Manage Cards

After you set up your customer with their cards, you can offer them a number of functionalities using Nium APIs. The following are the card management APIs:

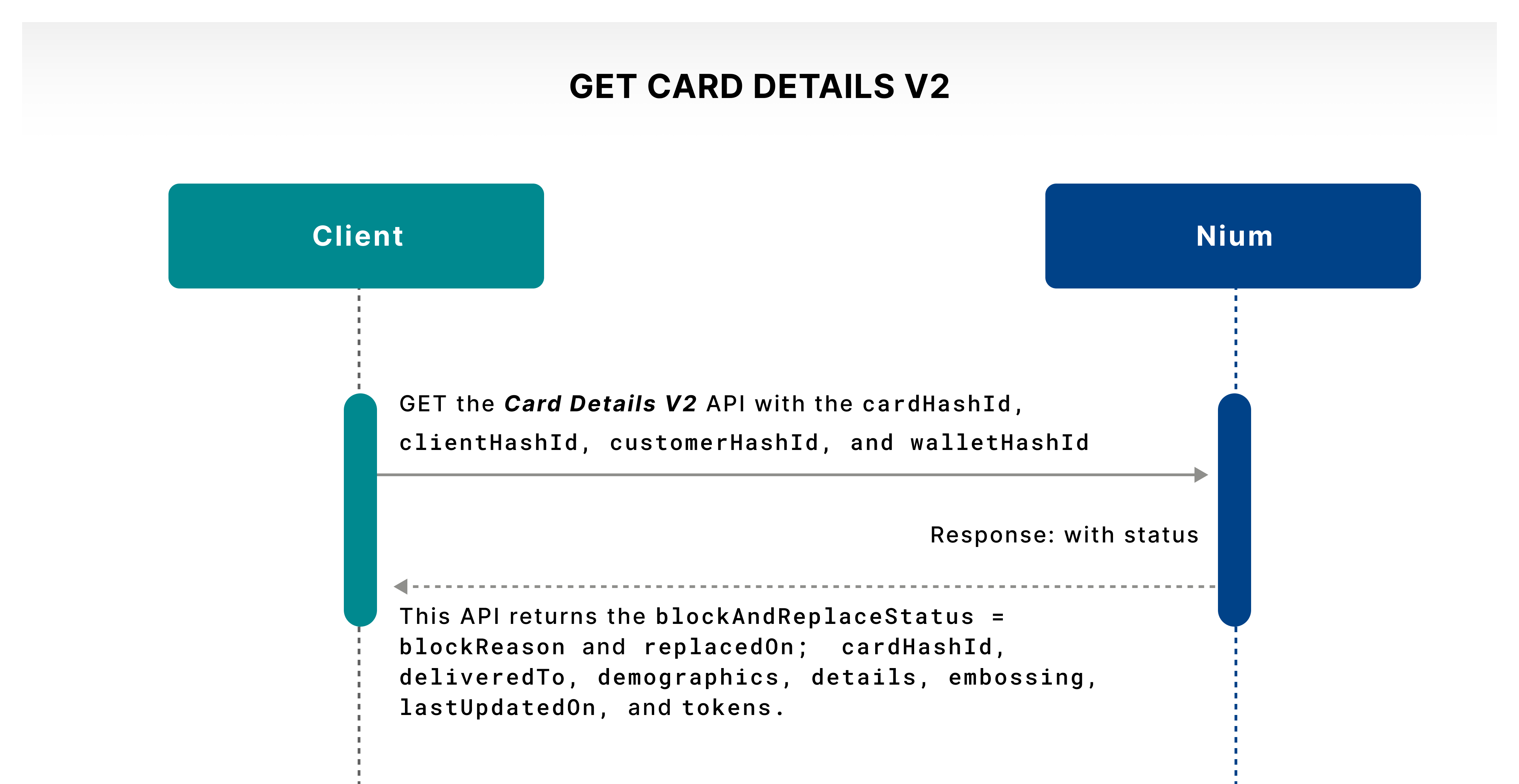

Get card details

The Card Details V2 API lets you get details about a card. Call this operation to help your customer see their card details to make sure they're accurate.

Using the card's unique cardHashId, you can show your customer all card details, such as card status, demographics, and delivery information set during issuance, and other embossing and token details.

