Payroll

Payroll clients use Nium financial services to help them as part of their overall payroll management services such as paying salaries, benefits, and expense reimbursement. Payroll clients typically have their own payroll management software, and Nium primarily provides the payments capability to facilitate funds movement for the money to be paid to the workforce.

The target segments for Nium payroll clients can be broadly divided into two categories:

Payroll platform providers

These are primarily technology companies and start-ups that have built modern payroll management software that automates the management of payroll services such as salary, benefits, expenses, and tax payments for their customers to easily pay their workforce and tax authorities. These global payroll platform companies charge their customers a fee for the software-as-a-service that they provide.

This model typically works for global companies with local entities that perform the hiring but would like to outsource the HR functions such as payroll, benefits, tax deduction, reporting, etc. The local entities of the global companies are legally the employers. The companies contract global payroll platforms as their agents to pay their employees and handle compliance activities, such as tax payments.

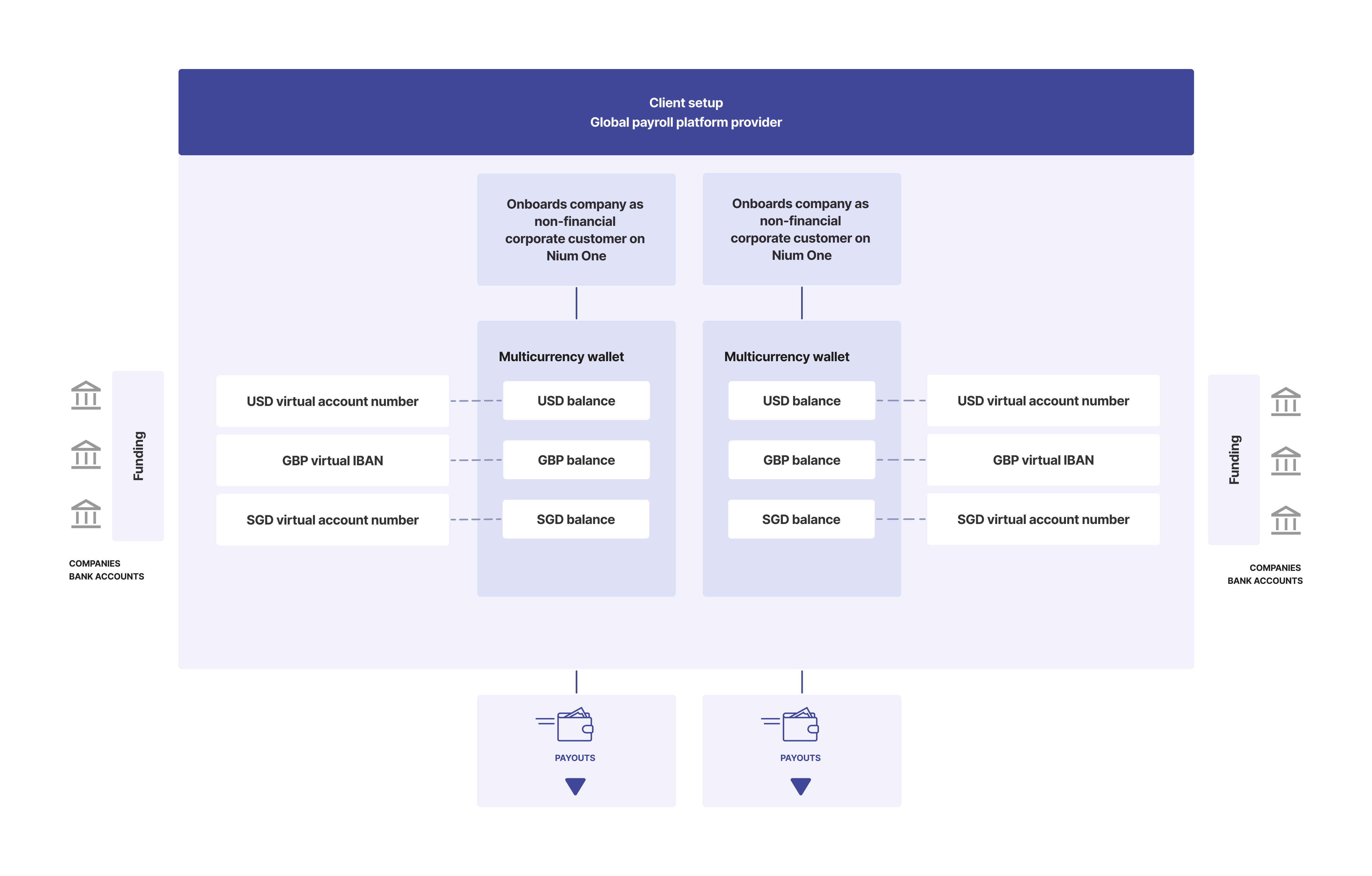

For non-financial payroll platform providers, their business customers need to be onboarded to the Nium One platform with due diligence done on their business customers. For these payroll platform providers, the electronic know-your-business (eKYB) process for onboarding their business customers facilitates a seamless onboarding experience.

