator.

The available balance is the amount you can use or withdraw. It reflects the actual balance minus any pending transactions (like card authorizations or holds) in addition to any incoming deposits that are pending clearance. The actual balance is the total amount of money in the account at a given point in time. It includes all posted transactions—both credits and debits—that have fully settled.

📘 NOTE

Credit funding accounts will appear as negative values when you load cards from them.

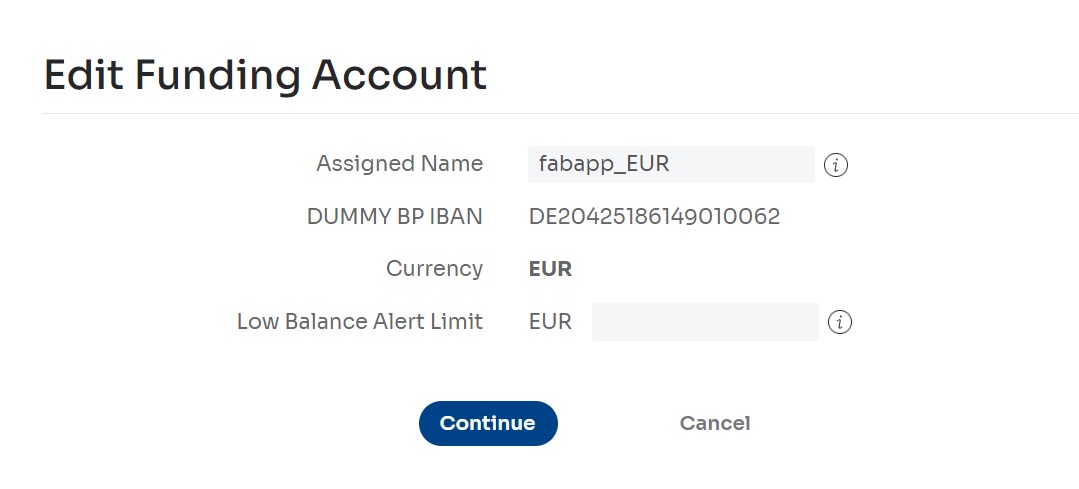

To view or edit funding account details (such as the IBAN bank account you can use to add money to a funding account), select the View/Edit option from the ⋮ menu for a funding account chosen.