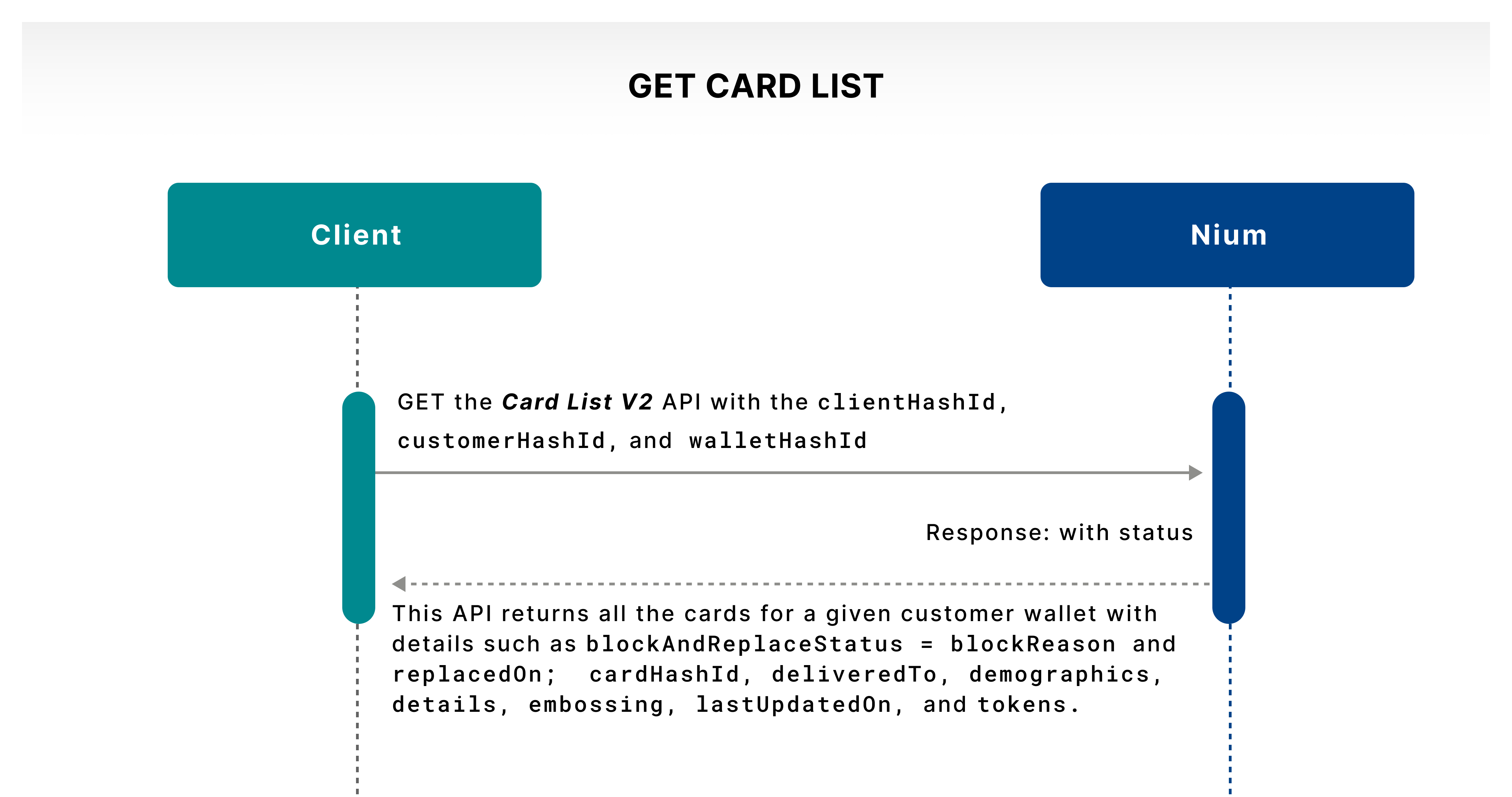

Get card list

The Card List V2 API returns all the cards issued to a wallet so your customer can see them. This operation responds with the tabulated card details for your customer.