Non-financial platforms can not make payments on behalf of their customers to employees.

Client setup for non-financial payroll platform

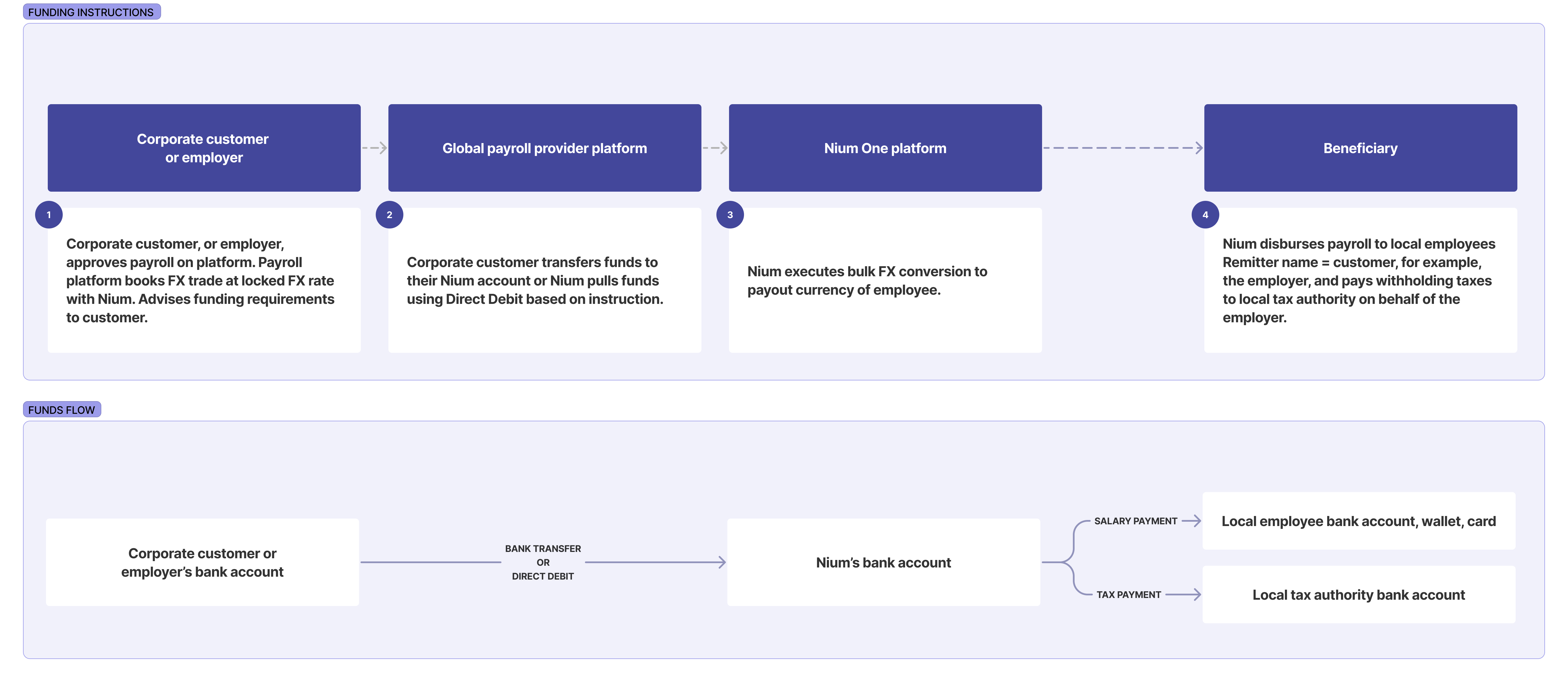

Funds flow for non-financial payroll platform

Steps for non-financial payroll platform

- The payroll platform’s customer, who's the legal employer, approves payroll within the platform’s software by a cut-off date to be included in the upcoming payroll cycle run. The payroll platform calculates the employees' payroll and any withholding taxes to be paid to the local tax authorities. The payroll platform books the FX trade at a locked FX on behalf of the customer with Nium and informs their customer about the funding requirements.

- The payroll platform’s customer provides funding through one of the following:

- Pushes funds through a bank transfer into their account with Nium

- Authorizes funds to be pulled from their bank account into their account with Nium through Direct Debit

- Nium executes any FX trade from the funding currency to the payout currency.

- Nium executes a payout to:

- Customer’s local employees for salary payment in the local currency with the necessary purpose code, net any withholding of taxes.

- Local tax authorities for tax payment in the local currency with the necessary references passed in the payment to the tax authority. This can happen independent of the salary payment at a pre-determined schedule, for example monthly, quarterly, etc.

The remitter name in the payout instruction to the employee is the name of the corporate customer since they're the legal employer.

