Spend Management

Spend Management is a term used to refer to how businesses and entities manage their spending and expenses. Platforms use Nium to help manage how much they're spending and expensing.

Specifically, clients use Nium to provide services that centralize and automate the processes for disbursing and monitoring corporate expenditures made by employees and enforce corporate policies related to expenses.

These Spend Management clients usually use their platform to provide employee expense cards and/or accounts payable services.

Typically, the platforms automate the process of reconciling accounts, verifying expenses based on corporate policies, delivering financial analyses, and integrating the platform with their underlying customers' accounting frameworks.

Nium primarily provides payment capabilities that streamline the process of transferring funds for disbursement. Payments can be directed towards suppliers or merchants through methods such as bank transfers or corporate purchasing cards. Additionally, payments to employees can be facilitated via bank transfers, serving as reimbursements for expenses incurred when utilizing personal funds or cards.

Typically, spend management will fall into two broad use cases:

Additionally, Nium clients in Spend Management are part of one of the following two categories:

Key features

The following table shows the most important Spend Management capabilities for a B2B client:

| Global Spend Management platform requirements | Nium solution |

|---|---|

| Global network reach on funding currencies and payout corridors | Nium's global payin and payout network corridors' expansion in your target markets. |

| Easy funds management | Direct Debit with an automated way for funds to be pulled from your customers. |

| Certainty in payments involving cross-currencies with guaranteed FX rates | Bulk FX conversion with a locked FX rate and flexible settlement period for funding in home and desired currency with payout in local currencies. |

| Predictability of invoice schedules | Scheduled payouts to merchants and suppliers. Reimbursement to the employees based on the expected payroll date. |

| Minimal declines and returns | Confirmation of payee accounts in advance of the scheduled payout date, intelligent routing, and guaranteed beneficiary amounts. |

| Spend with cards | |

| Collect revenue | Collect using bank transfer |

| Access control and workflow automation tools for validation |

Spend using corporate cards

Corporate cards empower employees and users to securely and transparently pay any merchant who accepts Visa or Mastercard as a form of payment. Employees get access to a wide range of e-commerce sites and brick-and-mortar stores, while control is retained for spending parameters—such as geography, channel, merchant, amount, timing, and frequency—in accordance with corporate policies.

Nium provides key features such as Parent-child hierarchy, Digital Wallet Tokenization, Dynamic Authorization that allow you to customize your spend management platform and support you to manage your end-user ledger and funds. The dynamic and flexible platform also allows you to manage and offer spending controls.

Card spend can be further categorized into two use cases:

Travel and Entertainment (T&E) Expensing

Your corporate customer requires their employees to spend on travel and other expenses on the company's behalf, following specific organizational policies. You also want to track each expense meticulously, feeding comprehensive metrics into your reporting and data analytics providing insights to your customer.

Purchase and Procurement

Your corporate customer needs to make purchases at various vendors, suppliers, and merchants, whether online or in physical stores. Your customer achieves this through cards stored with e-commerce merchants or accessed collectively by a team. You can actively utilize card transaction data to monitor and reconcile all expenditures for your customer.

