Individual Customers

An individual customer is an end-user who holds the balance. In a corporate travel-and-expense (T&E) use case, this would be a staff member who receives a T&E card. In a consumer-funded use case, this would be a retail end-customer who has an account. Depending on the nature of the product or program, the know-your-customer (KYC) and the onboarding process differ. Work with your Nium representative to determine the right approach.

KYC Overview

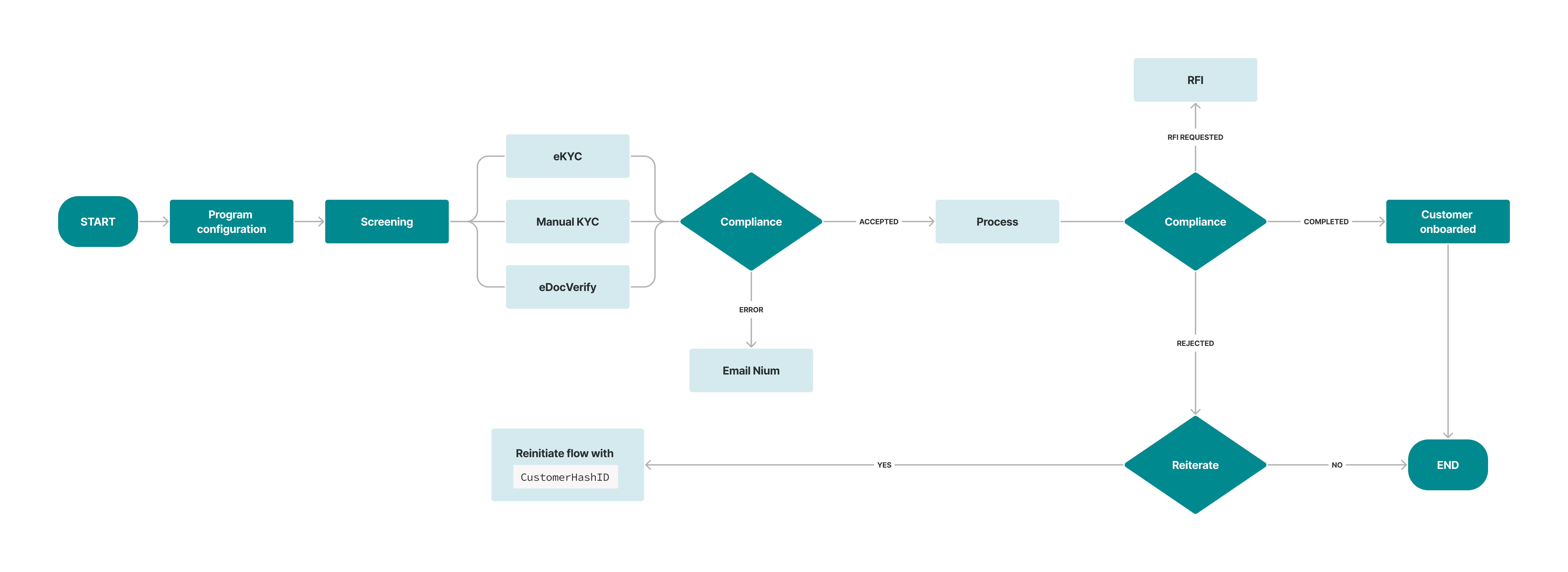

The Unified Add Customer API is used for adding individual customers in the following flow.

Region-Specific KYC Offerings

Nium supports automated KYC for most of the regions.

| Regulatory region | KYC offerings | Description |

|---|---|---|

| AU | E_KYCMANUAL_KYC | |

| EU | E_DOC_VERIFY | Automated document verification by eDocument verification vendor. |

| SG | E_KYCE_DOC_VERIFYMANUAL_KYC | |

| UK | E_DOC_VERIFY | Automated document verification by an eDocument verification vendor. |

| US | E_KYC | Automated KYC for US nationals by eKYC vendor. |

Onboarding Customers

The following are the steps of the Nium customer onboarding process:

- Create a Customer Account

- Submit Account for Compliance Checks

- Complete Compliance Checks

- Complete RFI Items

Step 1: Create a Customer Account

You can create the customer account by providing customer details through the Unified Add Customer API. The customer details include the customer’s personal, contact, and KYC details. Some of the details are optional, depending on the defined KYC option.