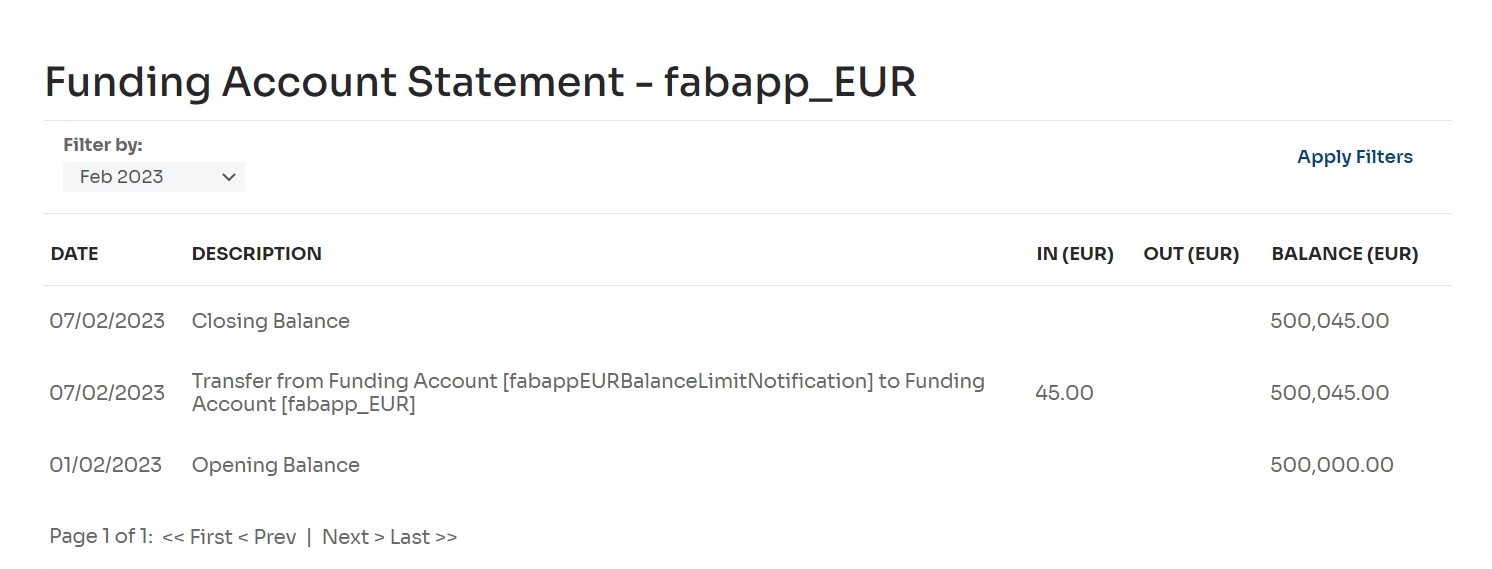

You can view a funding account statement, including all related transactions in the current month. You can export the daily transaction history of a funding account to a CSV file.

To perform these actions, go to Funds > Funding Accounts > Manage Funding Accounts, which will open the Funding Accounts page.

See related sections for more information.

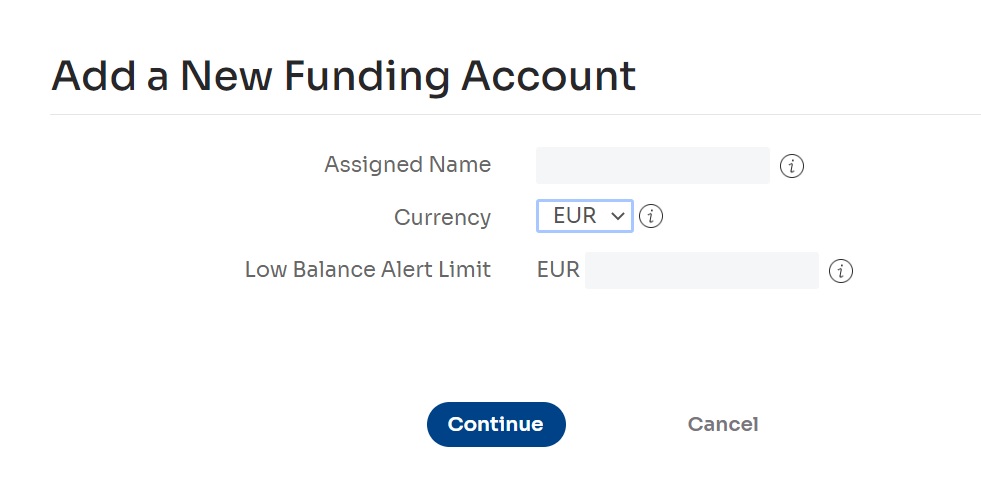

Creating a funding account

Use the Add a New Funding Account page to create a funding account.

- Select Funds > Funding Accounts > Manage Funding Accounts and select the Add Account button. The Add a New Funding Account page is displayed.

- In the Assigned Name field, type a unique name for the funding account. In the Currency field, select the currency.

📘 NOTE

Available currency options depend on your account configuration.

- Select the Continue button to save.

- Select the Close button on the New Funding Account Added page, which contains the new funding account’s data.

The Funding Accounts page is displayed.

📘 NOTE

The New Funding Account Added page contains an IBAN account bank that you can use to add money to your funding account.

📘 NOTE

Credit funding accounts can only be created by your Nium company account administrator.

After a funding account is created, you can add money to it, withdraw it, transfer it to another funding account, view recent transactions and statements, edit the account details, or delete the funding account. To perform any of these actions, select the ⋮ icon in the appropriate row on the Funding Accounts page and choose one of the options from the drop-down menu.

