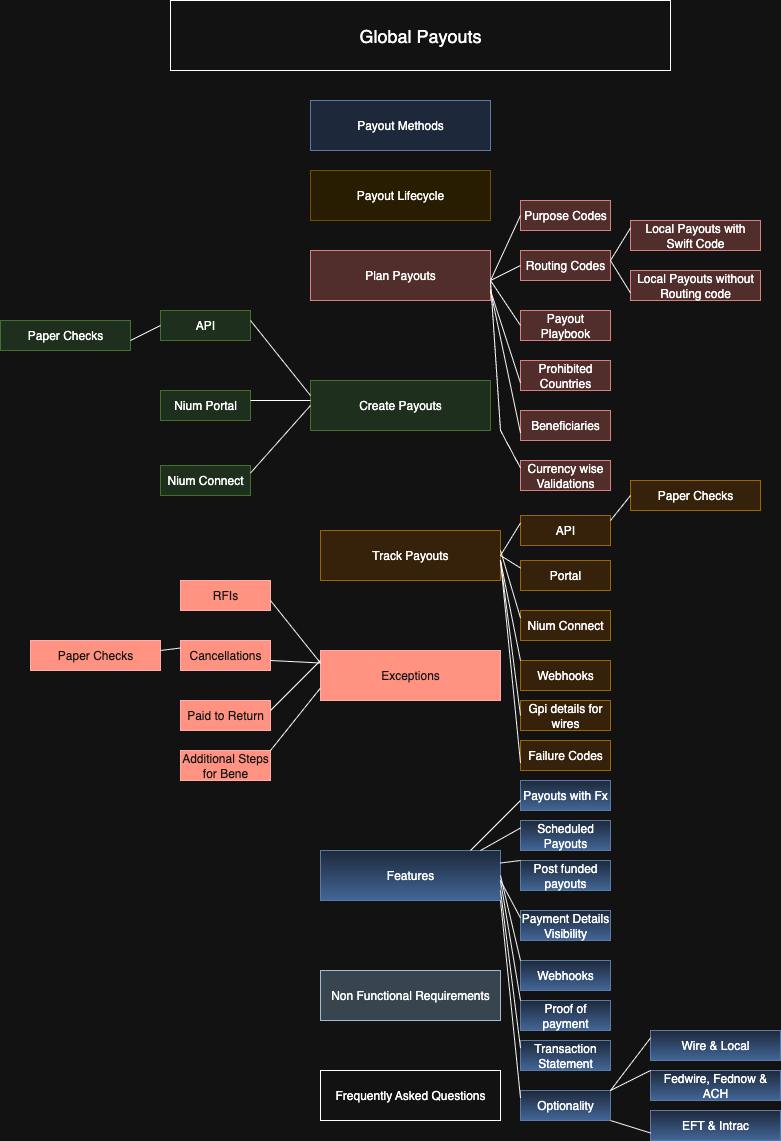

Payouts

Nium Payouts lets you send money to over 190 countries and make real-time, on-demand payments in more than 100 countries.

With Payouts, funds move instantly from the source to the destination during the transaction. Payments are automatically routed and settled in real time.

You can use Payouts to send money to individuals or businesses. Supported transaction types include:

- Individual to Individual (P2P): Also called Person-to-Person or Peer-to-Peer.

- Corporate to Individual (B2P): Also called Business-to-Person.

- Corporate to Corporate (B2B): Also called Business-to-Business.

- Individual to Corporate (P2B): Also called Person-to-Business.

Payouts can be delivered to a beneficiary’s bank account, card, digital wallet, or in some countries, through cash pickup.

Depending on your region, additional verification can be required before creating payouts. For more details, see Verification of Payee.

To explore available payout corridors, visit the Nium Playbook.

You can filter by country or payout method to see where and how you can send money across the Americas, Europe, the Middle East, Africa, Oceania, and Asia-Pacific.

Sending Payouts

Nium offers several ways to send payouts, depending on your team’s setup. You can use one or a combination of the following:

API integration

Best for: Technical teams, payroll platforms, and large banks

Integrate directly with Nium’s APIs to automate and scale your payouts. This is ideal for high-volume use cases or extending payout services to your own users.

Nium Portal

Best for: Small businesses and teams without developers

Use Nium Portal to create single or batch payouts without writing code. The Portal is great for fast onboarding and managing transactions from a browser.

Nium Connect (SWIFT-Based)

Best for: Banks and financial institutions using SWIFT

Use your existing MT or ISO 20022 message formats to send payments—no API required. Go live faster and route payouts through Nium’s global network.

Custom integration

Best for: Teams who want flexibility

Combine UI elements, forms, and APIs based on your needs. This option works well if you want to conserve technical resources without losing functionality.