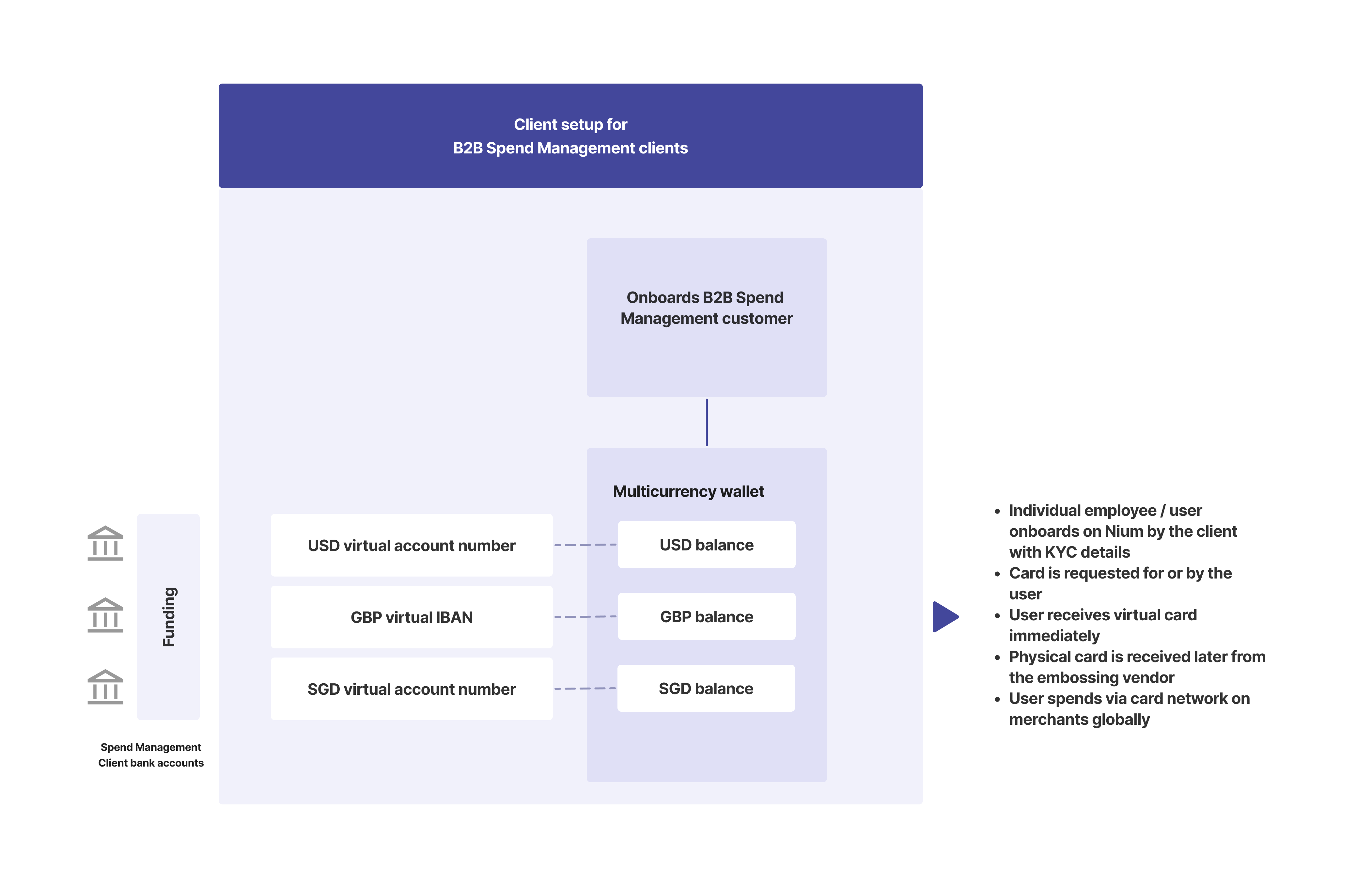

Client setup

Once you and your corporate customers have been onboarded to Nium, you can issue cards to your corporate customers which can be used by their employees. In a common scenario using the wallet there are two models — Hosted or Extended Authorization models, you can use the below client setup to fund the wallet account and use the cards.