Transferring money between funding accounts

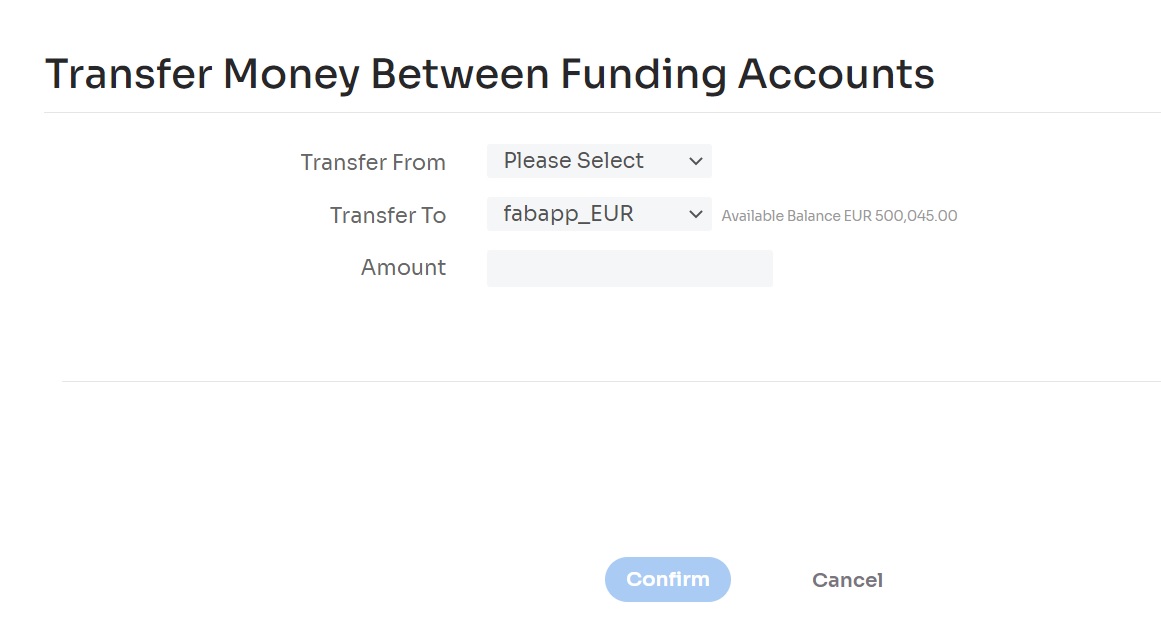

Use the web app's Transfer Money Between Funding Accounts page to transfer money between funding accounts. It is worth noting that the Business Console supports fund transfers between the various currencies depending on the region and based on the commercial agreement the client has.

📘 NOTE

Credit funds cannot be moved between funding accounts.

- On the Funding Accounts page, locate the funding account you want to transfer money.

- Select the ⋮ icon to open the context menu.

The context menu is displayed. - In the context menu, select Transfer funds.

The Transfer Money Between Funding Accounts page is displayed.

- Select the source (where the money is to be transferred from) in the Transfer From field and enter the amount in the Amount field.

📘 NOTE

The Transfer To field contains the funding account selected in the first step, but you can change it if necessary.

- Select the Confirm button to transfer money between funding accounts.

📘 NOTE

There may be a limit on the amount that can be transferred between funding accounts without approval by an authoriser.

- Select the Close button on the confirmation page that contains data about the transfer.

The Funding Accounts page is displayed.

