Direct Debit UK

Nium One platform clients in the United Kingdom can accept Bacs Payment Schemes Limited Direct Debit payments from business customers with a UK bank account using the Bankers' Automated Clearing System (BACS).

You can use Direct Debit as many times as you want. Direct Debit is a non-real-time payment method from payment creation, to processing, and acknowledgment of its success or failure.

Refer to the Direct Debit guide for more information.

Prerequisites

These are the requirements for this funding mechanism:

- Your customer needs to have a bank account in the UK with BACS Direct Debit enabled and a Nium GBP wallet.

- Your customer needs to authorize the Direct Debit mandate to debit from their bank account and accepts Nium's terms and conditions (T&C).

- Your customer needs to have enough money in their added bank account to start your transactions.

- Your customer is the only person who can authorize the Direct Debit mandate for their bank account.

- Your customer needs to be a corporate customer.

Configuration

- Nium approves your Direct Debit mandate set-up pages. You can't change these pages without notifying Nium in advance. You need to collect the Direct Debit mandate from your customer, displaying the BACS Direct Debit Guarantee to your customer while collecting their bank account details.

- During the mandate creation and customer account addition, the customer needs to authenticate themselves with Nium via an email one-time password (OTP) process.

- You agree to send advance notifications to your customers 3 days before initiating the payment request to Nium.

Direct Debit API endpoints

The following APIs support the Direct Debit feature:

| HTTP method | API name | Action |

|---|---|---|

| POST | Add Funding Instrument | Add the funding instrument ID to your customer's wallet to start a Direct Debit transaction. Use this API to add the payer's funding instrument to the customer's wallet so that Direct Debit payments can be initiated against it. Provide the funding instrument's country code, currency code, account number, and sort code. |

| GET | Get Funding Instrument Details | Get the details of your customer's funding instrument using the fundingInstrumentId. This endpoint is optional. The fundingInstrumentId is returned as a response in the Add Funding Instrument request. |

| GET | Get Funding Instrument List | Get the list of funding instruments registered with your customer. It's optional to use this API. |

| POST | Confirm Funding Instrument | Confirm the funding instrument with OTP authentication. Use this API to communicate the OTP your customer entered. Nium sends the OTP to the customer through email after the Add Funding Instrument API call. By confirming the Direct Debit mandate, your customer authorizes Nium to debit payments from their bank account. |

| POST | Fund Wallet | Fund into your customer's wallet by selecting the funding channel as a direct_debit transaction. You also need to provide the fundingInstrumentId obtained from the response in the Add Funding Instrument API call. The debit payments appear on your customer's bank statement as Nium. |