Once you create the customer account, the compliance process begins automatically.

Step 2: Submit Account for Compliance Checks

The customer compliance check involves customer verification, screening, and the KYC process.

| Step | Description |

|---|---|

| Screening | Checks whether the customer is part of any of the regulatory blacklists and if Nium can legally do business with the customer. |

| KYC | Verifies whether the customer details are accurate. It includes authenticating the customer's identity and address using proof of identity (PoI) and proof of address (PoA). |

Step 3: Complete Compliance Checks

The following table describes the states customer accounts go through as they're reviewed by Nium's compliance team and go through the compliance check process.

| Compliance status | Description |

|---|---|

INITIATED | Compliance is initiated, and the customer needs to take a few more steps to complete the KYC process, such as adding the required information. This status is applicable only for eKYC. |

IN PROGRESS | The KYC compliance process is in progress, and the customer has some pending action, such as uploading a document. |

ACTION REQUIRED | The customer uploads documents and waits for verification from the compliance team. |

RFI REQUESTED | The Nium compliance team raises a request-for-information (RFI) and the customer responds to the RFI through the Respond to RFI API. |

COMPLETED | The compliance process is complete. |

ERROR | No action is taken. The customer application fails due to an error. Contact Nium customer support for assistance. |

EXPIRED | The submitted document's date expires. The Nium team may raise an RFI. |

REJECT | If the compliance team rejects the KYC process, the status changes to REJECT. The reinitiate-KYC process is available in this case. |

Each action depends upon separate kycStatus and complianceStatus as detailed in this table:

| KYC status | Compliance status | Your next action | APIs involved | Remarks |

|---|---|---|---|---|

Pending | INITIATED | Wait for the compliance status callback. | Customer Details V2 | eKYC is initiated. The system updates the status according to the KYC vendor and our screening results. |

Failed | REJECT | Reinitiate eKYC by providing the same customerHashId. | Customer Details V2 Unified Add Customer | Check the remarks or the compliance remarks. |

Pending | ERROR | Email Nium. | Customer Details V2 | Nium's compliance team might need to check the errors manually. |

Pending | ACTION_REQUIRED | Wait for the next compliance status update. | Customer Details V2 | Nium's compliance team requires a manual check on this request. |

Pending | RFI_REQUESTED | Check the rfiDetails array and provide the requested information through the Respond To RFI API. | Fetch Individual Customer RFI Details Respond To RFI | Nium's compliance team requires additional information to verify the customer. |

Pending | RFI_RESPONDED | Wait for the next compliance status update. | Customer Details V2 | Nium's compliance team verifies the information in your Respond to RFI API. Usually, the system updates the compliance status to ACTION_REQUIRED. |

Clear | COMPLETED | Continue your user journey, for example, Add card. | Customer Details V2 | eKYC is successful and the customer is onboarded. |

Nium calls the compliance status callback URL to inform you of any change in the compliance status. Then, you need to call the Customer Details V2 API to retrieve the detailed information.

Within the complianceStatus:

INITIATEDis the first status.COMPLETEDis the final status.

Step 4: Complete RFI Items

Refer to RFI process for individual customers.

Resubmit Customer Applications

The onboarding process can be reinitiated if the compliance status is ERROR or REJECTED. However, applications rejected due to high risk or non-compliance will be blocked from being resubmitted to Nium. Resubmission is still allowed for reasons unrelated to compliance, such as incomplete applications, typos, wrong addresses, etc.

For reinitiation, call the Unified Add Customer API with the previously generated customerHashId.

Upload Documents

When onboarding is initiated with kycMode = MANUAL_KYC, then the proof of identity documents are required to be submitted to initiate the KYC process.

In addition to the Unified Add Customer API, Nium offers the Upload Document API which can accept the additional documents in multiple steps.

Use Case

Spend Management

This is applicable for the use cases where the business expenses made by the employees are funded by a corporation, i.e., their employer. The employees are required to be onboarded in Nium along with their corporate customers.

While onboarding employees for spend management use cases, the same Unified Add Customer API is used with minimal information for their identity verification. An employer letter alone is sufficient to onboard an employee in Nium. For more information, see Configure the corporate customer and employee relationship.