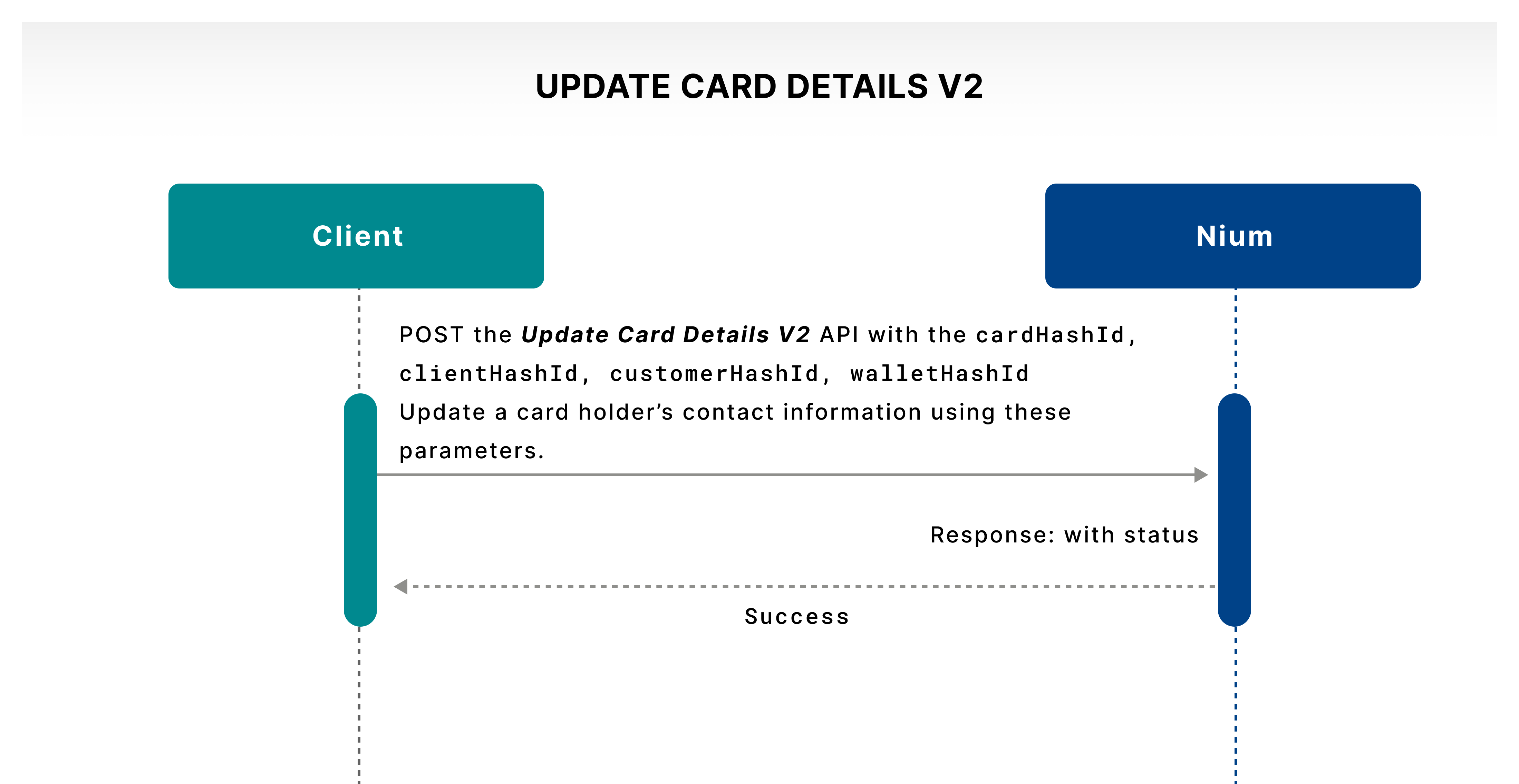

Update card details

The Update Card Details V2 API lets you update your cardholder's contact information. You can let your customers change their card delivery address and contact details according to your policies. This operation captures the address for a card replacement or renewal and the contact information for 3DS and strong customer authentication (SCA) purposes.

Use a card

Your customers may need the flexibility to control their spending through your user experience. Nium APIs give you capabilities that let your customers control their card expenses.

Transaction channels

You can use your Nium-issued cards through various payment channels. Nium defines the following channels where the cardholder can restrict card usage. Refer to the Card overview guide for more information.

| By location | By mode | By physical card-use mechanism |

|---|---|---|

| Cross-border: A cardholder can enable or disable cross-border transactions where the spending is in a foreign currency. \n \nDomestic transactions are not affected. | ATM: Enabling or disabling ATM usage lets a cardholder control if the card can be used to withdraw money at the ATM machine as applicable under the program. \n \nIn-store: Enabling or disabling in-store usage lets a cardholder control if the card can be used to make card-present transactions at merchant locations. \n \nOnline: Enabling or disabling online card usage lets a cardholder control if the card can be used online for card-not-present transactions by keying in the security details such as the 16-digit primary account number, the card name, the CVV, and the expiration date. | Magnetic stripe: Enabling the channel, also called magstripe, lets a cardholder use the capability to swipe at the merchant’s POS location while making a card-present transaction. \n \nDisabling it prevents magstripe use. \n \nOther card features such as insert (chip) and tap (NFC) are not affected. |