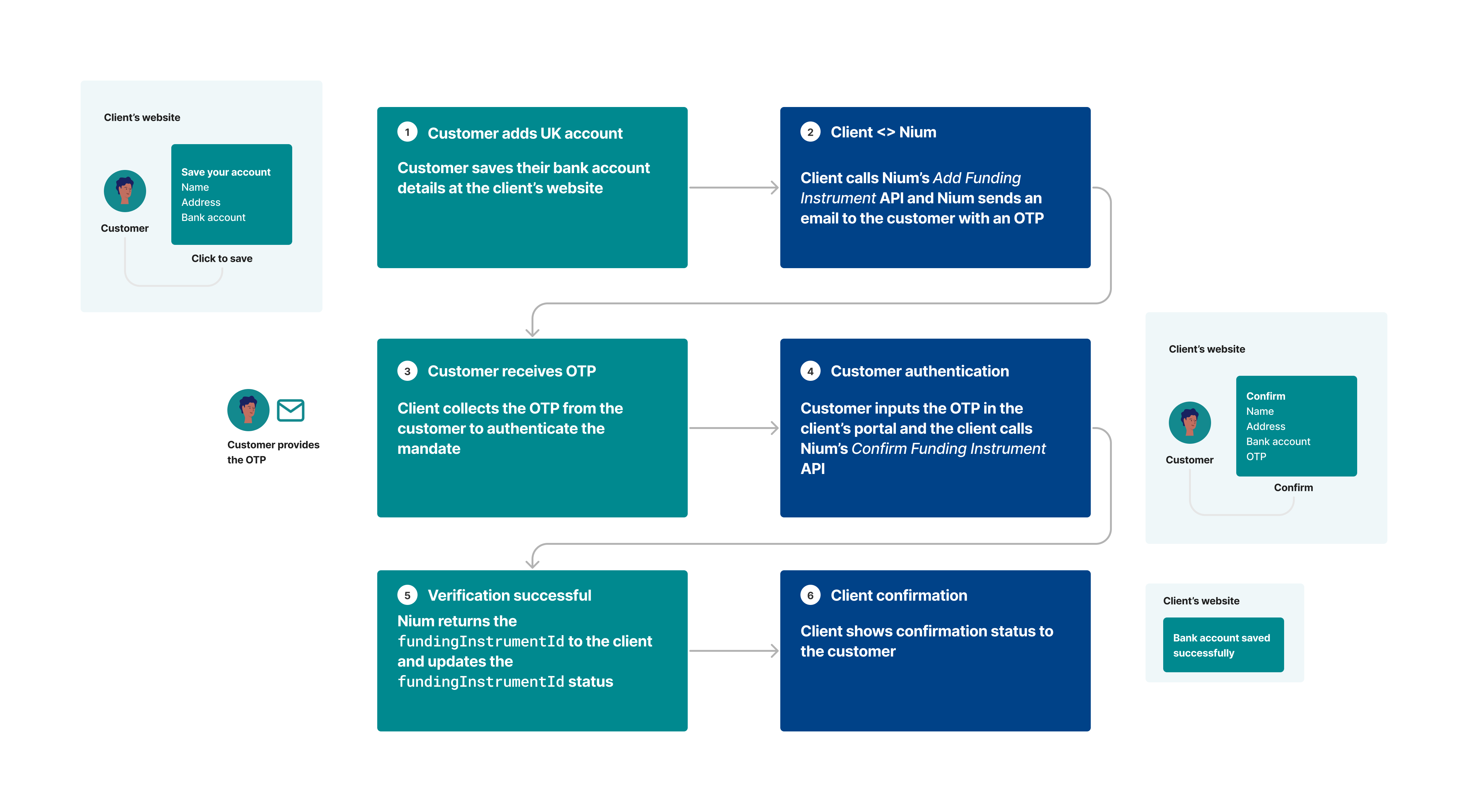

UK Direct Debit flow for customers.

Payment flow

- Call the Add Funding Instrument API to add your customer’s bank account.

- Nium sends an email with the OTP to the customer.

- Call the Confirm Funding Instrument API with the OTP.

- Nium validates it and returns the

fundingInstrumentId. - Nium sets up the Direct Debit.

- You and your customer can also inquire about the status by calling the Get Funding Instrument Details API.

Funds flow timeline

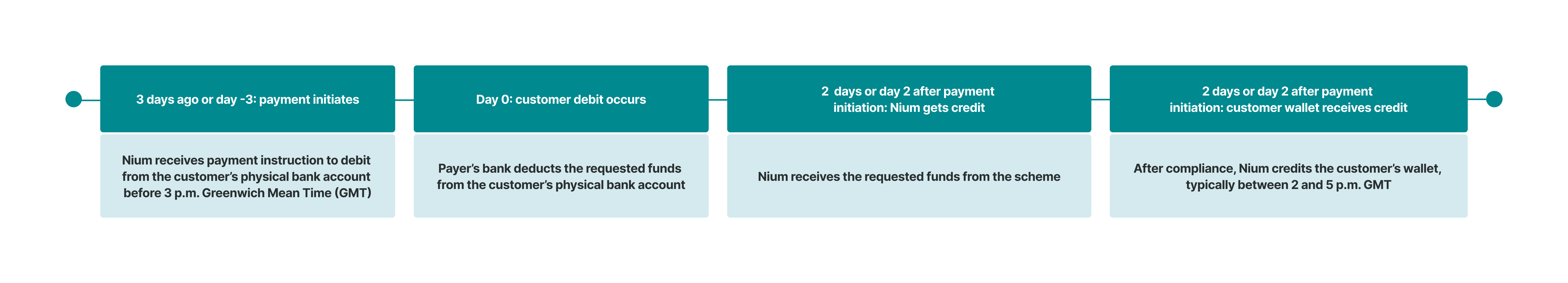

Direct Debit is a non-real-time payment method and can take 5 days, from payment creation, to processing, and acknowledgment of its success or failure.

The UK Direct Debit settlement timing, which can take 5 days.

Mandates

You need to get your customer's permission to debit their bank account through a mandate. A mandate is an authorization that the customer provides, giving Nium permission to debit their account. The mandate isn't physically signed by the customer. Once the customer provides the OTP, which has been verified successfully, they have duly agreed to the mandate.

Once you have that, you need to notify your customer every time you debit their bank account at least 3 days before each payment. If you fail to do this, you become liable for any chargebacks. Nium is the service provider to debit the funds from the customer’s bank account. It also sends your customer an email with this information 3 days before each payment.

Your customer may cancel a mandate at any time by emailing their bank or financial institution. Canceling a mandate invalidates any future direct debit requests that you issue using this mandate. If you want to accept additional payments from your customer, you need to establish a new mandate with them.

Chargebacks

Your customer can initiate a dispute with their bank after the funds are credited to their Nium wallet for an unlimited time period. If their bank agrees, the money is pulled from the customer's Nium wallet.