Hosted Models

The Hosted Model is the default authorization logic on the Nium One platform. This model allows Nium to serve as the primary statement of record holder and authorizing entity for clients and their customers. The model allows Nium to centralize the financial authorization process.

This model only applies to card-based transactions. You need to work with your implementation manager to set it up.

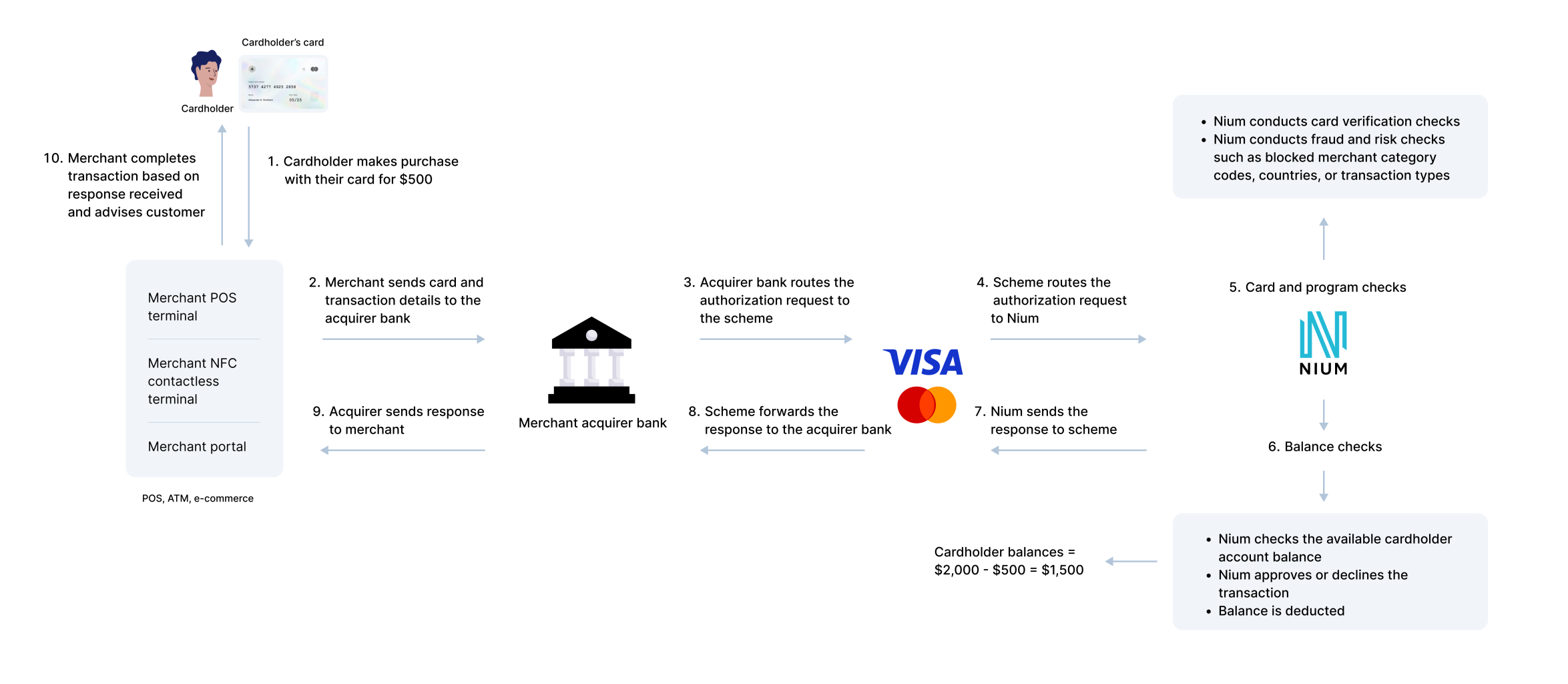

Hosted Model flow

With the Hosted Model, Nium is the financial license holder, the ledger of balances, or the database of record. Nium holds the funds in segregated client and customer accounts.