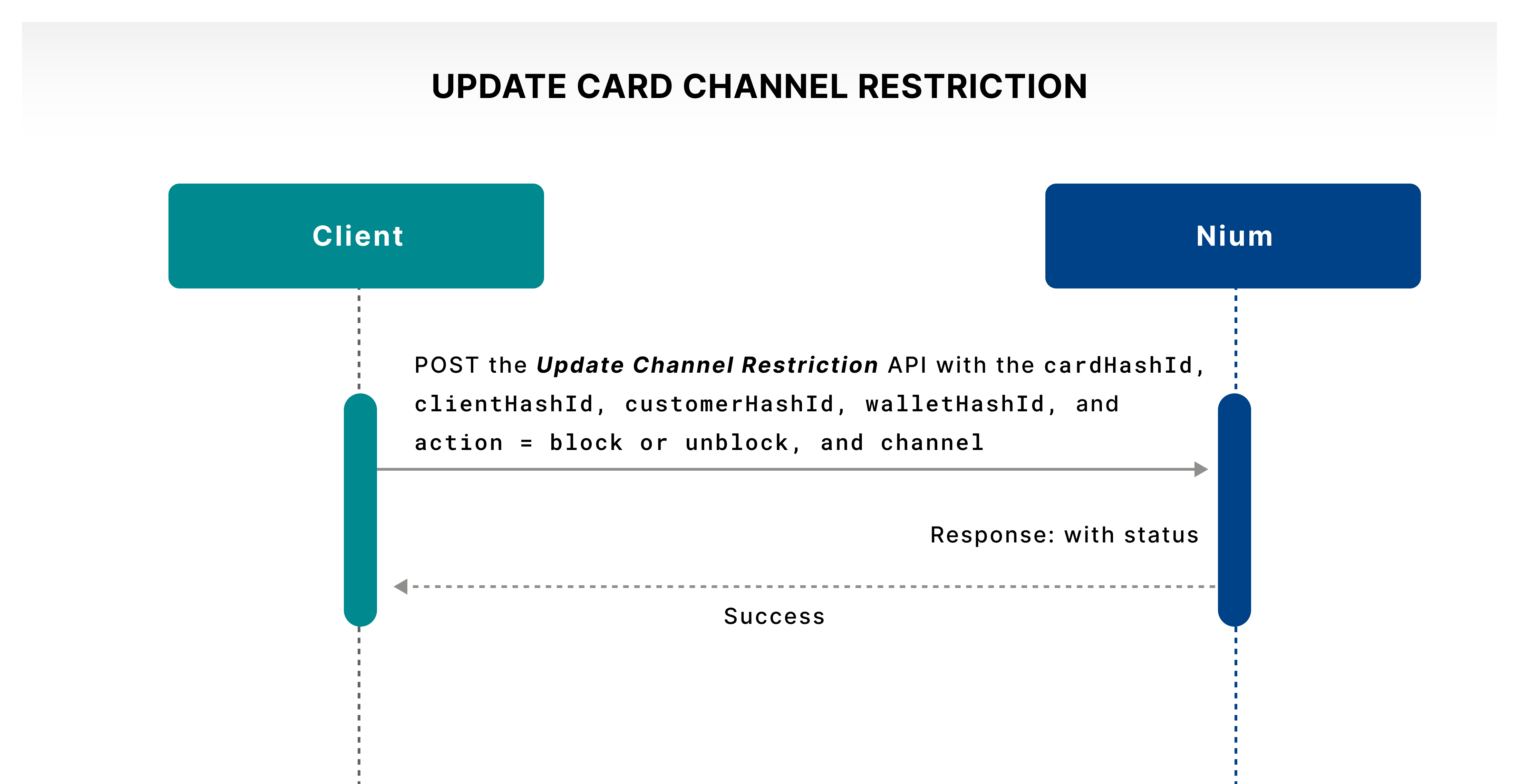

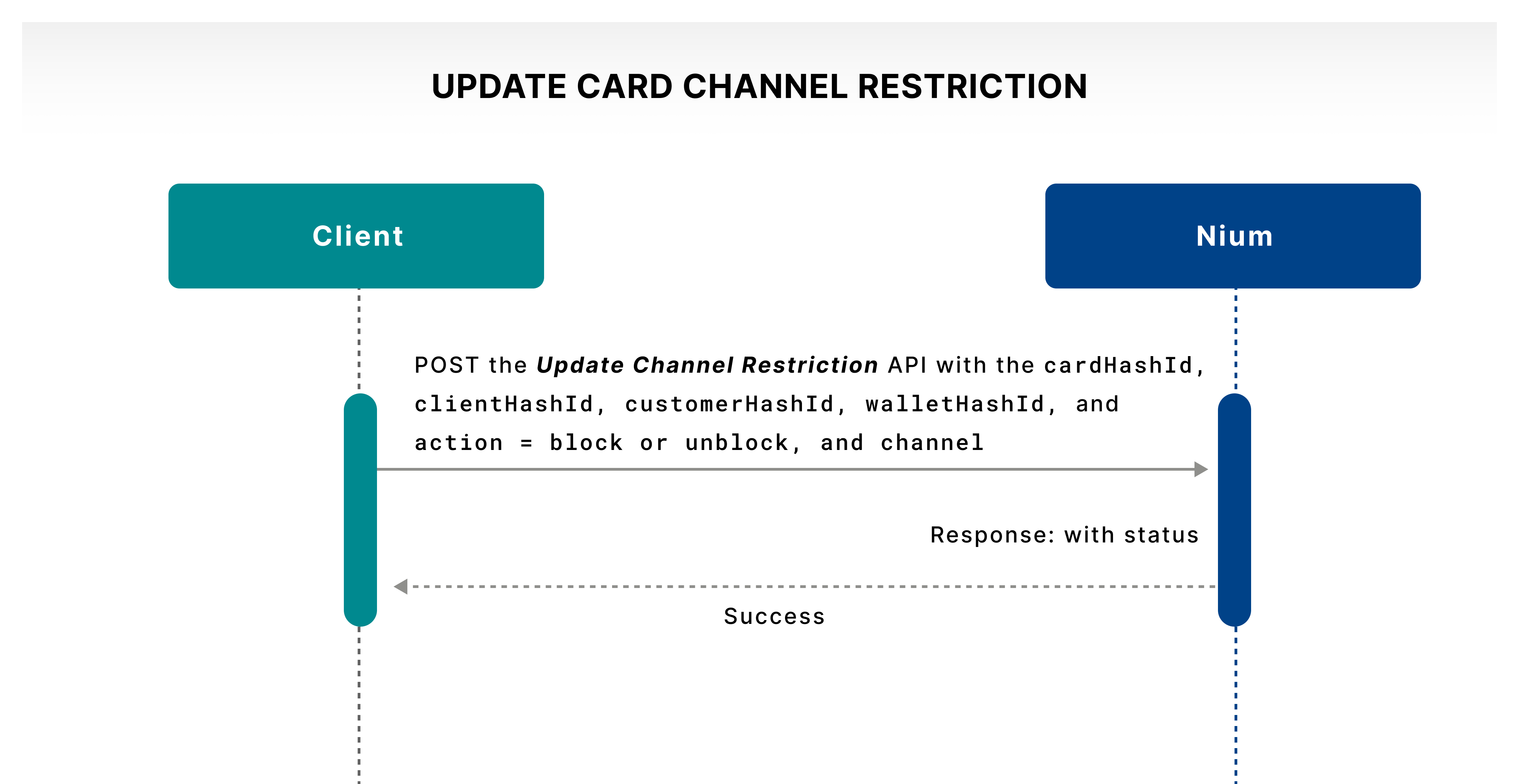

Update a card restriction

The Update Channel Restriction API lets a cardholder enable or disable, via block and unblock actions, the cross-border, ATM, in-store, online, and magnetic stripe card transaction channels.