Viewing funding account history

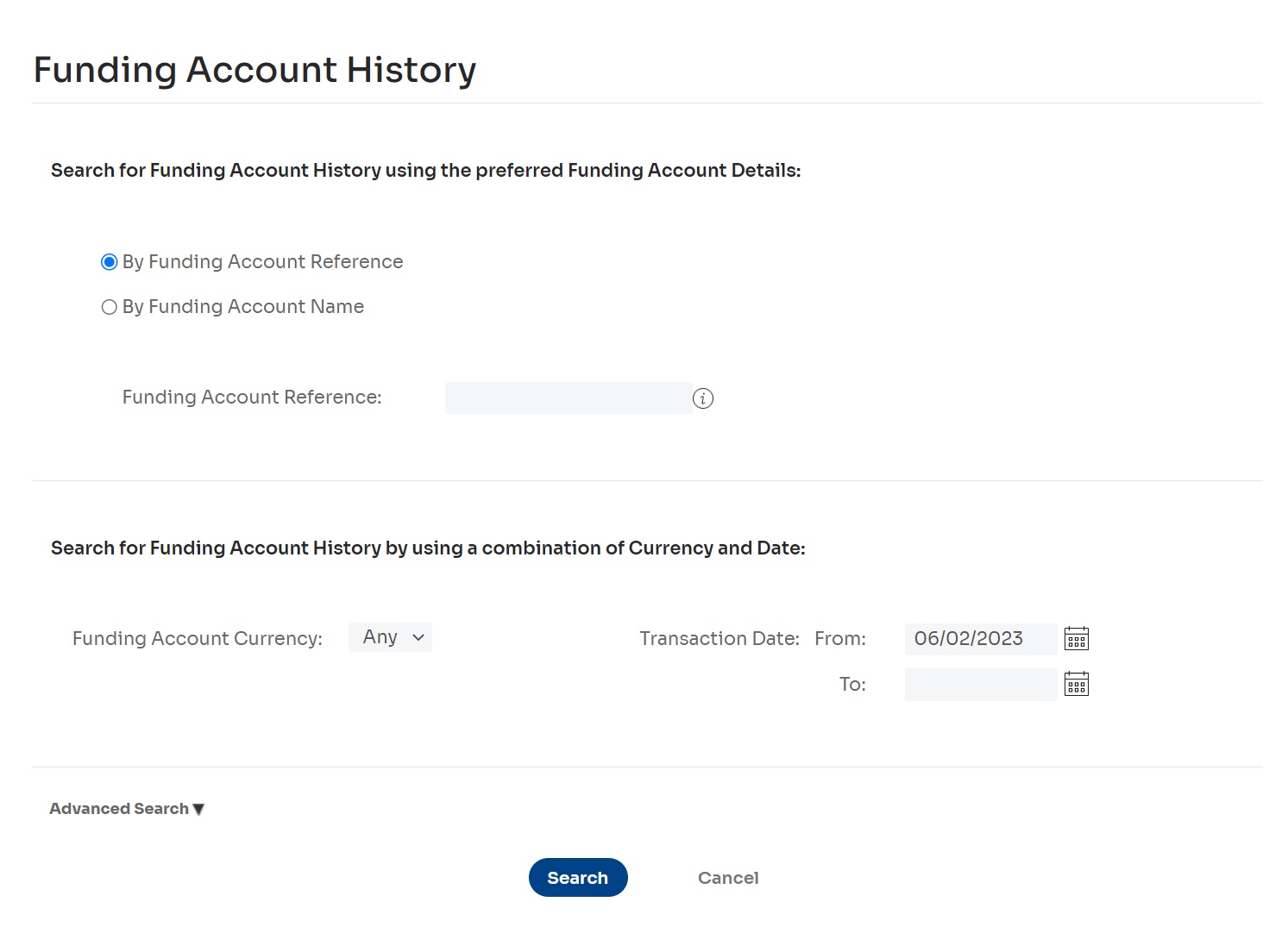

Use the Funding Account History page to view a funding account’s history.

- Select Funds > Funding Accounts > Funding Account History from the menu.

The Funding Account History page is displayed.

- Use one of the following sections and fields to view a funding account’s history:

- Select the By Funding Account Reference radio button and enter the funding account reference in the Funding Account Reference field. (The funding account reference is a unique external identifier of the funding account.)

- Select the By Funding Account Name radio button and enter the funding account name in the Funding Account Name field. (Funding account names are unique.)

- Select a funding account currency in the Funding Account Currency field.

- Select a search period in the Transaction Date section by entering the start date in the From field and the end date in the To field. (You can select the calendar buttons to choose dates using a visual calendar).

- Optionally, select the Advanced Search option to open the advanced search section and use one of the following sections and fields to view a funding account’s history:

- Enter a transaction reference in the Transaction Reference field. (The transaction reference is a unique external identifier of the transaction).

- Select a transaction type in the Transaction Type field.

- Select a transaction status in the Transaction Status field.

- Select the currency of the transaction in the Transaction Currency field.

- Enter a transfer amount in the Transaction Amount field.

- Select the Search button to retrieve a list of funding account history entries matching the criteria.