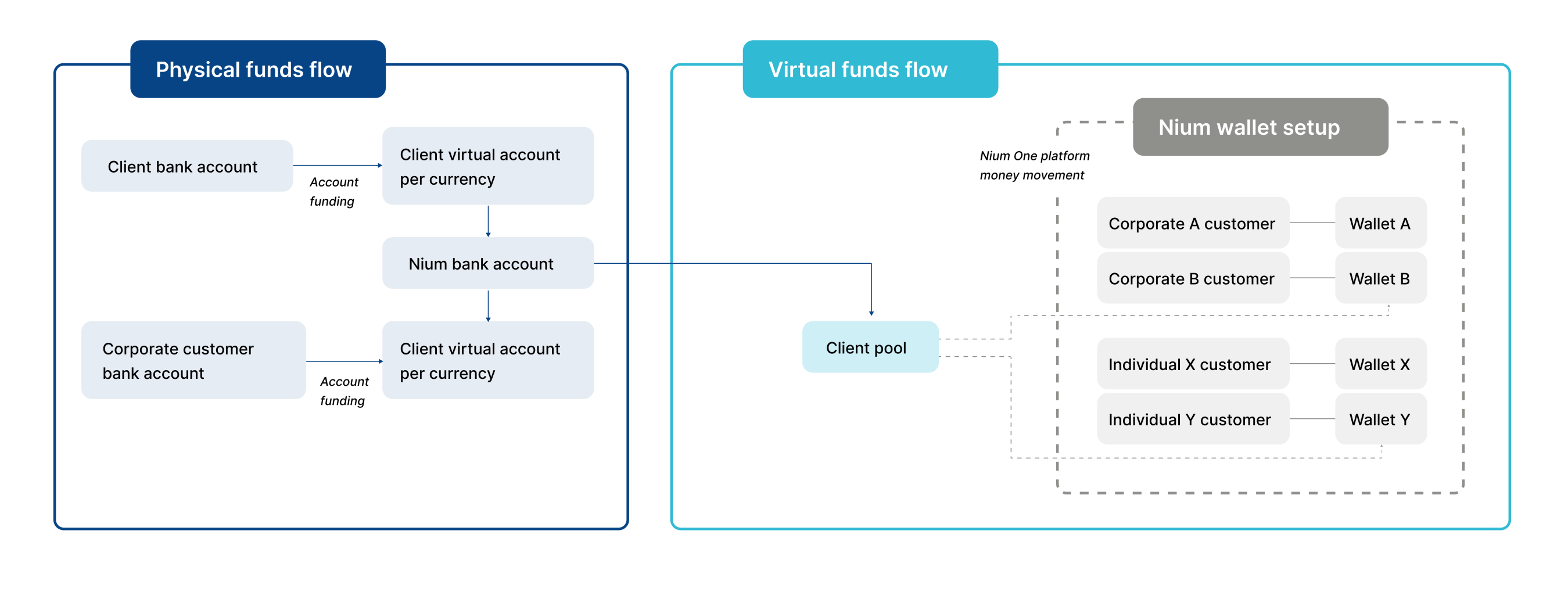

Physical funds flow

- Nium receives funds from the client or the corporate customer to run the card program.

- Nium provides virtual account numbers (VANs) to clients and corporate customers which lead to the same Nium bank account. For example, the Nium bank account receives $5,000 from the client or the corporate customer.

Virtual funds flow

- The prefund at the client level is used to fund customer wallets. For example, the Nium system client pool account increases in value by $5,000.

📒 NOTE

The Nium client system includes the client host and ancillary support systems that the client manages.

- The corporate and individual customer funds are mapped on the Nium system which is the basis of balance checks during transactions.

- For example, the client disburses $2,000 into the individual Y customer wallet

- Individual Y can only spend $2,000 as the customer's wallet balance is checked by the Nium system during transactions.

Target segment

The target segments for the Hosted Model are companies that don't need custom spending rules, such as:

- Payroll platforms

- Spend Management platforms