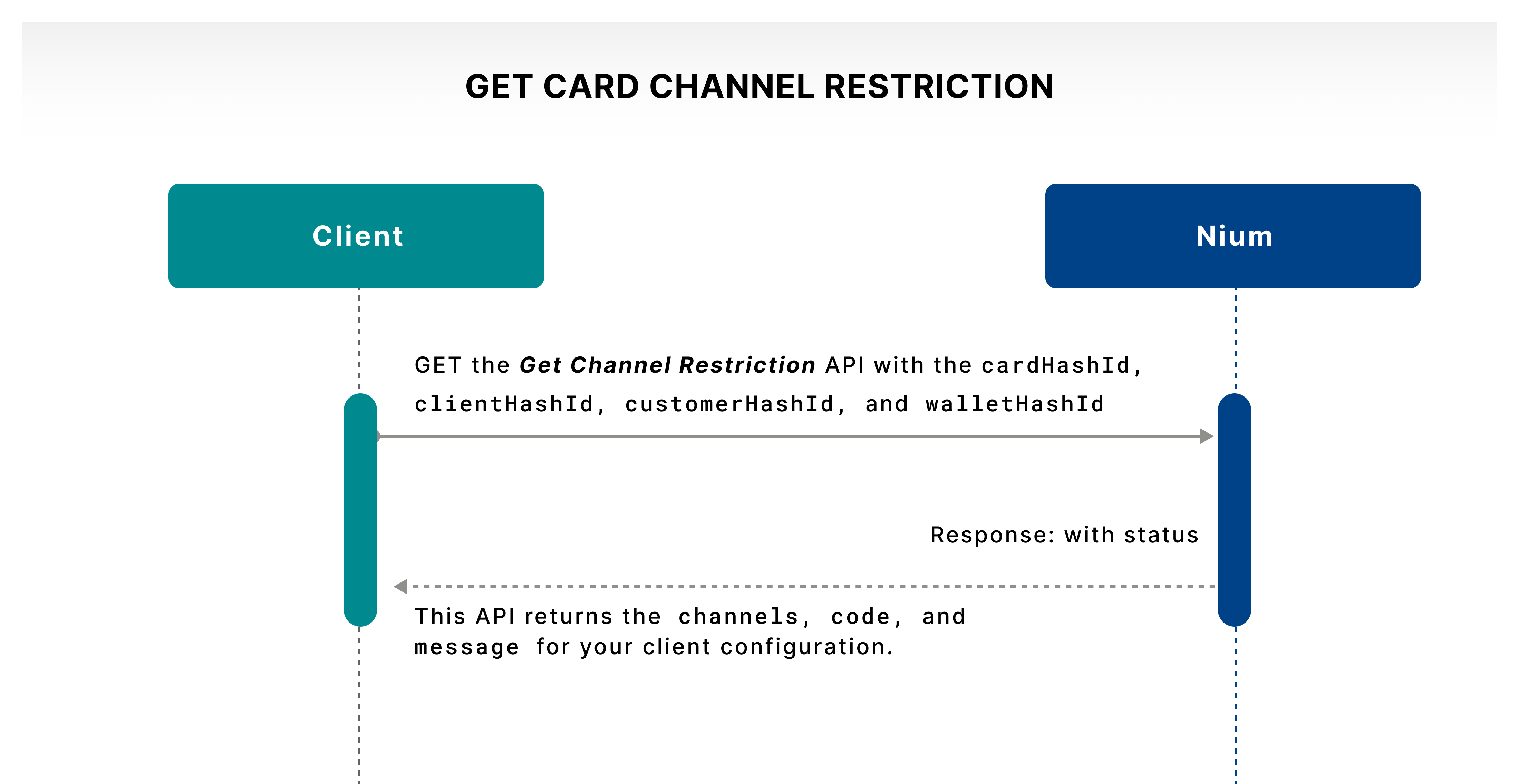

Get a card restriction

The Get Channel Restriction API lets a cardholder get the transaction channel restriction set at the card level for cross-border, ATM, in-store, online, and magnetic stripe. The cardholder can check which channel is active or inactive.

Convert a card

Use the Convert Card request to convert a virtual card to a physical card.

- Only active virtual cards can be converted.

- The card's expiry date remains the same after conversion.

This request is useful when your customer initially receives a virtual card and later requests a physical version for in-store or ATM use.

Merchant category codes

Merchant category codes (MCCs) are standard four-digit classifications for the merchants operating under the Visa® or Mastercard® network. There are hundreds of categories covering different goods or services such as lodging, food service, groceries, apparel, etc.

Your customers may want to manage their spending by enabling or disabling certain merchant categories. The following are the Nium MCC management APIs:

Update an MCC restriction

The Update MCC Channel Restrictions API lets you create MCC-based channel restrictions at the card level. Merchant categories are allowlist or denylist. Your customer can create such merchant lists which can be set to active or inactive using the API call.

Example: Status = Active and ChannelStrategy = WHITE_LIST. If the list contains commercial equipment or office supplies, the card can only transact at these merchants, while all other merchants are blocked for transactions.

Example: Status = Active and ChannelStrategy = BLACK_LIST. If the list contains airline and lodging merchants, the card can't transact at these merchants, while all other merchants are open for transactions.

Nium, as a licensed entity, needs to restrict specific merchant categories as listed by regulators. Nium also filters required merchant categories based on the card program needs. These restrictions supersede any customer-level merchant restrictions.

