Tracking Wires

Considering SWIFT cross-border transactions are passed to multiple correspondent banks, these transactions take time to reach the intended beneficiaries. With GPI tracking, you can review the intermediary status details for SWIFT wire transactions.

important

GPI tracking is only available for SWIFT wire transactions.

Some of the benefits of using SWIFT GPI include:

- Tracking delayed transfers: SWIFT GPI can be used as an effective alternative to the MT103 SWIFT message type to track delayed transfers.

- Increased visibility and transparency: Use the additional details provided by SWIFT GPI to enhance visibility and transparency, which, in turn, will help reduce the number of queries you receive from your customers.

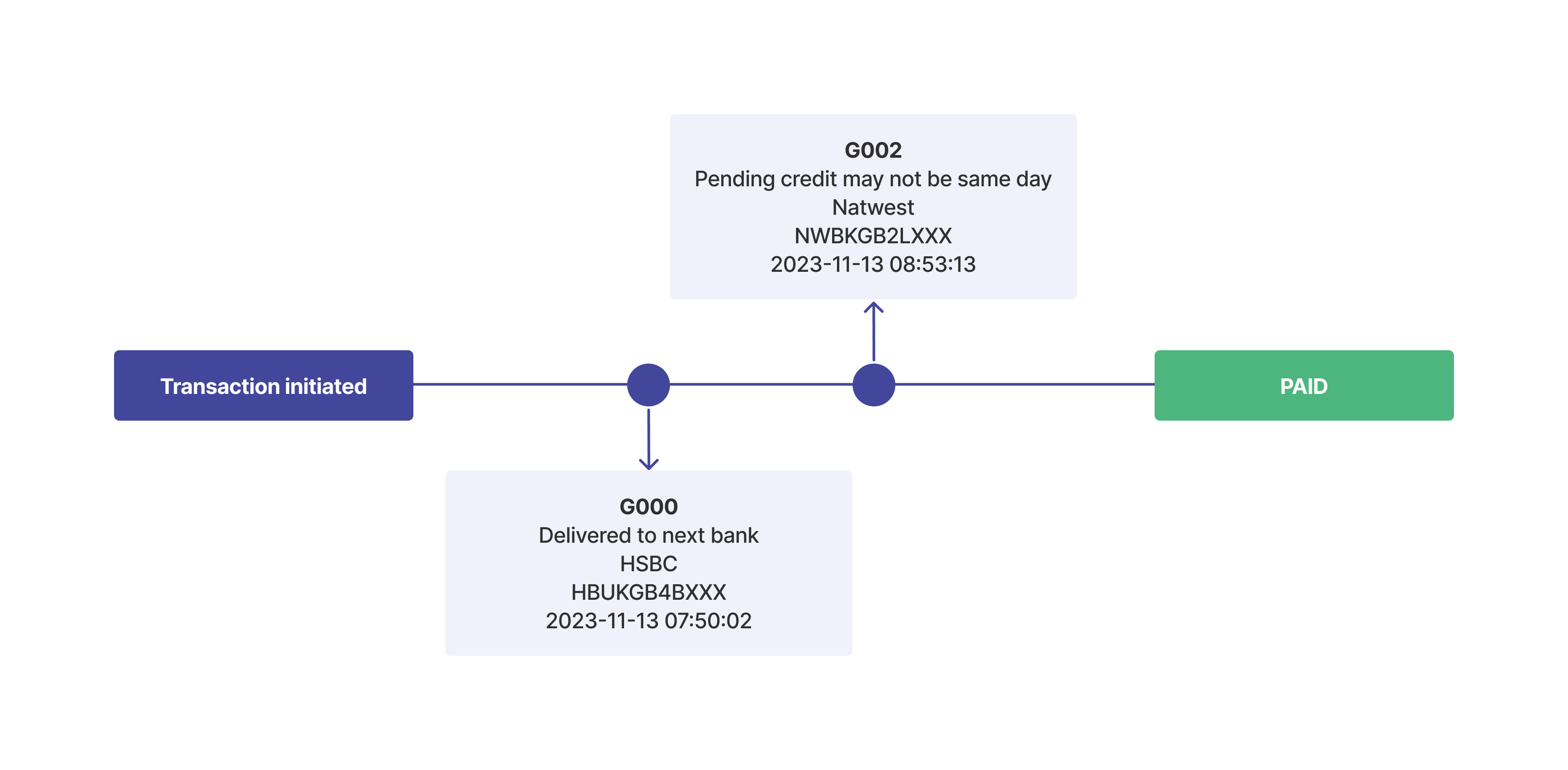

- More transaction details: SWIFT GPI provides more details about transactions and how they're being processed. In addition to tracking delayed transfers, you use this additional information to enhance your customer's experience by creating transaction timelines on your platform or by sharing these details directly via texts/emails for those who prefer messages. See the graphic below for an example of a transaction timeline.

How do I access GPI details?

GPI details can be obtained through the gpi object in the following request and event:

- Fetch Remittance Lifecycle request

- Remit Transaction Sent To Bank webhook event

The Nium One client dashboard also displays GPI details at the transaction level in the Remittance Transaction Reports section.

GPI parameters

| Field | Description |

|---|---|

reasonCode | GPI code shared by the SWIFT partner bank |

statusDescription | Description of the GPI reason code |

timestamp | Date and time of the last status change |

forwardBankName | Name of the next participant bank to which the payment has been forwarded. |

forwardBankCode | Bank identification code (BIC) of the next participant bank to which the payment has been forwarded |

remarks | Detailed description of the reasonCode. This interpretation is provided directly by Nium. |

GPI reason codes and status descriptions

status | gpi#reasonCode | gpi#statusDescription | gpi#remarks |

|---|---|---|---|

SENT_TO_BANK | G000 | Delivered to the next bank | The payment has been forwarded to the next participant bank in the SWIFT network. It can be either credited to the beneficiary directly or passed to the next bank. |

SENT_TO_BANK | G001 | Delivered to the next bank (no tracking) | This often suggests the user may not receive GPI updates beyond this point and will receive a final terminal status. |

SENT_TO_BANK | G002 | Pending credit may not be same day. | Often it means that the payment is under manual due diligence in the bank and settlement may take a few hours. |

SENT_TO_BANK | G003 | Pending receipt of documentation from the beneficiary. | This often suggests an action on the beneficiary or beneficiary bank. The sender may contact the beneficiary in case of delays or can ensure that the beneficiary details provided are correct. |

SENT_TO_BANK | G004 | Pending receipt of funds from the previous bank. | This suggests the forward bank (next SWIFT network bank) has received an instruction to credit the funds to the beneficiary but it has not received the funds yet. Cover payment is missing but it is expected to arrive soon. The funds are expected to reach the beneficiary upon arrival of cover payment. |

SENT_TO_BANK | G005 | Delivered to beneficiary bank as GPI. | This suggests that the payment will be credited soon. |

SENT_TO_BANK | G006 | Delivered to beneficiary bank as non GPI. | This suggests that the payment will be credited soon. |