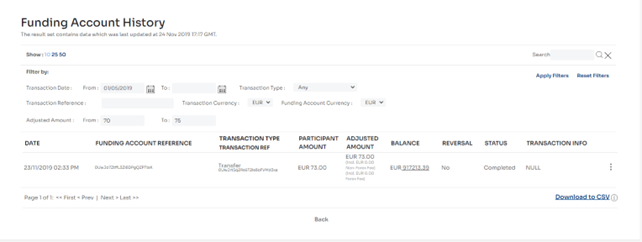

A list of funding account history entries that match the selected criteria is displayed on the Funding Account History page.

- You can modify the search criteria and select the Apply Filters button to rerun the search with modified criteria.

- To view full details for a specific history entry, select the ⋮ icon to open the context menu and choose View all details.

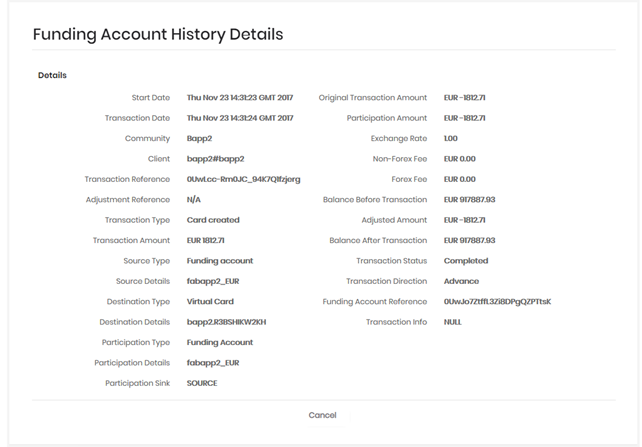

For a detailed explanation of all fields on the Funding Account History Details page, see Appendix: Viewing funding account history details

- You can also export the list of funding account history entries to a file:

- Select the Export to CSV link below the list of history entries on the Funding Account History page. (You can select the Close button in the confirmation window to close it. The export process will not be aborted.)

- When the file generation process is complete, the Export to CSV link is replaced by a Download File link. Select this to download

Appendix: Viewing funding account history details

There are the fields you may in the Funding Account History Details page.

| Field | Description |

|---|---|

| Start Date | The date when the transaction started. |

| Transaction Date | The date when the balance movement was performed. |

| Community | The name of the community that a client belongs to in Nium. |

| Client | The name of the client as set up in Nium. |

| Transaction Reference | A unique transaction identifier. |

| Adjustment Reference | A unique identifier for each balance movement. NOTE: A transaction can have multiple balance movements. |

| Transaction Type | The type of activity carried out on the funding account. The following reported transaction types are available: |

| Transaction type | Description | Transaction info field |

|---|---|---|

| Transfer | Transfers to or from this funding account. | • If the transfer is initiated by the client, this field contains NULL. • If the transfer is initiated by Nium, this field contains comments entered by the Nium officer. |

| Fee reversal | A reversal of a previous fee. | Contains the original transactionID of the transaction for which the fee is being reversed. |

| Bank deposit | A deposit via a bank transfer. | It contains the name of the provider used to make the bank deposit. |

| Bank deposit reversal | The reversal of a deposit to the funding account via a bank transfer. Possible reasons for this could be that the bank reverses the transaction or the client doesn't supply Nium with bank documents. | Contains the original transactionID of the transaction for which the bank deposit is being reversed. |

| Card return | The withdrawal of funds to a bank card. | NULL |

| Bank return | The withdrawal of funds to a bank account. | NULL |

| Bank return reversal | The reversal of a fund transfer from the funding account to a bank account. Possible reasons for this could be incorrect bank details, cancelled by bank, cancelled by Nium due to unapproved bank details, etc. | Contains the original transactionID of the transaction for which the bank return is being reversed. |

| Revenue share | A revenue share deposit. | Contains comments entered by the Nium officer. |

| Manual credit | A positive manual adjustment on a card. | Contains comments entered by the Nium officer. |

| Manual debit | A negative manual adjustment on a card. | Contains comments entered by the Nium officer. |

| Card created | The creation of new cards (which could involve fund transfer). | NULL |

| Card deleted | The deletion of cards (which could involve fund transfer). | NULL |

| Card deposit reversal | The reversal of a deposit via a bank (credit/debit) card. | Contains the original transactionID of the transaction for which the card deposit is being reversed. |