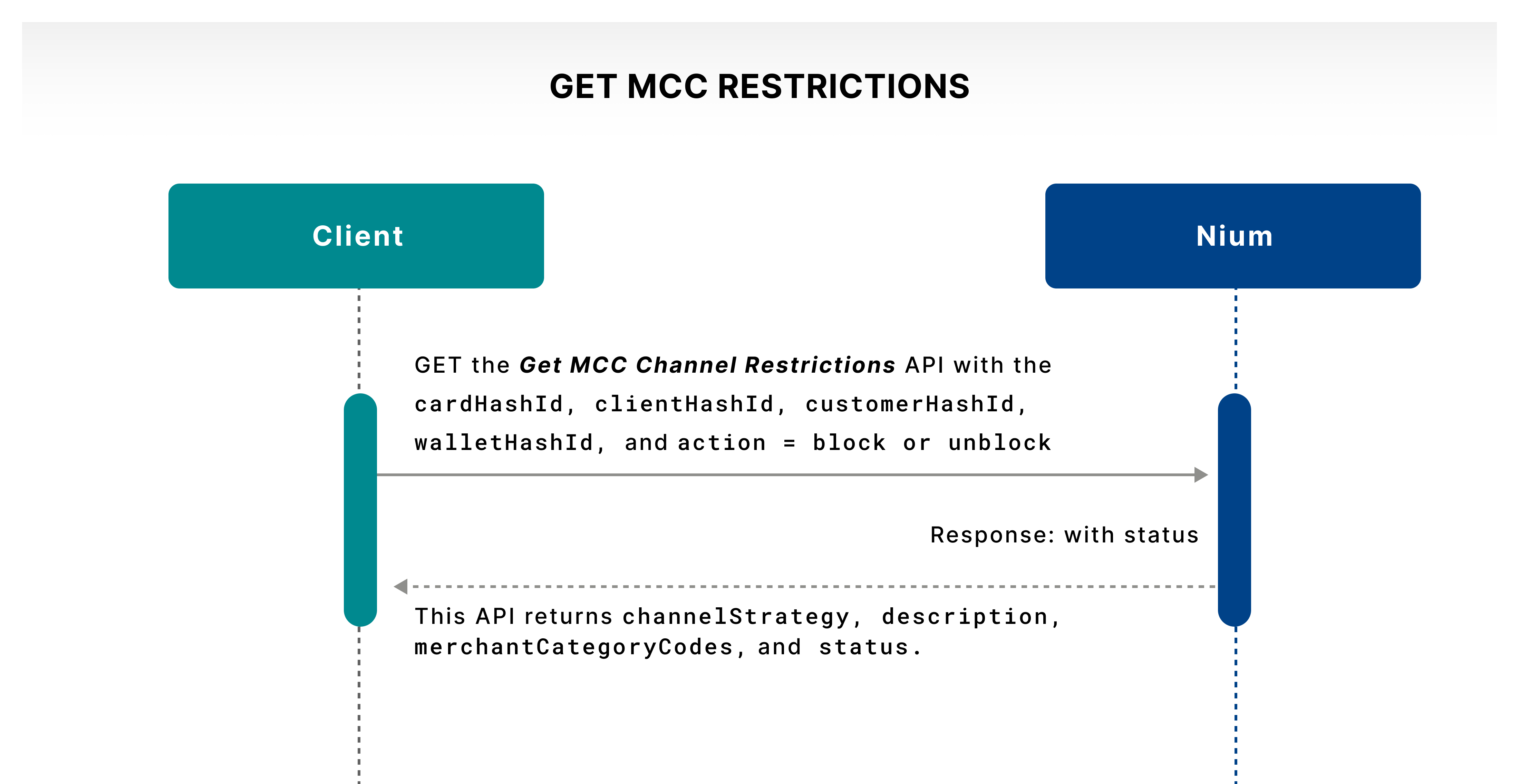

Get an MCC restriction

The Get MCC Channel Restrictions API lets you fetch the MCC-based channel restrictions at the card level. It lets the cardholder check the active or inactive status of the merchant list.

Set card limits

You can also give cardholders the flexibility to control how much and how frequently they spend on each card that they own at Nium.

A customer can set each of the transaction card limits as Active or Inactive. They can also set a percentage of acceptance. The additionalPercentage value allows transactions to be breached by the set percentage over the limit, allowing a little flexibility on the limits.

The Card Limits API lets a cardholder set their own custom card limits using the following parameters. Program-level restrictions supersede these controls.