Corporations paying salaries to their employees

These are corporations with a direct relationship with Nium. Typically, they have their own payroll management software but are looking to integrate with financial service providers like Nium who can help them with funds movement for paying their employees. An example of these companies is a corporation that already has Oracle NetSuite integrated into their internal systems, and they're looking for a global financial service provider like Nium to help them with payouts to their global workforce dispersed in different countries.

This model typically works for global companies that do not have local entities for hiring in the required markets. The payroll platform provider hires and pays their employees as the sole legal employer of record (EOR) and contracts out their employee services to their customers. The payroll platform provider as the EOR does not make payments on anyone’s behalf but pays its own employees.

Client setup for EOR payroll model

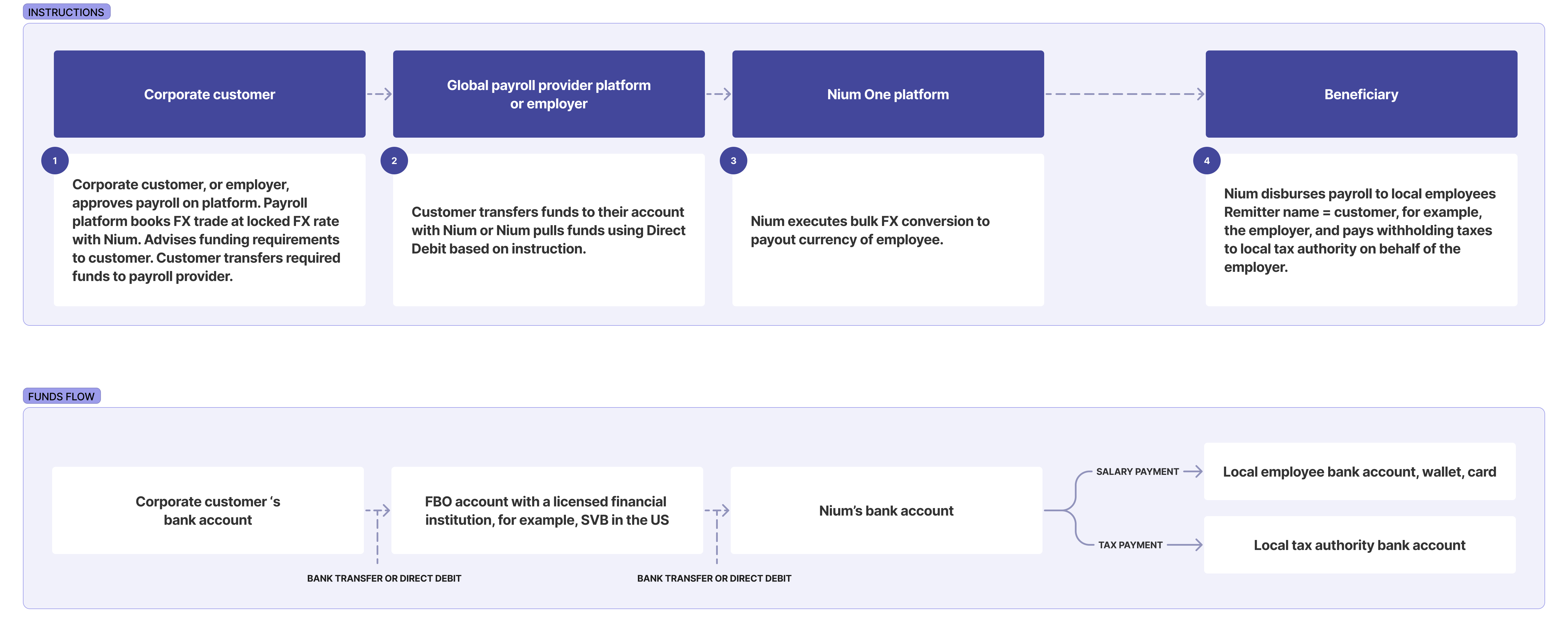

Funds flow for EOR payroll model

Steps for EOR payroll model

- The platform’s customer reviews payroll within the platform software by a cut-off date to be included as part of the upcoming payroll cycle run. The payroll platform calculates the employees' payroll and any withholding of taxes to be paid to the local tax authorities. The payroll platform books the FX trade at a locked FX rate with Nium and informs their customer about the funding requirements. The payroll platform’s customer provides funding through one of the following:

- Pushes funds through a bank transfer into the payroll platform’s bank account

- Authorizes funds to be pulled from their bank account into the payroll platform’s bank account through Direct Debit

- The payroll platform transfers funds from their bank account into their Nium account.

- Nium executes any FX trade from the funding currency to the payout currency.

- The payroll platform instructs Nium to perform a payout to:

- Their local employees for salary payment in the local currency with the necessary purpose code, net any withholding taxes

- The local tax authorities for tax payment in the local currency with the necessary references passed in the payment to the tax authority. This can happen independent of the salary payment at a predetermined schedule, for example, monthly, quarterly, etc.

The remitter name in the payout instruction to the employee is the name of the payroll platform provider since they're the legal employer.