| Funding account created | The creation of a new funding account. | NULL |

| Funding account deleted | The deletion of a funding account. | NULL |

| Loss recovery | A negative card balance recovery. | NULL |

| Transaction Amount | The total monetary value represented in transactionCurrency, including the cost of goods or services and any applicable taxes, fees, or charges. This is the amount that is authorized and charged to the customer’s payment method at the time of the transaction. |

| Source Type | The source participant initiating transaction. |

| Source Details | A friendly name identifying the transaction's source participant. |

| Destination Type | The destination participant receiving the transaction. |

| Destination Details | A friendly name identifying the transaction's destination participant. |

The type of transaction participant (it can be a source or a destination participant).

Participation type

| Funding Account | An account maintained with Nium, used by the client to issue and load cards. |

| Virtual Card | A card issued through Nium for corporate purchasing or payments. |

| Bank Account | A bank account registered in Nium for bank transfers. |

| Manual Account | Manual accounts are tagged accounts used by Nium for manual adjustments. These include: |

| Revshare | Used to show revenue share credits/debits. |

| Forex_Fee | Used to adjust forex credits/debits. |

| Misc_Clearing | Used to adjust one-off occasional adjustments (supported by a note). |

| Testing | Used to adjust testing credits/debits. |

| Settlement_Loss | Used to collect losses on client settlement processing. |

| Settlement_Charge | Used to collect fees associated with settlement charges (not collected by the system). |

| Dispute_Fee | Used to collect dispute fees on client requests. |

| Dispute_Won | Used to credit funds won related to disputes processed. |

| Card_Fee | Used to collect/refund card fee charges manually. |

| Transfer_Fee | Used to collect/refund fees generated on a transfer manually. |

| Bank_Charge | Used to collect/refund fees associated with a bank transfer. |

| Tracing_Charge | Used to collect/refund fees associated with a bank transfer trace. |

| Professional_Fee | Used to collect fees associated with a bespoke task that had previously communicated a charge. |

| Setup_Fee | Used to collect/refund setup fees. |

In card reports, participantType is always Virtual Card.

In funding account reports, participantType is always Funding Account.

| Participation Details | A friendly name identifying the transaction's destination participant. For example, bank account information (if the participant type is Bank Account), funding account name (if the participant type is Funding Account), etc. |

| Participation Sink | Possible values are SOURCE or DESTINATION. |

| Original Transaction Amount | The total value of the transaction as submitted by the cardholder at the point of purchase. This is the gross amount before any currency conversion, issuer fees, or adjustments, and reflects the full charge authorized on the card |

| Participant Amount | The value portion of the authorized or settled transaction in the currency of the participant excluding the forex (see: participantCurrency). For example, if the client requested 1000 GBP, participantCurrency is EUR, and the current GBP to EUR exchange rate is 1.1, participantAmount is 1100. |

| Exchange Rate | The exchange rate used between source currency and destination currency (if they are different). |

| Non-Forex Fee | Contains non-Forex fees for the reported transaction, where applicable. |

| Forex Fee | Contains Forex fees for the reported transaction, where applicable. |

| Balance Before Transaction | The balance on the funding account before the transaction was processed. |

| Adjusted Amount | The final value of a transaction after modifications such as currency conversion, fee application, partial captures, reversals, or refunds. This reflects the amount that is ultimately settled against the cardholder’s account, which may differ from the originally authorized amount |

| Balance After Transaction | The balance on the funding account after the transaction was processed. |

There are three transaction statuses:

Transaction Status

| Completed | Transaction completed successfully. |

| Failed | Transaction failed, and no fund movements happened. |

| Initialised | The transaction is in a suspended state, and funds have only been partially moved. |

| Initialised completed | The transaction was previously in a suspended state but has been resumed and completed successfully. Funds have also been fully moved. |

| Initialised failed | Transaction that was previously in a suspended state and is now in a failed state. Fund movements that happened initially have been reversed and a new balance movement entry has been created. |

| Transaction Direction | Indicates whether a transaction is an Advance or a Reversal. |

| Funding Account Reference | A unique Nium reference of the funding account. |

| Transaction Info | Additional information is specific to each transaction type. |