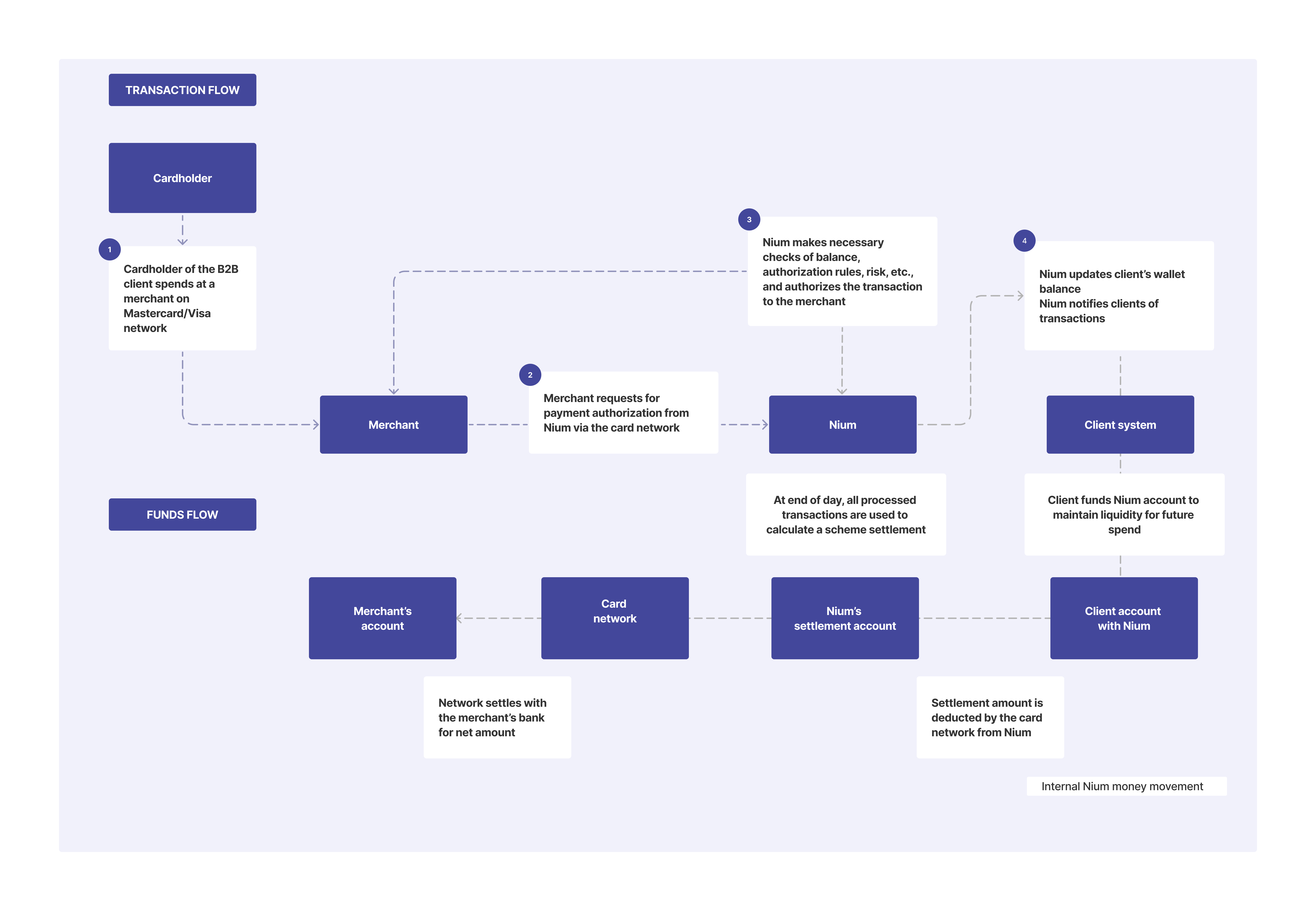

Funds flow

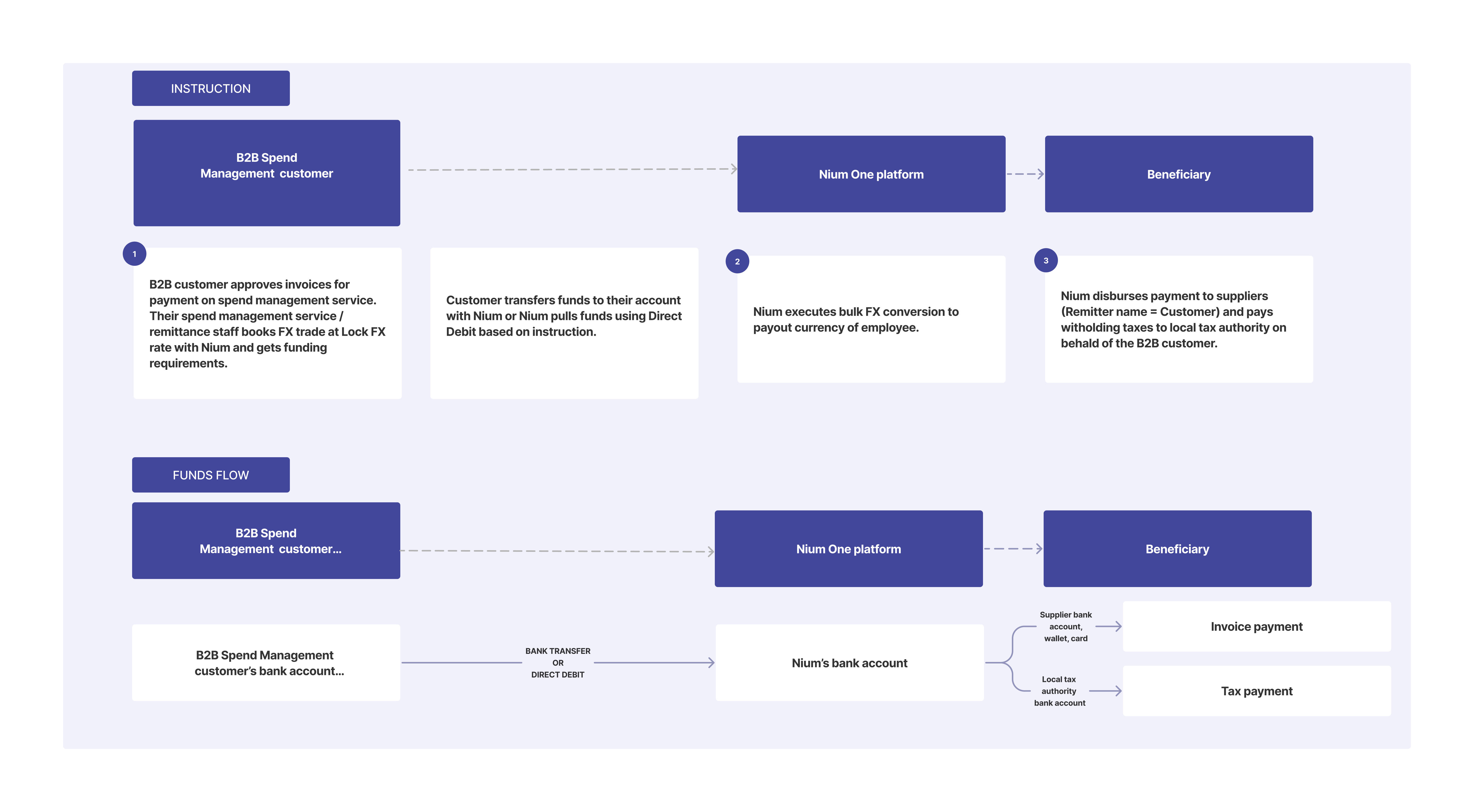

Invoice payments

Client setup

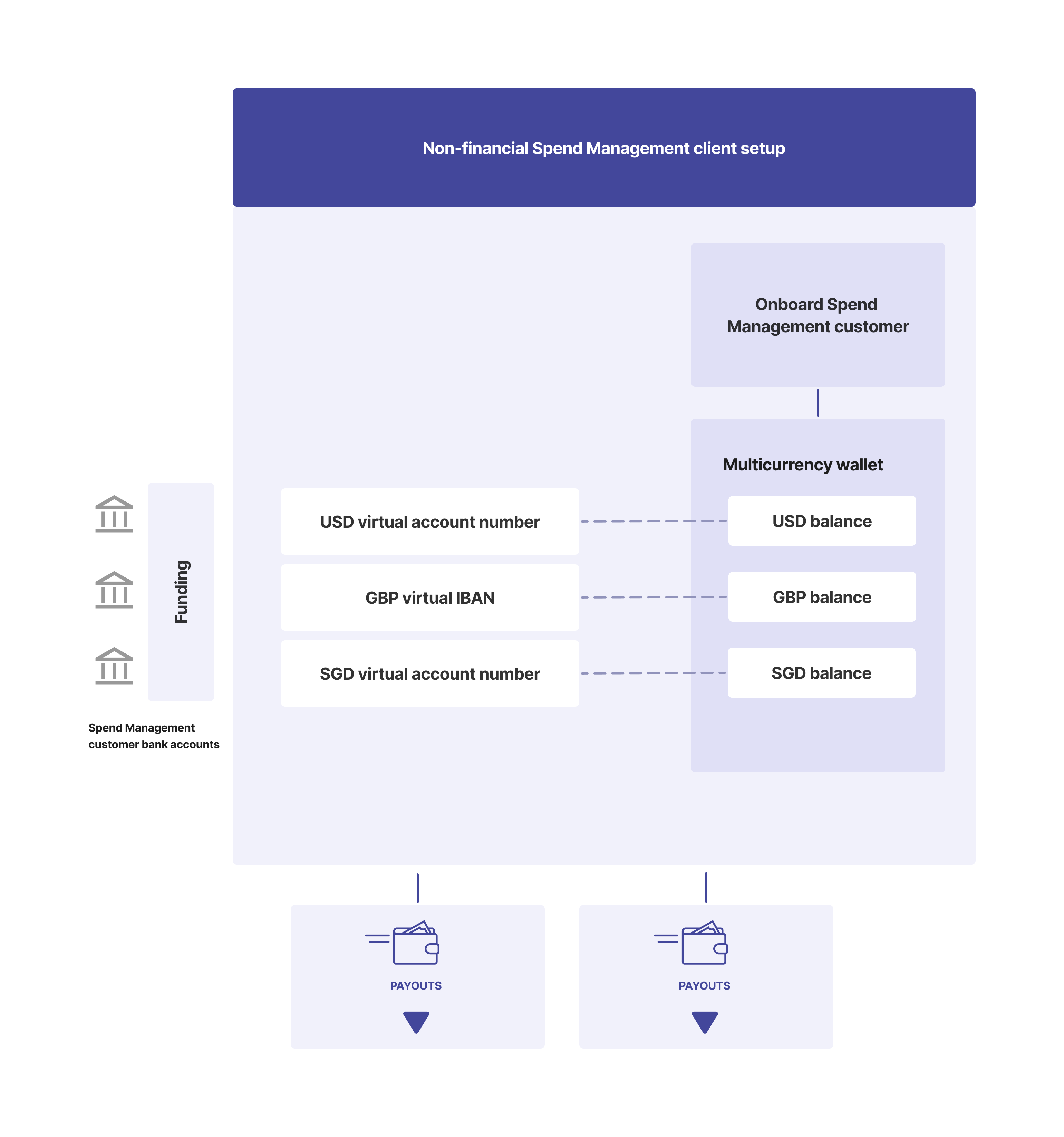

If you are a Spend Management client with no money transfer license, you onboard your customers onto Nium using the Nium APIs that are integrated with eKYB and eKYC verifications to provide seamless onboarding. The underlying customers fund their Nium wallets directly and instruct Nium (via your platform UX) to make payouts to suppliers or utilize payment cards issued by Nium to pay suppliers. Given that you are not directly receiving funds from your customers, you are not required to be licensed or rely on an applicable exemption from licensing requirements in the country(ies) where you are providing services.

Funds flow

The following steps are illustrated in the diagram below to help explain a non-financial B2B Spend Management client's funding flows.

- Your B2B Spend Management customer approves an invoice payment within their Spend Management software by a cut-off date to be included as part of the upcoming invoice cycle run. The Spend Management software calculates the supplier invoice and