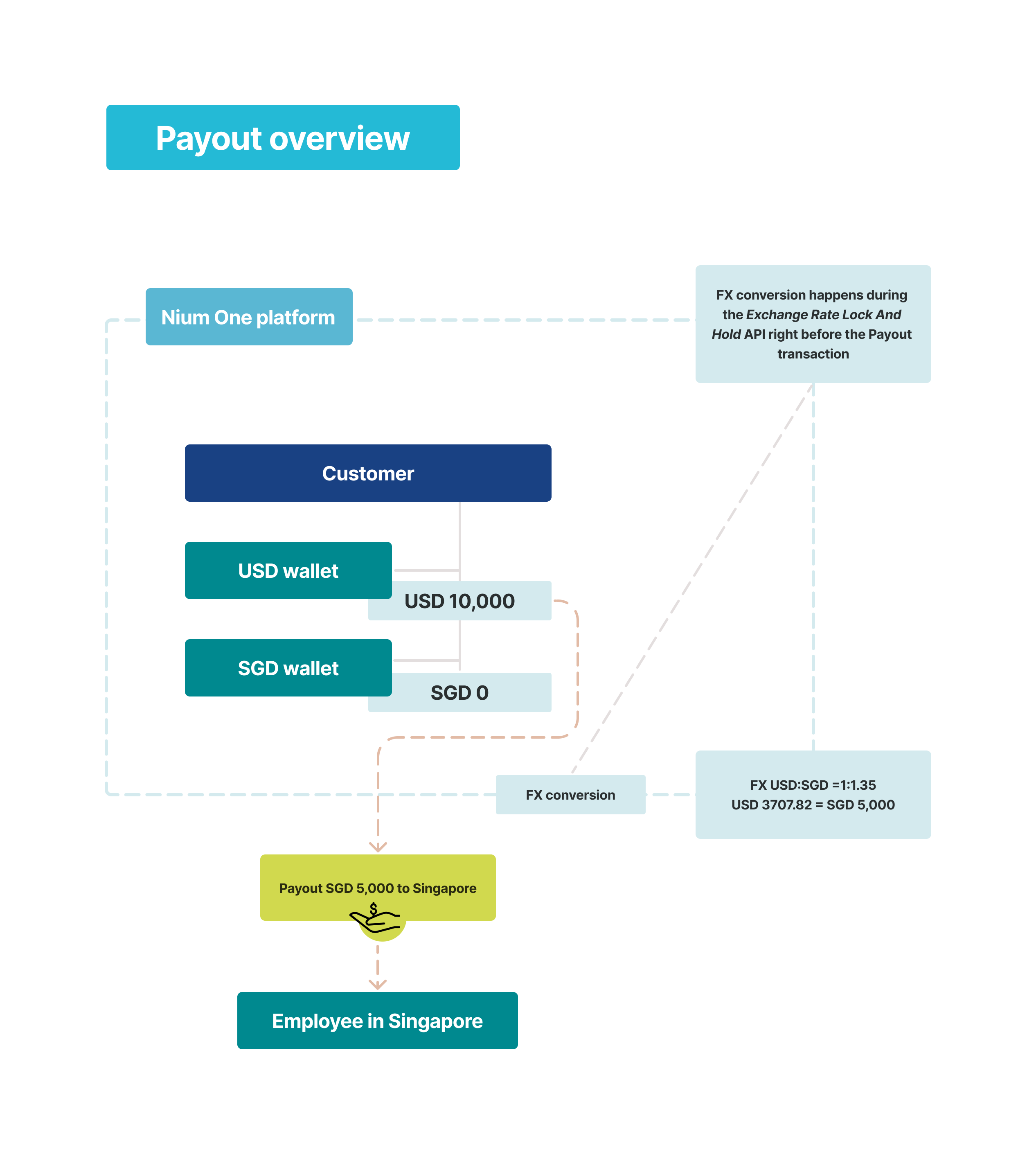

Payouts overview

TPS limits apply specifically to payout transactions. For request-level rate limits (per second, per day, burst capacity), see Rate Limits.

If you expect to exceed this TPS limit due to business growth or planned traffic spikes, contact your Nium account manager or Nium Support.

Local currency wires

Nium supports local currency wires to bank accounts in eight countries. This includes:

- China

- Iceland

- India

- New Zealand

- Saudi Arabia

- South Africa

- United Arab Emirates

- Vietnam

For more information, see the Nium Playbook.

Foreign exchange

For international payouts, our foreign exchange (FX) service automatically converts currencies, streamlining cross-border transfers.

For example, a client wants to pay S$5,000 (Singapore dollars) to employees in Singapore from a wallet with $10,000 (United States dollars).

Using Payouts on Nium One, you send the money for the payment from your USD wallet with $10K to the SGD wallet that has no money. As part of this transaction, your payment goes through the required foreign exchange (FX) money conversion, which happens during the Exchange Rate Lock And Hold API call before the payout transaction.

The FX rate from USD to SGD is $1 USD to $1.33 SGD. So, $5,000 SGD is equivalent to $3,707 USD. Submitting a $3,707 USD payout to an SGD wallet results in a S$5,000 payout.

The FX rate used is taken from Reuters® FX service every day of the week, 24/7-including weekends and holiday-with a refresh cycle rate of 15 minutes. The FX rate is based on the currencies used pairs between the source and destination.

- The payout fee calculation is done in real-time during the transaction.

- Additional configurations are available for Payouts based on the payment methods used.

Nium Portal

You can also use Nium Portal to create a submit payouts. This is helpful for users with less technical expertise that want to avoid the need to build and integration with the Nium API.

For more details, see Nium Portal - Payouts.