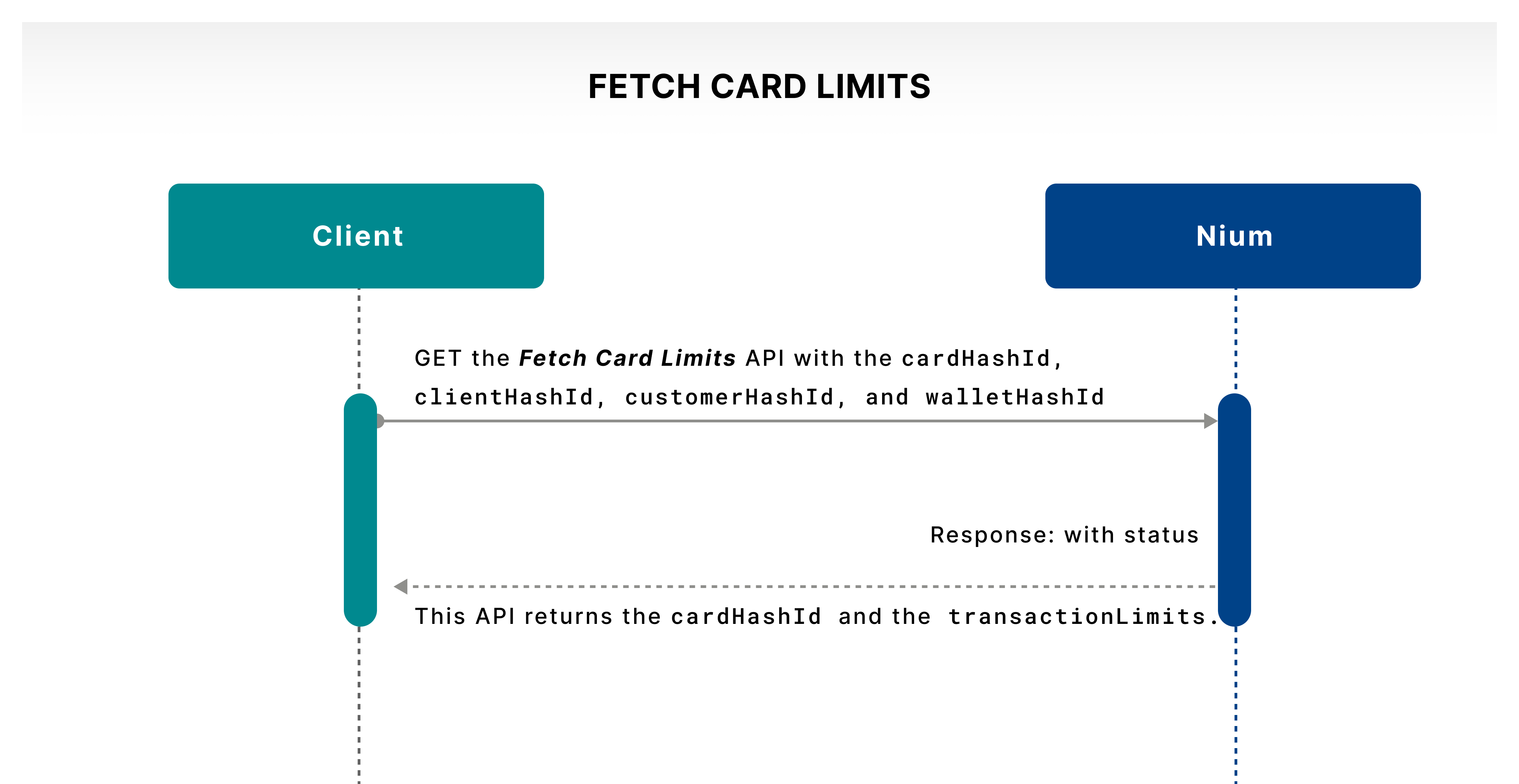

Get card limits

The Fetch Card Limits API lets a cardholder check the status of all the limits set.

| Card limit | Description |

|---|---|

| PER_TRANSACTION_AMOUNT_LIMIT | A per-transaction amount limit means the maximum amount you can spend during a payment transaction. Limits are set by mutual agreement between the client and the customer. \n \nIf a customer sets a $100 per transaction limit, all transactions over $100 are effectively declined from the time of limit setting. |

| DAILY_AMOUNT_LIMIT | A daily amount limit means the maximum amount a cardholder can make transactions on the purchase of goods or services and cash advances using the card within a day or a 24-hour period, starting at midnight. \n \nIf a $1,000 limit is set, and the system notes a $900 transaction until 6 p.m. local time and a $200 transaction is attempted at 7 p.m., it's declined. |

| MONTHLY_AMOUNT_LIMIT | A monthly amount limit means the maximum transaction amount that can be spent in a month. The duration is the calendar month starting at midnight. It includes the sum of debit transactions subtracted by any reversals. \n \nThis limit is similar to the daily amount limit. The system accounts for this cap for transactions over the entire month. |

| LIFETIME_AMOUNT_LIMIT | A lifetime amount limit means the maximum amount that can be spent, starting with the issuance of the card to the time when it's used. If a $5,000 limit is set and the system notes a $4,900 transaction in the lifetime of the card, if a $200 transaction is attempted, it's declined. |

| LIFETIME_COUNT_LIMIT | A lifetime count limit is similar to the transaction amount limit. The limit can be placed on the number of transactions during the card's lifetime. |

| TRANSACTION_DURATION_LIMIT | A transaction duration limit is set for a date range in the YYYYMMDD-YYYYMMDD format and Coordinated Universal Time (UTC)+00 time zone format. It restricts based on when the card is enabled for a transaction. |