any withholding of taxes to be paid to the local tax authorities. Your customer then books the FX trade at a locked FX with Nium and provides funding through one of the following:

- Pushing funds through a bank transfer into their account with Nium.

- Authorizing funds to be pulled from their bank account into their account with Nium through Direct Debit.

- Nium executes any FX trade from the funding currency to the payout currency.

- Your customer instructs Nium to perform a payout to:

- Their suppliers for invoice payment in the local currency with the necessary purpose code, net any withholding of taxes.

- Local tax authorities for tax payment in the local currency with the necessary references passed in the payment to the tax authority. This can happen independent of the invoice payment at a pre-determined schedule, for example, monthly, quarterly, etc.

FI Spend Management

Nium qualifies you as an FI Spend Management client if you are licensed to provide the financial services to your end customers in the countries in which your end customers are located. Your financial services license must permit you to accept funds from customers, retain those funds within a stored value account, and disburse the funds to suppliers (including potential use of payment cards).

A variant of the FI Spend Management Client involves an unlicensed entity that receives sponsorship from another FI, such as a bank. In this scenario, you act as an intermediary for the FI, effectively leveraging the FI's payment services to serve your customer base.

Non-financial spend management platform

A Non-FI Platform Spend Management Client is generally unlicensed and does not directly receive funds from its customers. Instead, the Client enrolls its customers onto Nium's platform.

These end customers independently fund their Nium accounts and then direct Nium to carry out Payouts to suppliers or use payment cards issued by Nium for supplier payments. As the Spend Management Client doesn't directly obtain funds from customers (with Nium being the recipient, holder, and transmitter of funds), there's no requirement for the Client to possess a license or rely on an applicable exemption from licensing obligations in the countries where it operates. This is because Nium is the entity responsible for providing the regulated payment services in question.